What is the Max VA Loan Amount?

Contents

- The Max VA Loan Amount is determined by the county in which the property is located.

- The Max VA Loan Amount is also based on the Veteran’s entitlement.

- The Max VA Loan Amount can change annually.

- The Max VA Loan Amount can also be increased if the Veteran is disabled or if the Veteran purchases a home with energy-efficient features.

If you’re a veteran looking to purchase a home, you may be wondering what the maximum VA loan amount is. The answer may surprise you – there is no maximum!

Checkout this video:

The Max VA Loan Amount is determined by the county in which the property is located.

The maximum loan amount for a VA Loan is determined by the county in which the property is located. The loan limits are based on the conforming loan limit, which is the maximum loan amount that Fannie Mae and Freddie Mac will purchase. The conforming loan limit for a single-family home is $484,350 as of 2019. The maximum VA Loan amount is higher in some counties, but cannot exceed $726,525 regardless of the county in which the property is located.

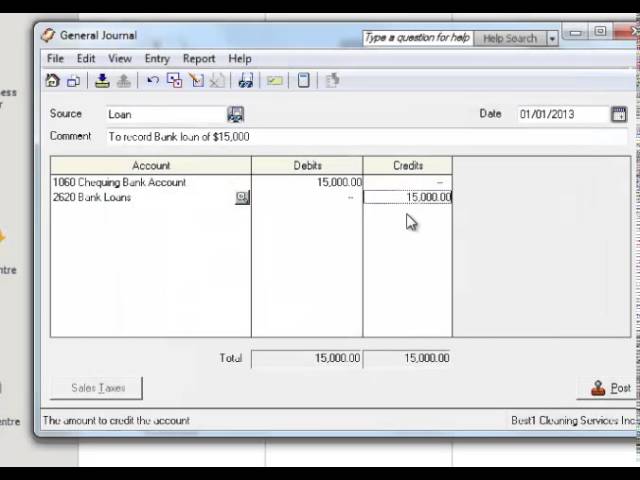

The Max VA Loan Amount is also based on the Veteran’s entitlement.

The Max VA Loan Amount is also based on the Veteran’s entitlement. If a Veteran has full entitlement available, they can generally borrow up to the Fannie Mae conforming loan limit for the county in which the property is located. If the Veteran does not have full entitlement available, they may still be eligible to borrow up to an amount known as the Temporary Financial Limit.

The Max VA Loan Amount can change annually.

The maximum VA loan amount is determined by county. The maximum loan limit is $484,350 in most counties, but it can go as high as $726,525 in high-cost areas of the country. You can check the maximum VA loan limits for your county here.

The Max VA Loan Amount is based on two factors:

1. The Veteran’s Entitlement. This is the amount of money that the Veteran has available to put towards a home purchase. The Entitlement can be used more than once, but it will be reduced after each home purchase.

2. The Loan Limits set by the Federal Housing Finance Agency (FHFA). The FHFA sets loan limits for Conventional and Government-Backed mortgages each year. For 2020, the FHFA has set the Conforming Loan Limit at $510,400 for most counties in the U.S., with higher limits in certain high-cost areas.

The Max VA Loan Amount can also be increased if the Veteran is disabled or if the Veteran purchases a home with energy-efficient features.

The Veteran’s Administration (VA) insures loans made by private lenders to Veterans and Active Duty service members. The VA does not actually lend the money for these home loans; they only ensure a portion of the loan, making it easier for private lenders to offer financing.

There are few restrictions on who can apply for a VA loan. Most importantly, you must have satisfactory credit and sufficient income to make your monthly mortgage payments. You will also need a Certificate of Eligibility (COE) from the VA, which you can get through a lender or the VA itself.

The maximum amount that you can borrow with a VA loan varies from county to county, but it is generally $417,000. However, the VA does provide some flexibility for Veterans who need to borrow more money. The Max VA Loan Amount can also be increased if the Veteran is disabled or if the Veteran purchases a home with energy-efficient features.