What is the SEC. Code on a Credit Card?

Contents

If you’re ever wondered what that random string of numbers on the back of your credit card is, it’s called the SEC. code. In this blog post, we’ll tell you everything you need to know about this important security measure.

Checkout this video:

What is the SEC code?

The SEC code is a security code used to verify that a credit card is in the possession of the person who is using it. The code is also known as the card verification code, or CVC.

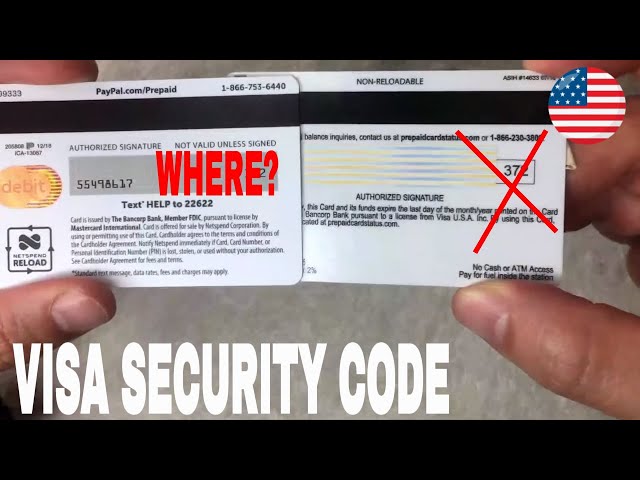

The code is a three- or four-digit number printed on the front or back of a credit card. On the front of American Express cards, the code is a four-digit number printed on the right side above the account number. On most other cards, including Visa, Mastercard, and Discover, the code is a three-digit number printed on the back of the card in the signature panel.

When you use your credit card online or over the phone, you may be asked to provide the SEC code as a way to verify that you are in possession of the card. This helps to prevent fraud and protect your identity.

If you are asked for your SEC code and you are not comfortable providing it, you can always ask the person or company requesting it what other forms of payment they accept.

How do I find the SEC code on my credit card?

The SEC code is a three- or four-digit number printed on the back of your credit card, usually near the signature strip. It’s also known as the card security code (CSC), credit verification code (CVC), or card verification value (CVV).

The number provides an additional measure of credit card security when you’re making purchases over the Internet or by phone. When you provide the SEC code, the merchant verifies that the credit card is actually in your possession.

Depending on your credit card issuer, the number may be called something different. For example, American Express refers to it as the “card identification code” (CID). Mastercard calls it the “card identification number” (CIN), “card security code” (CSC), or “personal security code” (PSC). Visa calls it the “card verification value” (CVV) or “security code” (CVN).

You should never give out your SEC code to anyone who calls you on the phone and asks for it, even if they say they’re from your bank. That’s because scammers have been known to pose as bank representatives in an attempt to steal yourSEC code and use it to commit fraud.

If you’re shopping online, most retailers will require you to provide your SEC code when you checkout. And if you’re using a mobile wallet like Apple Pay or Google Pay, you’ll typically need to enter your SEC number before completing a transaction.

What is the SEC code used for?

The SEC code is the three-digit number on the back of your credit card that is used to help prevent fraud when making online or over-the-phone purchases. This code is also known as the card security code or CSC.

When you make an online purchase, the SEC code is one way that businesses verify that your credit card is authentic and that you are authorized to use it. When you provide the SEC code, the business can be reasonably certain that you actually have the credit card in your possession and that someone else is not using your card without your permission.

The SEC code is also sometimes used to verify your identity when making over-the-phone purchases or other transactions where the credit card is not physically present. For example, if you call your credit card company to report a lost or stolen card, they may ask for the SEC code as a way to verify your identity before they provide sensitive account information.

If you are making an online purchase, it’s important to make sure that the website is secure before entering your credit card information, including the SEC code. You can usually tell if a website is secure if the URL starts with “https” instead of just “http” and if there is a padlock icon next to the URL in your browser window.

It’s also a good idea to keep an eye out for any red flags that might indicate a website is not legitimate, such as misspellings in the URL, poor grammar on the website itself, or unexpected popup windows. If something doesn’t look right, it’s best to err on the side of caution and not enter any sensitive information like your credit card number or SEC code.

How do I use the SEC code?

The Security Code is an important security feature for credit card transactions in person or online. The code is a three or four-digit number printed on your card. For Visa, Mastercard, and Discover cards, it appears on the back of your card in the signature strip. For American Express cards, it appears on the front of the card above the credit card number.

When you use your credit card in person, the merchant will ask you to enter your Security Code as an additional verification step. This helps to ensure that you are the legitimate cardholder and that your credit card is not being used fraudulently.

For online transactions, your Security Code is used as an added layer of protection to prevent fraudsters from using your credit card information. When you make an online purchase, you will typically be asked to enter your Security Code as part of the checkout process.

What are the benefits of using the SEC code?

The SEC code is a three- or four-digit number that is printed on the back of your credit card. It is also sometimes referred to as the card verification code (CVC) or card security code (CSC).

The SEC code is an important security feature that helps to protect you from fraud and identity theft. When you make an online purchase, the SEC code helps to verify that you are the rightful owner of the card. Many websites will require you to enter your SEC code as an added layer of protection.

In addition to providing security, the SEC code can also help to improve your credit score. This is because when you use your SEC code, it shows that you are taking extra steps to protect your personal information. This can be helpful if you are trying to build or improve your credit score.