When Can You Drop PMI on an FHA Loan?

Contents

If you’re thinking about buying a home with an FHA loan, you may be wondering when you can drop the mortgage insurance premium (MIP) that’s required. Here’s what you need to know.

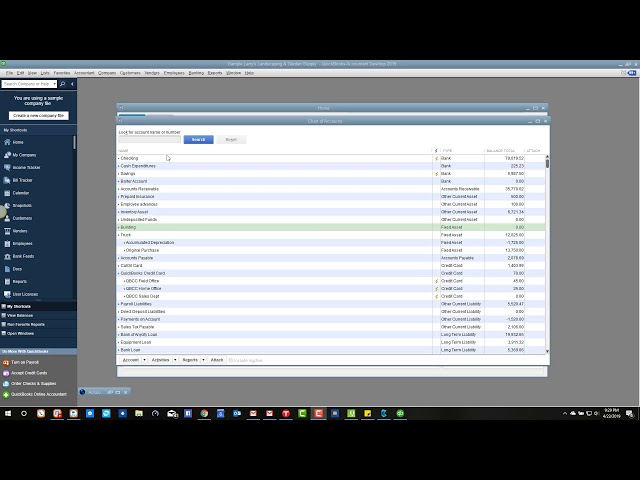

Checkout this video:

Mortgage Insurance

The Federal Housing Administration (FHA) offers several mortgage insurance programs. These programs are designed to protect lenders from loss if the borrower defaults on their loan. Mortgage insurance also allows borrowers to qualify for loans that they might not otherwise be able to obtain.

What is Mortgage Insurance?

Mortgage insurance is insurance that protects the lender or investor in the event that you, the borrower, default on your loan. It’s important to know that mortgage insurance is not the same as private mortgage insurance (PMI), which is insurance that protects the borrower in the event of default. Mortgage insurance is paid by the borrower, and PMI is paid by the lender.

There are two types of mortgage insurance: primary and secondary. Primary mortgage insurance is required if you are a first-time homebuyer, or if you have less than 20% equity in your home. Secondary mortgage insurance is required if you are a repeat homebuyer and you have less than 20% equity in your home.

Mortgage insurance can be canceled, but it usually requires that you have at least 20% equity in your home. If you cancel your mortgage insurance, you will need to pay for it yourself if you ever default on your loan.

Types of Mortgage Insurance

There are different types of mortgage insurance, and each type has its own advantages and disadvantages.

Private Mortgage Insurance (PMI)

PMI is insurance that protects the lender in the event that you default on your mortgage. PMI is required if you have a conventional loan with a down payment of less than 20%.

Mortgage Insurance Premium (MIP)

MIP is insurance that protects the lender in the event that you default on your FHA loan. MIP is required if you have an FHA loan with a down payment of less than 10%. MIP is also required if you have an FHA loan with a down payment of 10% or more, but your loan-to-value ratio is above 80%.

FHA Mortgage Insurance

FHA loans require mortgage insurance, which is a monthly premium, just like auto and homeowners insurance. The insurance protects the lender if a borrower defaults on their loan. You can cancel the insurance when you have 22% equity in your home. You can also refinance to a conventional loan to drop PMI.

What is FHA Mortgage Insurance?

FHA mortgage insurance is required for all FHA loans. It costs the same no matter your credit score, with only a slight increase in price for down payments less than five percent. FHA mortgage insurance includes both an upfront cost, paid as part of your closing costs, as well as a monthly cost, included in your monthly payment.

How Much Does FHA Mortgage Insurance Cost?

FHA mortgage insurance rates have three components – an upfront premium (paid at closing) and two annual premiums. The upfront premium is 1.75% of the loan amount and is paid when the borrower gets the loan. The annual premiums are:

-0.45% for loans with terms of 15 years or less

-0.70% for loans with terms of more than 15 years

How Long Do You Pay FHA Mortgage Insurance?

The upfront insurance premium for FHA mortgages is usually 1.75% of the loan amount, regardless of the loan’s term or the borrower’s credit history. The annual premium, which is paid monthly, depends on several factors-most importantly, the size of the loan and the borrower’s credit score. For loans with terms of 15 years or less and LTV ratios of 78% or less, the annual premiums range from .80% to .85% of the loan amount. For loans with terms greater than 15 years and LTVs greater than 78%, the annual premium ranges from .45% to 1.05%. Borrowers with credit scores below 580 payfs a higher premium (1.35%) than those with credit scores above 580 (1.30%). Finally, FHA borrowers who put down less than 10% on their home purchase must pay an upfront mortgage insurance premium (UFMIP) equal to 1.75% of their mortgage amount.

