When Can I Get a Credit Card?

If you’re wondering when you can get a credit card , the answer is usually after you turn 18. However, there are a few other factors to consider.

Credit Card?’ style=”display:none”>Checkout this video:

The Basics of Credit Cards

In order to get a credit card, you must first understand the basics of credit cards . A credit card is a plastic card that allows the cardholder to borrow money from the issuer in order to make purchases. In order to be eligible for a credit card, you must have a good credit score.

What is a credit card?

A credit card is a tool that allows you to borrow money from a lending institution, which you can then use to make purchases or withdraw cash. Each month, you will be required to make a minimum payment, which will go towards repaying the borrowed amount plus any interest and fees that have accrued. If you do not repay your balance in full each month, you will be charged interest on the outstanding balance.

How do credit cards work?

Credit cards are a type of loan. When you use a credit card, you are borrowing money from the card issuer. The card issuer is usually a bank or credit union. There are two types of credit cards: unsecured and secured. Unsecured credit cards do not require collateral, while secured credit cards require collateral, such as a deposit.

The interest rate on a credit card is the rate at which the issuer charges you for borrowing money. The annual percentage rate (APR) is the interest rate charged on your outstanding balance, if any, every year. The APR can be fixed or variable. A fixed APR does not change over time, while a variable APR can change based on changes in an index, such as the prime rate.

Most credit cards have grace periods. A grace period is the time between the end of your billing cycle and when your payment is due. During this time, you will not be charged interest on your outstanding balance, if any. To take advantage of your grace period, you must pay your entire balance by the due date every month. If you do not pay your entire balance by the due date, you will be charged interest on your outstanding balance from the date of purchase until you pay your balance in full.

Minimum payments are typically around 3% to 5% of your outstanding balance. Although making minimum payments will help you avoid late fees and penalties, it is important to remember that this amount does not reflect how much interest you will be paying over time or how long it will take to pay off your debt if only make minimum payments every month

What are the benefits of using a credit card?

Credit cards offer a number of benefits over other payment methods, such as cash or debit cards. For one thing, they can help you build your credit history, which can be helpful in getting a loan or other financial products in the future. Additionally, credit cards offer fraud protection, which can be helpful in the event that your card is lost or stolen. Finally, many credit cards offer rewards programs, which can give you cash back or other benefits for spending on the card.

Who Can Get a Credit Card?

There are a few things to consider when you’re thinking about getting a credit card. The first is your credit history. If you have a good credit history, you’re more likely to be approved for a card. The second is your income. You’ll need to have a steady income in order to make payments on your credit card. Finally, you’ll need to be at least 18 years old to get a credit card.

What is the minimum age for getting a credit card?

The minimum age for getting a credit card is 18 years old.

What is a good credit score?

There is no simple answer to this question because there is no one credit score that lenders look at. Instead, they look at a range of scores from different sources and use them to assess your creditworthiness. The most important thing is to make sure that all of your scores are in the good or excellent range (above 650).

In general, you will need a good credit score to qualify for a credit card. If you have a bad credit score, you may still be able to get a card, but it will likely have high interest rates and fees. If you have a very poor credit score, you may not be able to get a card at all.

There are a few things you can do to improve your chances of getting a credit card:

-Check your credit report for accuracy and dispute any errors.

-Make sure you make all of your payments on time.

-Pay down your debts so that you have more available credit.

-Apply for a securedcredit card.

What are some other requirements for getting a credit card?

In order to get a credit card, you will need to meet some basic requirements. In addition to being 18 years of age or older, you will need to have a steady income and a good credit history. You may also be required to provide proof of identity, such as a driver’s license or passport.

How to Get a Credit Card

The best time to get a credit card is after you have established a good credit history. This means that you have been using credit responsibly for at least a year, and that you have a good mix of different types of credit accounts. Once you have established a good credit history, you can start shopping around for the best credit card offers.

Applying for a credit card

There are a few things you need to do before you can start using your credit card. In this section, we’ll go over what you need to do to get a credit card, how to use it, and how to avoid interest and fees.

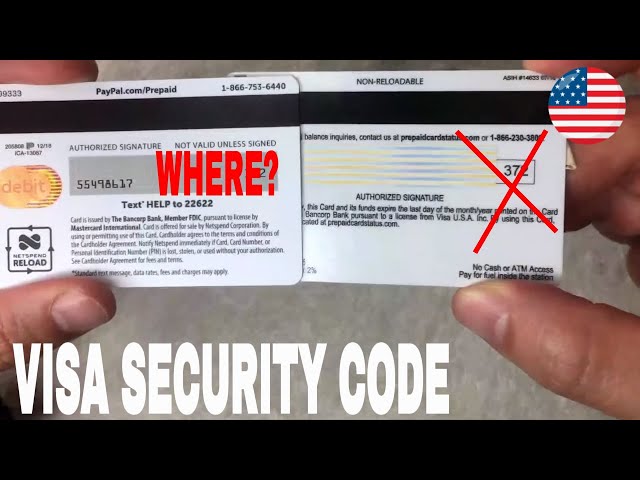

To get a credit card, you’ll first need to find a financial institution that offers credit cards and then complete an application. Once you’ve been approved, you’ll receive a credit card in the mail with your name, the card’s issuer, and the account number. You can start using your credit card as soon as you receive it by making purchases or transferring balances.

It’s important to know that your credit card comes with certain terms and conditions that you’ll need to agree to before using it. These terms will outline things like the APR, grace period, annual fee, and other important information. Be sure to read through these carefully so that you understand what you’re agreeing to before using your card.

Once you’ve received and activated your credit card, you can start using it right away. When making purchases, be sure to keep track of your spending so that you don’t exceed your credit limit. It’s also important to make sure that you make your payments on time each month in order to avoid interest and late fees.

Using a credit card

A credit card can be a useful tool if used correctly. It can help you manage your finances and build your credit history. But, if not used carefully, it can also lead to debt.

Here are some things to consider before using a credit card:

– Do you have a budget?

– Can you pay off the balance in full each month?

– Do you have a plan for dealing with unexpected expenses?

– Are you aware of the interest rate and fees?

If you answered yes to all of these questions, then using a credit card may be a good choice for you. Just be sure to use it wisely and pay off the balance in full each month.

Tips for using a credit card responsibly

There are a few things you should keep in mind when using a credit card:

– You should never spend more than you can afford to pay off. This means you should only charge what you know you can pay back within the grace period.

– You should try to pay off your balance in full each month to avoid interest charges. If you can’t do this, then at least make sure you’re making more than the minimum payment.

– You should always monitor your credit card statements and report any fraudulent charges immediately.