When Can I Apply For a Second PPP Loan?

If you’ve already received a Paycheck Protection Program (PPP) loan and are wondering if you can apply for a second one, the answer is maybe. Read on to learn more about the requirements for a second PPP loan and how to apply.

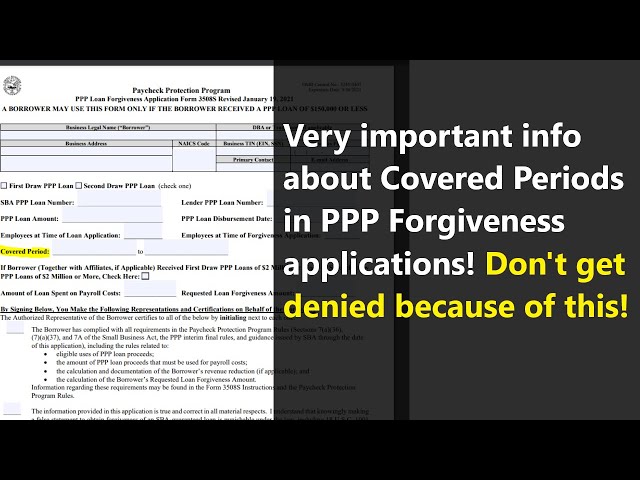

Checkout this video:

Overview

The Paycheck Protection Program (PPP) is a loan designed to help small businesses keep their workforce employed during the Covid-19 (coronavirus) pandemic.

The PPP has been incredibly successful, with over 5 million loans totaling more than $525 billion being approved as of June 30, 2020.

For many small businesses, the PPP has been a lifeline that has allowed them to keep their doors open and their employees on the payroll.

The good news is that the PPP is not a one-time thing. The recently passed Paycheck Protection Program Flexibility Act of 2020 makes it possible for eligible small businesses to apply for a second PPP loan.

Here are the main things you need to know about second draw PPP loans:

You can apply if you:

-Have used up your first PPP loan

-Are still experiencing economic injury as a result of Covid-19

-Have no more than 300 employees

-Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020

If you are approved for a second PPP loan, the amount you can receive will be based on your payroll costs, just like the first time around. However, the maximum loan amount has been increased from $10 million to $2 million.

You will also have more flexibility in how you use the funds from your second PPP loan. In addition to payroll costs, you can use the money for other allowable expenses such as rent, mortgage interest, and utilities. You will also have up to 24 weeks to use the funds, instead of the original 8 week period.

Applying for a second draw PPP loan is similar to applying for the first one. You will need to fill out an application and submit it to an approved lender. There are several new lenders who are now participating in the program, so even if you did not get your first loan from an SBA-approved lender, you should still be able to apply for a second one.

Just like with the first round of loans, there is no credit score requirement and collateral is not required. The interest rate on second draw loans is also 1%, and there is no prepayment penalty if you choose to pay off your loan early.

If you think you might be eligible for a second draw PPP loan, reach out to your lender today and start the application process. With cash flow still being an issue for many small businesses due to Covid-19, these loans can be vital in helping you keep your business afloat during these difficult times.

How to Qualify

According to the SBA, you need to demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020. If your business is seasonal, you must compare receipts from the first quarter of 2020 to the fourth quarter of 2019 or the second quarter of 2020 to the first quarter of 2019.

To qualify, you must also employ an average of at least 50 full-time equivalent employees (FTEs) per month from Feb. 15, 2020 through June 30, 2021.

Applying for a Second PPP Loan

The Paycheck Protection Program (PPP) is a loan designed to help small businesses keep their workforce employed during the COVID-19 (coronavirus) pandemic.

The PPP provides small businesses with cash-flow assistance through 100% federally guaranteed loans. The loan amounts will be forgiven as long as borrowers maintain their payrolls during the covered period and use at least 60% of the forgiven amount for payroll.

Borrowers can apply for a second PPP loan if they:

-Are applying for the loan through an eligible lender

-Have used or will use the full amount of their first PPP loan

-Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020

If you think you might be eligible for a second PPP loan, talk to your lender about how to apply.

Tips

The first draw of the PPP loan must have been used in its entirety before applying for a second PPP loan.

In order to receive a second PPP loan, you must:

-Demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

-Not have more than 300 employees.

-Have used, or will use, the full amount of their first PPP loan prior to the disbursement of the second PPP loan.

-Have or will spend the proceeds from their first PPP loan on eligible payroll and non-payroll expenses before they can receive a second PPP loan.

What if I Don’t Qualify?

If you don’t meet the eligibility requirements for a second PPP loan, you may be able to apply for an EIDL loan through the U.S. Small Business Administration (SBA). You can learn more about EIDL loans here.

FAQs

You may be eligible for a Second Draw PPP Loan if the following apply:

-You are a small business, non-profit organization, veterans organization, or tribal business concern that has fewer than 300 employees;

-You have used, or will use, the full amount of your first PPP loan; and

-You can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

If you believe you may be eligible for a Second Draw PPP Loan, we encourage you to speak with your lender. If you need help finding a SBA-approved lender, please visit our Lender Match website or give us a call at 1-800-659-2955 (the TTY number is 1-800-877-8339).