What is the Principal of a Loan?

Contents

The principal of a loan is the initial amount of money that you borrow. The interest rate is the percentage of the principal that you pay to the lender as a fee for borrowing the money.

Checkout this video:

What is the Principal of a Loan?

The principal is the original loan amount plus any additional money that has been borrowed. The interest is the cost of borrowing the money, and is typically a percentage of the principal. The term of the loan is the length of time that the borrower has to repay the loan.

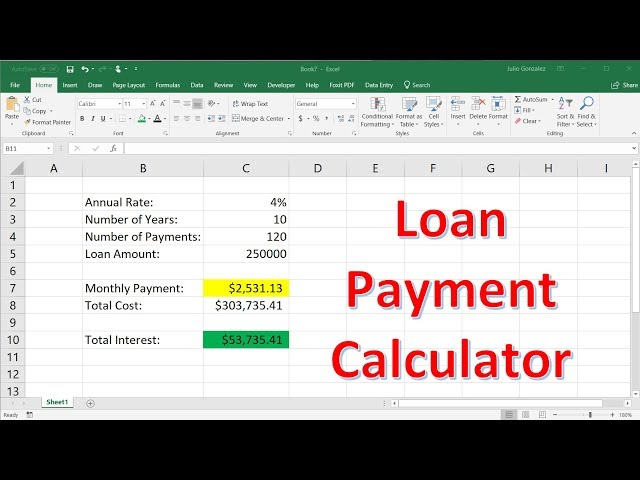

For example, if you take out a $100,000 loan with a 4% interest rate and a 30-year term, your monthly payments would be $477.42. Of that payment, $333.33 would go towards paying off the principal, and $144.08 would go towards paying the interest.

How the Principal is Used

The principal of a loan is the original sum of money that you borrowed from a lender. This amount does not include any interest or fees that may have been added to the loan. You are responsible for repaying the entire principal, plus any interest, over the life of the loan.

The principal is important because it is the main factor that lenders use to determine how much interest to charge on a loan. The higher the principal, the higher the interest rate will be. For this reason, it is important to try to keep your loan principal as low as possible.

There are several ways to do this:

-Make a larger down payment: The larger your down payment, the less money you will need to borrow and the lower your loan principal will be.

-Choose a shorter loan term: A shorter loan term means you will pay off your debt more quickly and have a lower loan balance.

-Get a lower interest rate: A lower interest rate will reduce the amount of interest you pay over the life of the loan and leave you with more money to put towards your principal.

How the Principal is Paid Back

The principal of a loan is the amount of money that is borrowed and needs to be paid back. The interest is the cost of borrowing the money and is usually a percentage of the principal. The term of the loan is the length of time that the borrower has to pay back the loan.

For example, if you take out a $100,000 loan with a 5% interest rate for 30 years, your monthly payments would be about $536 (not including taxes and insurance). Of that payment, $500 would go towards paying off the principal and $36 would go towards paying the interest. Assuming you make all of your payments on time, at the end of 30 years you would have paid back a total of $193,360 – $100,000 for the principal and $93,360 in interest.

The Importance of the Principal

The principal of a loan is the original amount that you borrowed, not including any interest that has accrued. In other words, it’s the amount of money you still owe on your loan. Your monthly loan payments will go toward both the principal and the interest, but the principal will always be the original amount you borrowed.

Why is the principal important? For one thing, it’s important to know how much money you still owe on your loan. If you’re trying to pay off your loan as quickly as possible, you’ll want to focus on making extra payments toward the principal. Doing so will reduce the amount of interest you pay over time and help you pay off your loan more quickly.

The principal is also important because it can affect your loan’s interest rate. In general, loans with a higher principal balance will have a higher interest rate than loans with a lower balance. This is because lenders see loans with a higher balance as being more risky, so they charge a higher rate to offset that risk.

If you’re considering taking out a loan, don’t forget to factor in the importance of the principal. Knowing how much money you’ll need to borrow and what kind of interest rate you’ll be paying can help you make the best decision for your needs.