Private Mortgage Insurance

If you have an FHA loan, you’re required to pay for private mortgage insurance, or PMI. This protects the lender in case you default on the loan. Once you’ve built up enough equity in your home, you may be able to cancel PMI.

What is Private Mortgage Insurance?

Private mortgage insurance (PMI) is insurance that helps protect a lender in case you default on your mortgage. Lenders require PMI when the down payment on a home is less than 20 percent of the loan value. Even if you have good credit, lenders view loans with less than 20 percent equity as high risk.

PMI protects the lender, not you. It does not go toward building equity in your home. You pay for PMI, and the lender is the beneficiary. Once you have at least 20 percent equity in your home, you can cancel PMI.

If you have an FHA loan, you are required to pay for mortgage insurance no matter how much equity you have in your home. With this type of insurance, the premium is paid entirely by the borrower and can be rolled into the cost of the loan.

How Much Does Private Mortgage Insurance Cost?

Private mortgage insurance, or PMI, is a type of mortgage insurance that borrowers are required to pay for when taking out a home loan. This insurance protects the lender in the event that the borrower defaults on their loan.

The cost of PMI varies, but is typically around 0.5% to 1% of the loan amount. So, on a $200,000 loan, you could be paying as much as $2,000 a year – or $167 per month – in PMI premiums.

Most lenders require borrowers to purchase PMI when they have a down payment of less than 20% of the home’s value. However, some lenders may allow borrowers to put down as little as 10%, in which case PMI would be required until the borrower’s equity in the home reaches 20%.

If you’re required to pay for PMI, you’ll likely see it listed as part of your mortgage payment on your monthly statement. The amount will likely change over time as your loan balance decreases and your equity in the home increases.

The good news is that you can eventually get rid of PMI once you’ve built up enough equity in your home (typically 20%). At that point, you can contact your lender and ask them to remove it from your loan agreement.

How Long Do You Pay Private Mortgage Insurance?

If you’re buying a home, lenders require private mortgage insurance (PMI) if you don’t have a 20% down payment. Here we take a look at the guidelines for dropping PMI on an FHA loan.

Most people with FHA loans pay for mortgage insurance up-front and monthly. Borrowers normally pay 1.75% of the loan amount for up-front MIP and .85% for monthly MIP. However, there are ways to get rid of PMI through refinancing or by converting your conventional loan to a non-FHA loan.

If you’re still paying off your home, you can get rid of PMI by refinancing your loan. You’ll have to reach 80% loan-to-value first, but that shouldn’t be too difficult given home prices today. You can also ask your lender to cancel PMI when you reach 78% LTV if your original mortgage was an FHA adjustable-rate mortgage (ARM).

If you have a conventional loan and aren’t eligible for HARP refinancing, another way to get rid of PMI is to refinance into a non-FHA loan. In this case, once you’ve reached 80% LTV, the lender should be able to cancel your PMI payments.

When Can You Drop Mortgage Insurance?

Mortgage insurance is required on all FHA loans unless 20 percent equity already exists in the home at the time of the loan funding. Fortunately, borrowers with existing FHA loans can reduce their monthly mortgage insurance premium by refinancing their home loan.

FHA Mortgage Insurance

FHA mortgage insurance is required for all FHA loans. It costs the same no matter your credit score, with only a slight increase in price for down payments less than five percent. FHA mortgage insurance includes both an upfront cost, paid as part of your closing costs, and a monthly cost, included in your monthly payment.

Private Mortgage Insurance

If you have a conventional loan, private mortgage insurance (PMI) is required if you have less than 20 percent equity in your home. With an FHA loan, you can get rid of it after 11 years if you are making timely payments on a HUD- insured mortgage. There is also an early termination option that allows you to get rid of PMI once you achieve 22 percent equity in your home, regardless of when you purchased it.

Assuming you qualify for the USDA Rural Housing Loan Program, pmi is also not collected on Direct or guaranteed loans for rural housing. Borrowers with these types of loans can request that their servicer cancel pmi when the outstanding principal balance of the loan falls to 78 percent of the original value of the home. This can happen even if it’s before the normal amortization schedule payoff date.