What is the Best Credit Card with the Lowest Interest Rate?

Contents

If you’re looking for the best credit card with the lowest interest rate, you’ve come to the right place. In this blog post, we’ll share some tips on how to find the best credit card for your needs.

Checkout this video:

Credit Card Basics

Before applying for a credit card, it’s important to understand the basics of credit cards. This will help you choose the right card for your needs. Credit cards come with different interest rates, annual fees, and rewards programs. It’s important to compare these factors before choosing a card.

What is a credit card?

A credit card is a plastic card that gives the holder a borrowing limit that can be used to make purchases or withdraw cash. Credit cards are issued by banks and other financial institutions and can be used anywhere that accepts the relevant card network, such as Visa or Mastercard.

The credit limit is the maximum amount you can borrow on your card at any one time, and your credit score will partly dictate how high this limit is. Your credit utilization ratio, which is the amount of your credit limit you use in a month, also plays a role in your credit score. Using too much of your credit limit can hurt your score, so it’s important to keep this number low.

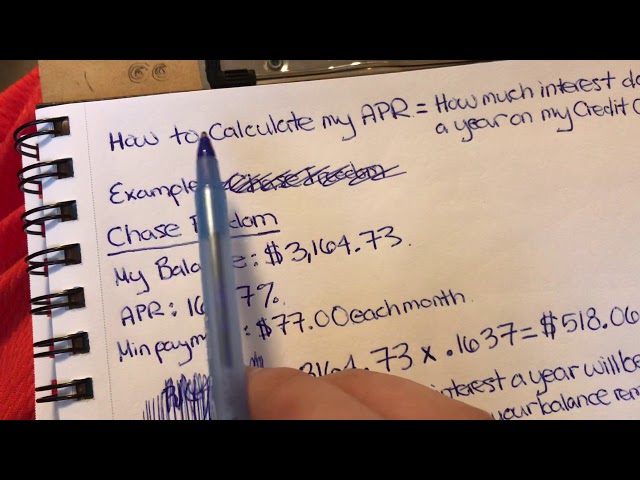

Interest is charged on credit card purchases when you don’t pay off your balance in full each month. The annual percentage rate (APR) is the interest rate you’ll pay on any outstanding balances. Some cards have introductory rates that are lower than the standard APR, which can be helpful if you plan to carry a balance on your card. However, it’s important to note that most intro rates eventually expire, so you could end up paying more interest down the line if you don’t pay off your debt before then.

In addition to interest, credit cards may also charge annual fees, late payment fees, and foreign transaction fees. These charges can add up, so it’s important to choose a card that doesn’t have too many of them. Some cards also offer rewards points or cash back on purchases, which can offset some of the costs associated with using a credit card.

When used responsibly, credit cards can be a helpful tool for managing finances and building credit. However, it’s important to understand the risks associated with using them before you apply for one.

How do credit cards work?

Credit cards are essentially loans that must be repaid with interest. When you use a credit card to make a purchase, you are borrowing money from the credit card issuer up to the credit limit on your card. You will then need to repay that loan, plus any interest and fees, at a later date.

If you do not repay your outstanding balance in full each month, you will be charged interest on the outstanding balance. The annual percentage rate (APR) is the rate at which you will be charged interest on your outstanding balance. APRs can range from around 10% to over 30%.

In addition to the APR, you may also be charged other fees, such as an annual fee, cash advance fee, foreign transaction fee or late payment fee.

What are the benefits of using a credit card?

There are many benefits of using a credit card, including the ability to build your credit score, earn rewards, and enjoy protections and perks.

Building your credit score is one of the most important benefits of using a credit card. Your credit score is used by lenders to determine whether you qualify for loans and what interest rates you’ll be offered. A higher credit score can save you thousands of dollars in interest over the life of a loan.

Rewards are another great benefit of using a credit card. Many cards offer points, miles, or cash back on your purchases. You can use these rewards to book travel, get cash back, or make purchases at participating retailers. Some cards even offer sign-up bonuses worth hundreds of dollars when you meet minimum spending requirements.

In addition to rewards and building your credit score, using a credit card also comes with protections and perks. Most cards offer purchase protection, which covers your items if they’re damaged or stolen within a certain time period after you make your purchase. Many cards also come with extended warranties on eligible purchases, and some even offer price protection in case an item you bought goes on sale soon after your purchase. Perks can include things like airport lounge access, free checked bags, or statement credits for streaming services.

Types of Credit Cards

There are many different types of credit cards available on the market, each with its own set of benefits and drawbacks. Some credit cards offer low interest rates, while others offer rewards programs or cash back. It’s important to understand the different types of credit cards before you decide which one is right for you.

Low interest rate credit cards

There are several types of credit cards available on the market today, each with its own set of benefits and drawbacks. One type of credit card that may be of interest to consumers who are looking to save money on interest charges is the low interest rate credit card.

As the name suggests, low interest rate credit cards offer a lower annual percentage rate (APR) than other types of credit cards. This can be a great benefit for consumers who carry a balance on their credit card from month to month, as it will save them money on interest charges over time.

However, it is important to note that low interest rate credit cards typically come with strict requirements in terms of creditworthiness. In order to qualify for a low interest rate, consumers typically need to have very good or excellent credit scores. As such, these cards may not be an option for everyone.

Additionally, low interest rate credit cards typically have lower rewards programs than other types of cards. So if you are looking for a card that offers great rewards, you may want to look elsewhere.

