What Is The Finance Charge On A Loan?

Contents

- What is the finance charge on a loan?

- How is the finance charge on a loan calculated?

- What are the factors that affect the finance charge on a loan?

- How can you avoid paying a finance charge on a loan?

- What are the consequences of not paying a finance charge on a loan?

- How can you negotiate a lower finance charge on a loan?

- What are the different types of finance charges on loans?

- How do finance charges on loans impact your credit score?

- What are some tips for minimizing finance charges on loans?

- What are some common mistakes people make with finance charges on loans?

If you’re considering taking out a loan, you’ll want to know what the finance charge is. This is the fee that the lender charges for providing the loan, and it can vary depending on the type of loan and the lender. Here’s what you need to know about the finance charge on a loan.

Checkout this video:

What is the finance charge on a loan?

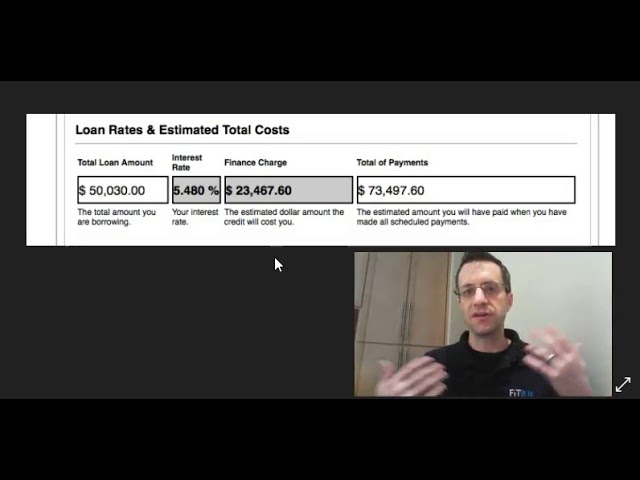

At its most basic, the finance charge on a loan is the cost of borrowing money. This includes any fees or interest charged by the lender. The finance charge can be a flat fee, like an origination fee, or it can be a percentage of the total loan amount, like an interest rate.

When you’re shopping for a loan, it’s important to pay attention to the finance charge so that you can compare different offers and choose the one that’s best for you. Keep in mind that the lowest finance charge doesn’t necessarily mean that the loan is free — you’ll still have to repay the borrowed amount plus any fees.

How is the finance charge on a loan calculated?

The finance charge is the total cost of borrowing money, and it’s calculated by adding the interest, points, mortgage insurance, and other fees to the loan amount. You can get an estimate of your finance charge by using a loan calculator.

What are the factors that affect the finance charge on a loan?

There are a number of factors that can affect the finance charge on a loan, including the type of loan, the amount of the loan, the interest rate, and the length of time you have to repay the loan. With some loans, such as credit cards, the finance charge may also be affected by things like cash advances and late payments.

How can you avoid paying a finance charge on a loan?

There are a few ways to avoid paying a finance charge on a loan. One way is to make sure that you only borrow what you need and that you repay the loan as soon as possible. Another way is to choose a lender that does not charge a finance fee. Finally, you can try to negotiate with the lender to waive the finance fee.

What are the consequences of not paying a finance charge on a loan?

If you do not pay the finance charge on a loan, the lender may choose to either:

-Charge you a late fee

-Report the delinquency to the credit reporting agencies, which could negatively impact your credit score

-Take legal action against you

How can you negotiate a lower finance charge on a loan?

Finance charges on loans can vary significantly depending on the type of loan, the lender, and the borrower’s creditworthiness. In general, however, borrowers can try to negotiate a lower finance charge on their loan by:

– requesting a lower interest rate from their lender

– agreeing to a shorter loan term

– providing collateral to secure the loan

– demonstrating a history of responsible credit management

What are the different types of finance charges on loans?

There are four different types of finance charges on loans: points, origination fees,Discount Points and Brokerage Commissions.

-Points: A point is equal to 1 percent of the loan amount. For example, on a $100,000 loan, one point would cost you $1,000.

-Origination Fees: This is a fee charged by the lender for processing the loan. It is typically a percentage of the loan amount, such as 1 percent.

-Discount Points: These are paid upfront to lower your interest rate. Each point typically lowers your rate by 0.25 percent.

-Brokerage Commissions: These are paid to mortgage brokers for their services in finding you a loan. They are typically 1 percent of the loan amount.

How do finance charges on loans impact your credit score?

Finance charges are fees that lenders charge for the use of their money. The finance charge is added to the outstanding balance of a loan and is paid off over time with monthly loan payments. Finance charges can impact your credit score in a number of ways.

The first way is by increasing your overall debt-to-income ratio. This ratio is a measure of how much debt you have relative to your income and is one of the key factors that lenders look at when considering a loan. A higher debt-to-income ratio may make it more difficult to get approved for new loans or lines of credit in the future.

The second way that finance charges can impact your credit score is by increasing the amount of interest you’re paying on your outstanding debt. The more interest you’re paying, the less money you have available to make monthly payments on other debts, which can eventually lead to late or missed payments. This can have a major negative impact on your credit score.

If you’re considering taking out a loan, be sure to carefully compare interest rates and fees from different lenders before choosing one. You’ll want to find a loan with the lowest possible finance charge to keep your debt-to-income ratio low and minimize the amount of interest you’ll pay over time.

What are some tips for minimizing finance charges on loans?

There are a few things you can do to keep your finance charges down:

-shop around for the best interest rates before you take out a loan

-pay your loan off as quickly as possible

-make sure you understand all the fees and charges associated with your loan before you agree to it

What are some common mistakes people make with finance charges on loans?

There are a few common mistakes people make when it comes to finance charges on loans. First, they may not understand what a finance charge is and think it’s simply the interest rate. However, a finance charge also includes any fees associated with the loan, such as origination fees or service charges.

Another mistake people make is not shopping around for the best deal. It’s important to compare offers from different lenders to make sure you’re getting the best rate and terms possible.

Finally, people sometimes fail to read the fine print and end up paying more in finance charges than they originally agreed to. Be sure to carefully review all loan documents before signing anything so you know exactly what you’re responsible for.