When to Request a Credit Line Increase

Contents

If you’re considering asking for a credit line increase, there are a few things to keep in mind. Here’s when to request a credit line increase and how to do it.

Checkout this video:

Reasons to Request a Credit Line Increase

A credit line increase can give you financial flexibility and can be a helpful tool in managing your finances. There are a few reasons you might want to request a credit line increase. Maybe you have a large upcoming purchase, you want to consolidate debt, or you want to have a cushion in case of an emergency. Whatever your reason, there are a few things to keep in mind before you request a credit line increase.

You Have a Good Payment History

If you have a good history of making payments on time, you’re more likely to be approved for a credit line increase. This is because you’ve demonstrated to your lender that you’re a responsible borrower who can be trusted to make payments on time. Lenders are typically more willing to increase the credit limits of borrowers who have good payment histories because they pose a lower risk of defaulting on their loans.

You Have a Low Credit Utilization Ratio

A credit utilization ratio is how much credit you’re using compared to how much total credit you have available. Simply put, it’s your balances divided by your credit limits. For example, if you have two credit cards—one with a $5,000 balance and $10,000 limit, and another with a $2,500 balance and $5,000 limit—your credit utilization ratio would be 30% (($5,000 + $2,500) / ($10,000 + $5,000)).

Ideally, you want to keep your credit utilization ratio below 30%. That demonstrates to creditors that you’re using your revolving credit lines responsibly and are not in danger of maxing out your accounts or becoming delinquent on your payments. If you have a low credit utilization ratio—say, 10% or less—it may be worth requesting a higher credit line from your card issuer. A higher credit limit will lower your overall credit utilization ratio, which can help improve yourcredit scores.

You Have a Long History with the Credit Card issuer

Customers who have had a credit card with the issuer for a long time and have always made their payments on time are usually good candidates for a credit line increase. The issuer knows that these customers are responsible and likely to repay any additional debt they incur. If you’ve held the same card for a few years and have been using it responsibly, you may want torequest a credit line increase.

How to Request a Credit Line Increase

If you have a credit card with a limit that’s too low to cover your needs, you may want to request a credit line increase from your issuer. This can be a helpful way to get the credit you need without having to apply for a new card. Here’s what you need to know about how to request a credit line increase.

Call the Customer Service Number

If you have a good track record with your credit card company, you may be able to get a credit line increase without having to go through a formal application process. Here’s how to do it:

1. Call the customer service number on the back of your credit card.

2. Tell the customer service representative that you would like to request a credit line increase.

3. The representative will likely ask you for some information about your income, employment, and credit history. Be prepared to answer these questions truthfully and accurately.

4. If the representative grants your request, you will usually see the new credit line reflected on your account within a few business days.

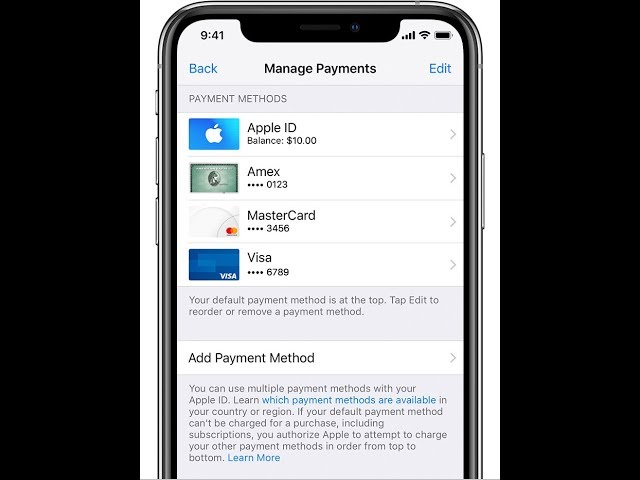

Go to the Credit Card issuer’s Website

Go to the credit card issuer’s website and log in to your account. Once you’re logged in, look for an option to request a credit line increase. This may be under “account services,” “customer service,” or something similar. If you can’t find it, call the customer service number on the back of your card and ask how to request a credit line increase.

Write a Letter to the Credit Card issuer

You can usually request a credit line increase online, over the phone or by writing a letter to your credit card issuer. Keep in mind that your credit card issuer may require you to provide additional information, such as your income, employment status and housing expenses, when requesting a credit line increase.

When writing a letter to request a credit line increase, be sure to:

-Include your full name, address, phone number and account number

-Specify the amount of the credit line increase you are requesting

-Include your reason for requesting the credit line increase

-Mention any recent changes in your financial situation, such as an increase in income or a change in employment status

If you have a good payment history with your credit card issuer and your current credit limit is too low to cover your needs, you may want to consider requesting a credit line increase.

What to Expect After You Request a Credit Line Increase

Requesting a credit line increase is a way to get more credit without having to apply for a new credit card or loan. It can be a good option if you have a good credit history and you need more credit for a large purchase. Most credit card issuers will automatically review your account every six to 12 months and may offer you a credit line increase without you having to request it.

Your Credit Score May Go Down

A hard credit inquiry will usually lower your credit score by a few points, but it typically only lasts for one year. If you have a good credit history and manage your credit responsibly, your score will likely rebound within a few months after the inquiry.

If you’re planning on applying for a loan or another type of credit soon, you may want to wait to request a credit line increase. That’s because multiple hard inquiries in a short period of time can signal to lenders that you’re struggling to manage your debts.

You May Be Charged a Fee

If you’re approved for a credit line increase, you may be charged a fee. The fee is typically a percentage of the credit line increase, and it’s added to your balance. For example, if you’re approved for a $1,000 credit line increase and there’s a 5% fee, you’ll owe an extra $50, which will be added to your balance.

You may also be charged an annual fee for having a higher credit limit. If you’re not sure if you’ll be charged a fee, ask the issuer before you request an increase.

Your Credit Card issuer May Require You to Have a Good Payment History

Your credit card issuer may require you to have a good payment history, which means making all of your minimum monthly payments on time, before approving a credit line increase. If you’ve been late on payments or have had any delinquencies, you may need to wait until those marks fall off your credit report, which could be up to seven years. Issuers also may review your income and employment information to make sure your financial situation hasn’t changed since you opened your account. If it has, they may not approve the increase or may only approve a smaller amount than you requested.