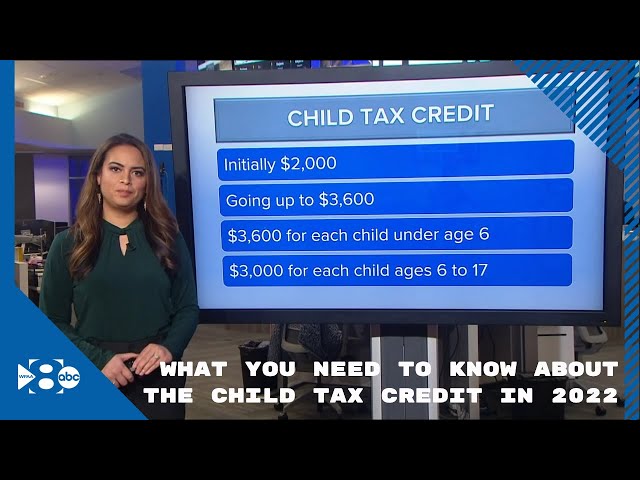

What is the Child Tax Credit for 2022?

Contents

The Child Tax Credit is a tax credit worth up to $2,000 per qualifying child. The credit is refundable, which means that if it exceeds the amount of taxes you owe, you will receive the difference as a refund.

Checkout this video:

What is the Child Tax Credit?

The Child Tax Credit is a tax credit that helps families with the cost of raising children. The credit is worth up to $2,000 per child under age 17. For 2021, the credit is worth up to $3,000 per child under age 18. The credit is refundable, which means that families can receive the credit even if they don’t owe any taxes. Families can also receive a smaller credit if they don’t have enough income to qualify for the full credit. The Child Tax Credit is different from the Child and Dependent Care Credit, which helps families with the cost of child care.

How Much is the Child Tax Credit?

The Child Tax Credit is worth up to $2,000 per qualifying child. The amount of the credit is based on your income, with the maximum amount available to those with an adjusted gross income (AGI) above $75,000 ($110,000 for joint filers). If your AGI is below these amounts, you may still be eligible for a partial credit. Families with three or more qualifying children can receive up to $1,400 in additional child tax credits.

How to Qualify for the Child Tax Credit

To qualify for the child tax credit, you must have a qualifying child under age 17. A qualifying child is your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of them (for example, your grandchild). The child must also meet all the following criteria:

For tax years 2020 and 2021, the child must have lived with you for at least half of the year.

The child must not provide more than half of his or her own support for the year.

The child must be younger than you (or your spouse if filing jointly) at the end of the tax year.

The child must not have filed a joint return for the year (or married filing separately).

How to Claim the Child Tax Credit

To claim the Child Tax Credit, you will need to provide the following information on your tax return:

The child’s full name

The child’s Social Security Number

The child’s date of birth

Your relationship to the child

Whether the child lived with you for more than half the year

If the child is disabled, you will also need to provide proof of disability, such as a letter from a doctor.

If you are claiming the credit for more than one child, you will need to provide information for each child.

When to Expect the Child Tax Credit

The Child Tax Credit is a tax credit that is available to taxpayers who have dependent children. The credit is worth up to $2,000 per child, and it can be used to offset the cost of raising a child.

The Child Tax Credit is scheduled to be available for the 2022 tax year. The credit will be available to taxpayers who have dependent children who are under the age of 18. The credit will be worth up to $2,000 per child.

If you are expecting a child in 2022, you may be able to claim the Child Tax Credit on your taxes. The credit can help offset the cost of raising a child, and it can also help you reduce your tax bill.