What Time Does Credit Karma Update?

Contents

If you’re wondering when Credit Karma will update your credit score, the answer is that it depends. Credit Karma updates your score regularly, but the specific timing can vary depending on a number of factors.

Checkout this video:

What is Credit Karma?

What is a credit score?

A credit score is a number that lenders use to evaluate your creditworthiness. It’s a snapshot of your credit history at a given point in time, and it’s one of the factors lenders consider when deciding whether or not to approve you for a loan or extend you credit.

Your credit score is based on the information in your credit report, which is a record of your credit activity over time. This information includes things like whether you make your payments on time, how much debt you have, and how long you’ve been using credit.

Lenders use this information to decide whether or not you’re likely to repay a loan if they lend you money. The higher your score, the more likely you are to get approved for a loan with favorable terms (like a low interest rate).

Credit scores range from 300 to 850, and the higher your score, the better. A score of 700 or above is considered good, while a score of 800 or above is considered excellent.

What is a credit report?

Your credit report is a record of your credit history. It includes information about your credit accounts, such as loan balances and repayment history, as well as any derogatory items, such as bankruptcies or foreclosures. Your credit report is used by lenders to help them determine whether or not to grant you a loan.

How often does Credit Karma update?

Credit Karma is a website that provides free credit scores and reports. It’s a great resource for monitoring your credit and staying on top of your finances. But how often does Credit Karma update?

How often is my credit score updated?

Your credit score is updated every 7 days.

How often is my credit report updated?

Your credit report is updated regularly, typically every 30 days. When lenders request your credit report, they’ll receive the most up-to-date information available.

You can check your credit report as often as you like, but keep in mind that each time you do, it will count as an inquiry on your report. Too many inquiries can negatively impact your credit score.

What factors affect Credit Karma updates?

Your Credit Karma score is updated every week, but the specific day of the week can vary. Several factors can affect how often your Credit Karma score is updated, including changes to your credit report and your credit utilization.

What factors affect my credit score?

Your credit score can be affected by several factors, including your payment history, credit utilization, credit mix, and length of credit history.

Your payment history is the most important factor in your credit score, and late or missing payments can have a major negative impact. It’s important to try to pay all of your bills on time, and if you can’t, try to contact your creditors as soon as possible to explain your situation and avoid additional penalties.

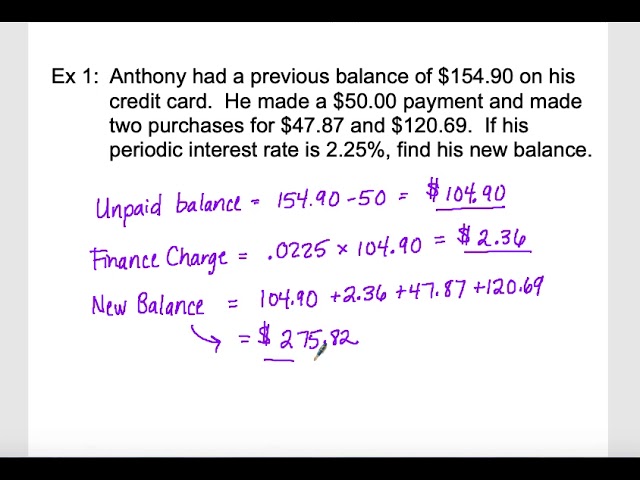

Credit utilization, or the amount of debt you have relative to your available credit limit, is also a major factor in your credit score. It’s important to keep your balances low and make sure you’re not using more than 30% of your available credit limit at any given time.

Credit mix is another important factor in your credit score. A variety of types of accounts (e.g., mortgages, car loans, credit cards) can show lenders that you’re a responsible borrower.

Finally, length of credit history can also affect your credit score. A long history of responsible borrowing is generally seen as a positive sign by lenders.

What factors affect my credit report?

There are a number of factors that can affect your credit report, including:

-The number of credit inquiries you have

-The type of credit you have

-Your payment history

-Your credit utilization ratio

Inquiries can have a negative effect on your score, but they will only stay on your report for two years. The types of credit you have can also affect your score. For example, having both installment loans and revolving lines of credit can be positive for your score. Your payment history is one of the most important factors in your score, so it’s important to make all your payments on time. Finally, your credit utilization ratio is the amount of debt you’re carrying compared to your credit limit. A higher ratio indicates greater risk, and can have a negative effect on your score.