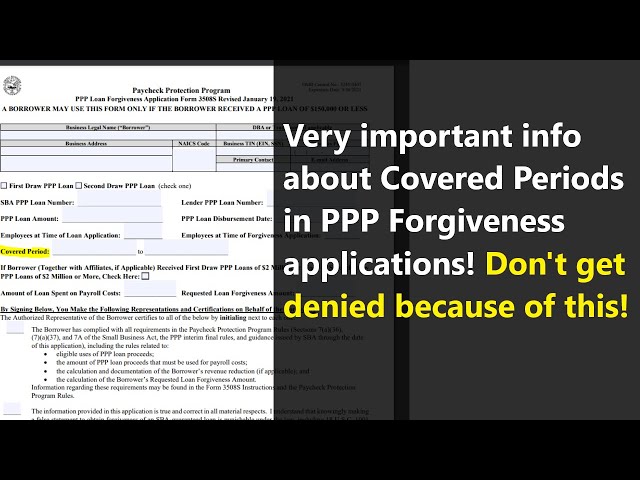

What is the Covered Period for PPP Loan Forgiveness?

Contents

The Covered Period for the Paycheck Protection Program (PPP) loan forgiveness is the period beginning on the date the loan is originated and ending on the date that is either 8 weeks or 24 weeks after the date of loan origination.

PPP Loan Forgiveness?’ style=”display:none”>Checkout this video:

Introduction

The covered period for PPP loan forgiveness can vary depending on when you received your loan. If you received your loan before June 5, 2020, the covered period is the 24 weeks (168 days) from the date you received your loan. If you received your loan on or after June 5, 2020, the covered period is the 24 weeks (168 days) from the date you spent your first PPP loan proceeds.

What is the Covered Period?

The covered period for PPP loan forgiveness is the 24-week period beginning on the date that your PPP loan is funded. During this period, you can use your PPP loan for payroll and other approved expenses in order to have your loan forgiven. If you do not use your PPP loan for approved expenses during the covered period, you will be required to repay the full amount of your loan.

What are the Eligible Expenses?

The Covered Period for PPP Loan Forgiveness is the time period during which eligible expenses must have been incurred and paid in order for those expenses to be eligible for forgiveness. The Covered Period begins on the date you receive your PPP loan and ends either:

-8 weeks after you receive your loan; OR

-24 weeks after you receive your loan

What is the Loan Forgiveness Application Process?

To have your PPP loan forgiven, you must apply through your lender using one of the SBA’s Forgiveness Applications. You can find the SBA’s application forms here:

-SBA Form 3508 – For loans of $50,000 or less

-SBA Form 3508EZ – For loans of $50,000 or less AND you meet one or more of the following criteria:

-You are self-employed and have no employees; OR

-You didn’t reduce the number of full-time equivalent employees; OR

-You didn’t reduce salaries or wages by more than 25 percent for any employee that made less than $100,000 annualized in 2019.

If you use the 3508EZ form, you will need to attach a Schedule A that calculates your employee headcount and payroll deductions.

Once you have completed and signed your forgiveness application, you must submit it to your lender with all required documentation. Your lender has 90 days to review and approve your application.

What are the SBA’s Loan Forgiveness Review Procedures?

The SBA will review all applications for loan forgiveness and make a determination on eligibility and the amount of loan forgiveness. Once the SBA has made its determination, it will notify the lender. The SBA expects to issue guidance on loan forgiveness before the end of August 2020.

The SBA’s decision on loan forgiveness will be final. Borrowers who disagree with the SBA’s decision may appeal the decision in accordance with the procedures set forth in 13 CFR 120.1100 et seq.

Conclusion

The covered period for PPP loan forgiveness can last anywhere from 8 to 24 weeks, depending on when you received your loan. If you received your loan before June 5, 2020, you have the option to choose an 8-week or 24-week covered period. If you received your loan on or after June 5, 2020, you will have a 24-week covered period.