When Does Citibank Report to the Credit Bureau?

Contents

- What is a Credit Bureau?

- What is the Difference Between a Hard Inquiry and a Soft Inquiry?

- How Often Does Citibank Report to the Credit Bureau?

- What Happens if I Have a Negative Report on My Credit Report?

- How Do I Dispute an Error on My Credit Report?

- How Do I Check My Credit Score?

- How Can I Improve My Credit Score?

- Bottom Line

If you’re wondering when Citibank reports to the credit bureau, the answer is that it varies. Citibank may report your account activity to the credit bureau monthly, quarterly, or even annually.

Checkout this video:

What is a Credit Bureau?

A credit bureau is a financial institution that collects information about consumers’ credit history. This information is then used by lenders to make decisions about whether or not to extend credit to a particular consumer.

There are three major credit bureaus in the United States: Experian, Equifax, and TransUnion. Each of these bureaus collects information about consumers’ credit history from a variety of sources, including banks, retailers, and other financial institutions. This information is then compiled into a credit report, which is used by lenders to make decisions about whether or not to extend credit to a particular consumer.

Citibank reports information to all three major credit bureaus on a monthly basis. Therefore, if you have an account with Citibank, your payment history will be updated on your credit report every month.

What is the Difference Between a Hard Inquiry and a Soft Inquiry?

A hard inquiry is when a lender checks your credit report because you have applied for a loan or credit card with them. Hard inquiries can stay on your credit report for up to two years, but they only impact your score for the first year.

A soft inquiry is when someone checks your credit report, but you have not applied for any new credit. Soft inquiries may be done by your current creditors, employers, or if you check your own credit score. These do not impact your credit score.

How Often Does Citibank Report to the Credit Bureau?

Citibank reports your credit activity to the three major credit bureaus every month. If you open a new account, it may take up to 45 days for Citibank to report the account to the credit bureaus. However, if you have recent credit activity, such as a missed payment, Citibank may report this activity sooner.

What Happens if I Have a Negative Report on My Credit Report?

If you have a negative report on your credit report, it may be removed if you dispute the report with the credit bureau. If the dispute is successful, the negative information will be removed from your credit report.

How Do I Dispute an Error on My Credit Report?

It is important to review your credit report regularly to make sure that all of the information is accurate. You can get a free copy of your credit report from each of the three major credit bureaus once every 12 months at www.annualcreditreport.com. If you find an error on your credit report, you can dispute it with the credit bureau and the company that provided the information to the credit bureau.

To dispute an error on your Citibank credit report, you can contact Citibank directly or file a dispute with the credit bureau.

If you contact Citibank directly, you should include:

-Your name, address, and telephone number

-A description of the error, including why you believe it is inaccurate

-The correct information

-Any supporting documentation you have

-A statement requesting that Citibank investigate the error and correct your credit report

You can send this information by mail or online. You can also call Citibank customer service at 1-888-248-4226.

If you file a dispute with the credit bureau, you should include:

-Your name, address, and telephone number

-A description of the error, including why you believe it is inaccurate

-The correct information

-Any supporting documentation you have

How Do I Check My Credit Score?

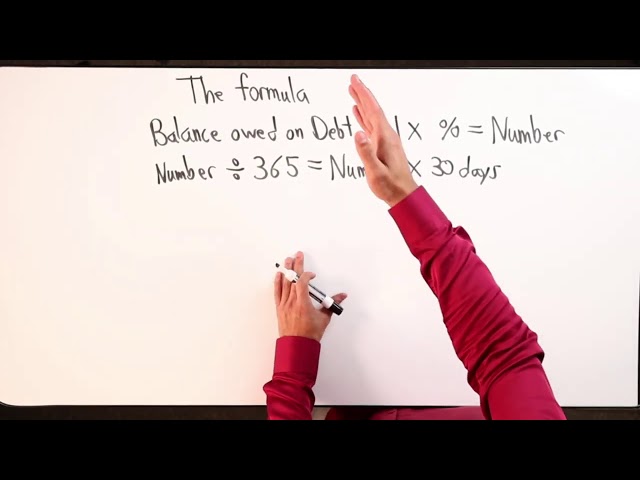

Your credit score is a three-digit number that represents your creditworthiness. It is used by lenders to determine whether you are a good candidate for a loan and how much interest they will charge you. A high score means you are a low-risk borrower, which could lead to a lower interest rate on your loan. A low score could lead to a higher interest rate.

There are many factors that go into calculating your credit score, including your payment history, the amount of debt you have, the length of your credit history, and the types of credit you have. While there is no one perfect formula for calculating a credit score, the most common scoring system is provided by FICO®.

You can check your credit score for free from several sources, including Credit Karma®, Experian®, and Bankrate®. These sites will also provide you with helpful information about how to improve your score.

How Can I Improve My Credit Score?

There are a number of things you can do to improve your credit score, including paying your bills on time, keeping your credit utilization low, and maintaining a good mix of different types of credit. You can also try to get negative items removed from your credit report, such as late payments or collections accounts.

Bottom Line

It’s important to know when your credit card issuer reports your activity to the credit bureaus, so you can keep track of your progress and make sure your payments are on time. Citibank reports to the credit bureaus at the end of each billing cycle, so if you’re trying to improve your credit score, you’ll want to make sure you’re using your Citibank card regularly and paying off your balance in full each month.