What is the Interest Rate on a Business Loan?

Contents

A business loan can help your small business grow and expand. But what is the interest rate on a business loan? We’ll break it down for you.

Checkout this video:

Introduction

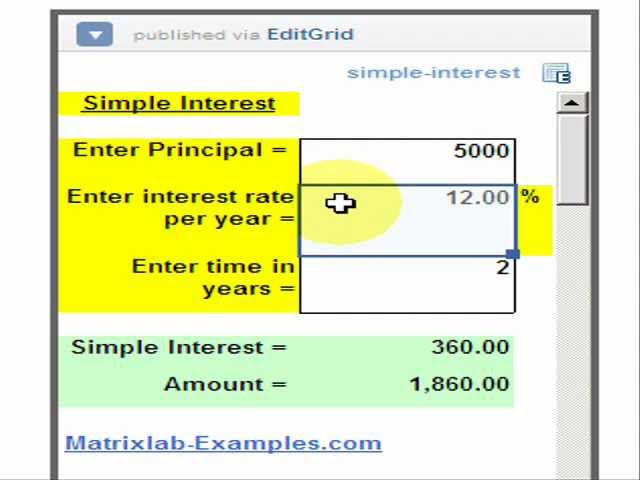

In order to make an informed decision about whether or not to take out a business loan, it is important to understand the interest rate. The interest rate on a business loan is the percentage of the loan that must be paid in addition to the original amount borrowed. The interest rate will vary depending on the lender, the type of loan, and the creditworthiness of the borrower.

The most common type of business loan is a term loan. A term loan is a lump sum of money that is borrowed for a specific period of time, usually between one and five years. The interest rate on a term loan is usually fixed, which means that it will not change over the life of the loan. The monthly payments on a term loan are usually fixed as well, which means that they will not change over the life of the loan.

Another type of business loan is a line of credit. A line of credit is an arrangement between a lender and a borrower in which the borrower can borrow up to a certain amount of money over a period of time, typically one year. The interest rate on a line of credit is usually variable, which means that it can change over time. The monthly payments on a line of credit are also typically variable, which means that they can change over time.

The interest rate on a business loan is important because it will determine how much money you will have to pay back in addition to the original amount borrowed. It is important to shop around for the best interest rate before you decide to take out a business loan.

What is the Interest Rate on a Business Loan?

The interest rate for a business loan can vary depending on the size of the loan, the creditworthiness of the borrower, and the type of lender. However, rates typically range from 5% to 25%.

The best interest rate that a borrower can get usually depends on the size of the loan. For example, SBA 7(a) loans have a maximum amount of $5 million and an interest rate range of 5.75% to 10%. On the other hand, SBA 504 loans have a maximum amount of $5.5 million and an interest rate range of 4% to 10%.

The creditworthiness of the borrower is another factor that can affect the interest rate on a business loan. Lenders will often offer lower rates to borrowers with strong credit scores and histories because they pose less of a risk. Similarly, borrowers with collateral may also be able to get lower rates.

Finally, the type of lender can also affect the interest rates on business loans. For example, online lenders may be able to offer lower rates than traditional banks because they have less overhead costs. However, it’s important to compare offers from multiple lenders to make sure you’re getting the best deal possible.

How to Get the Best Interest Rate on a Business Loan

The interest rate on a business loan is important, but it’s not the only thing to consider when you’re shopping for a loan. You also need to pay attention to the fees, the repayment terms, and the size of the loan.

The best way to get the best interest rate on a business loan is to shop around. Talk to your bank, talk to other banks, and talk to online lenders. Compare the offers that you get and choose the one that’s right for you.

There are a few things that you can do to improve your chances of getting a low interest rate:

-Have good credit: Lenders are more likely to give you a lower interest rate if you have good credit. If your business doesn’t have good credit, you can try finding a cosigner with good credit.

-Ask for a lower rate: Don’t be afraid to ask for a lower interest rate. If you have good credit, the lender may be willing to give you a lower rate.

-Offer collateral: You may be able to get a lower interest rate if you offer collateral, such as real estate or equipment.

You should also be aware of the fees that come with business loans. Some lenders charge origination fees, which can add up. Make sure that you compare the total cost of the loan, including the interest rate and all of the fees, before you decide which loan is right for your business.

Conclusion

The interest rate on a business loan depends on a number of factors, including the type of loan, the lender, the size of the loan, and the creditworthiness of the borrower. However, in general, business loans tend to have higher interest rates than other types of loans.