Overall, low interest rate credit cards can be a great option for consumers who are looking to save money on interest charges. However, it is important to understand the requirements and limitations associated with these types of cards beforeapplyings for one.

Rewards credit cards

Rewards credit cards offer points, cash back, or travel miles in exchange for your spending. Some even offer additional bonuses for sign-ups and everyday spending. If used properly, rewards cards can save you a considerable amount of money on things you were buying anyway. However, it’s important to remember that these cards typically have higher interest rates than non-rewards cards, so it’s important to pay your balance in full each month.

Some popular rewards cards include:

-Chase Freedom Unlimited: Offers 1.5% cash back on every purchase with no annual fee and a 0% introductory APR for 15 months.

-Capital One Venture Rewards: Offers 2 miles per dollar spent on every purchase, with no foreign transaction fees and a $95 annual fee (waived the first year).

-Discover it Cash Back: Offers 5% cash back in rotating categories each quarter (up to $1,500 spent) and 1% cash back on all other purchases, with no annual fee.

Cash back credit cards

These are the best credit cards for people who want to earn cash back on their purchases. Cash back credit cards typically offer a higher percentage of cash back on specific categories of purchases, such as groceries or gas, and a lower percentage on everything else. Some cash back credit cards also offer bonus rewards on specific categories of purchases during certain periods of time.

How to Choose the Best Credit Card for You

Credit card companies offer a variety of cards with different interest rates and terms. It can be difficult to choose the best credit card for your needs. To make the best decision, you should consider your spending habits and financial goals. In this article, we will provide you with a few tips on how to choose the best credit card for you.

Consider your credit score

One of the most important factors in choosing the best credit card for you is your credit score. Credit scores range from 850, which is excellent, to 300, which is poor. The higher your score, the easier it will be to get approved for a credit card with a low interest rate.

If you have a poor credit score, you may still be able to get approved for a credit card, but you will likely have to pay a higher interest rate. There are many different credit scoring models, but the most common one used by lenders is the FICO score. You can check your FICO score for free on websites like Credit Karma and Credit Sesame.

Once you know your credit score, you can start looking for credit cards that are designed for people with your level of credit. Here are some general guidelines:

Credit Score of 700 or higher: You should be able to qualify for just about any credit card on the market, including cards with low interest rates and great rewards programs.

Credit Score of 650-699: You should still be able to qualify for many goodcredit cards, although you may have to pay a slightly higher interest rate than someone with excellent credit.

Credit Score of 600-649: You may be limited in the types of credit cards you can qualify for, and you will likely have to pay a higher interest rate. However, there are still some good options available if you know where to look.

Credit Score of 550-599: If your credit score is in this range, your options will be very limited. You may only be able to qualify for securedcredit cards or subprime cards with high fees and interest rates

Compare credit card features

When you’re looking for a new credit card, it’s important to compare credit card features to find the best fit for your spending habits and repayment ability. Here are a few things to think about:

-Annual Percentage Rate (APR): This is the interest rate you’ll be charged on any balances you carry from month to month. Look for a card with a low APR to save on interest costs.

-Balance transfer fee: If you plan to transfer any balances from another credit card, look for a card with a low balance transfer fee. Some cards even offer introductory 0% APR periods on balance transfers, which can help you save on interest.

-Foreign transaction fee: If you travel overseas often or make purchases in foreign currencies, look for a card that doesn’t charge a foreign transaction fee. This could help you save a significant amount of money on your travels.

-Rewards: Many credit cards offer rewards programs that let you earn points or cash back on your purchases. If you frequently use your credit card for everyday spending, look for a card that offers great rewards so you can earn back some of what you spend.

Read the fine print

When you’re comparing credit cards, it’s important to read the fine print so that you understand the terms and conditions of each card. Some cards have annual fees, which can add to the cost of using the card. Other cards may charge foreign transaction fees if you use the card to make purchases outside of the United States.

It’s also important to compare the interest rates on different cards. The interest rate is the fee that you’ll pay for borrowing money from the credit card company. The higher the interest rate, the more you’ll pay in finance charges if you carry a balance on your card from month to month.

Some credit cards offer introductory rates, which can be lower than the standard interest rate. However, these rates typically only last for a limited time, so it’s important to know what the standard interest rate will be after the intro period expires.

Another fee to look out for is a balance transfer fee. This is a fee that some credit card companies charge when you transfer a balance from one credit card to another. Balance transfer fees are typically 3% of the amount being transferred, so they can add up if you’re transferring a large balance.

Finally, make sure you understand any rewards or perks that come with each card. For example, some cards offer cash back or points that can be used for travel or other purchases. Others may come with perks such as extended warranties on purchases made with the card.

The Bottom Line

Credit cards can be a great way to build credit, but only if you use them responsibly. The best credit card for you is the one that charges the lowest interest rate. This way, you can avoid paying high interest charges and keep your credit card balance under control.

The best credit card for you is the one that fits your financial needs and goals

The best credit card for you is the one that fits your financial needs and goals. If you’re looking for a card with the lowest interest rate, you’ll want to consider cards from both national and local banks. Some cards offer low introductory rates, while others charge no annual fee.

When choosing a credit card, it’s important to read the fine print and to understand the terms and conditions before applying. It’s also important to remember that the interest rate is only one factor to consider when choosing a credit card. Other factors such as annual fees, rewards programs, and perks should also be considered.