What is the Average Interest Rate for a Business Loan?

Contents

If you’re looking to take out a business loan, you’re probably wondering what the average interest rate is. The answer depends on a number of factors, but we’ve got all the info you need to make an informed decision.

Checkout this video:

Introduction

The average interest rate for a business loan depends on a number of factors, including the size of the loan, the creditworthiness of the borrower and the type of loan. Currently, average rates for both small business loans and SBA-backed loans range from 6 percent to 30 percent.

The Average Interest Rate Depends on the Type of Loan

The average interest rate for a small business loan depends upon a number of factors. The type of loan, the lender, the size of the loan, the length of the loan, and your credit history all play a role.

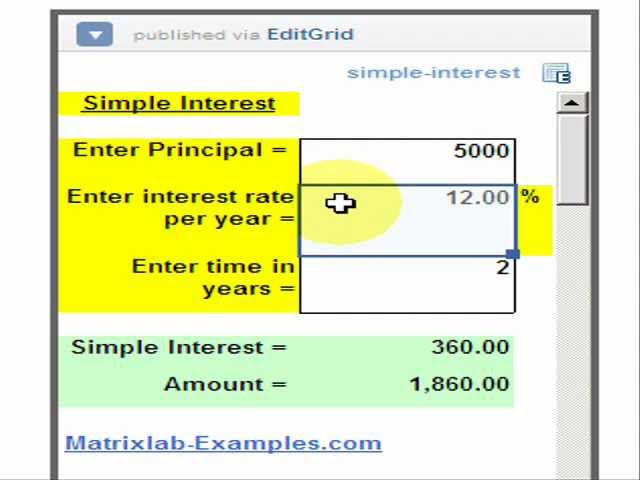

The most common type of loan is a term loan, which is a loan that is repaid over a fixed period of time, usually between two and five years. The average interest rate for a term loan is usually between six and eight percent.

The second most common type of loan is a line of credit, which is a revolving form of credit that can be used to finance various business expenses. The average interest rate for a line of credit depends on the prime rate, which is currently about three percent. However, because lines of credit are revolving, the interest rate may fluctuate up or down as the prime rate changes.

The third most common type of loan is an SBA Loan, which stands for Small Business Administration. SBA Loans are government-backed loans that are available to small businesses who may not qualify for traditional loans from banks. The average interest rates for SBA Loans are typically lower than those for other types of loans because they are backed by the government. Currently, the average interest rate for an SBA Loan is around seven percent.

The Average Interest Rate Depends on the Lender

The average interest rate for a business loan depends on the type of loan, the lender, your credit score and your ability to repay the loan.

The average interest rate for a small business loan is between six and eight percent.

For a business line of credit, the average interest rate is around 10 percent.

For an equipment loan, the average interest rate is between 12 and 20 percent.

The Average Interest Rate Depends on the Borrower

The average interest rate for a business loan depends on a number of factors, including the size of the loan, the creditworthiness of the borrower and the type of loan.

Small Business Administration (SBA) loans typically have lower interest rates than conventional bank loans. The SBA sets maximum interest rates for its 7(a) and 504 lending programs. As of April 2018, the maximum interest rate for 7(a) loans is 9.75%, with terms up to 25 years. The maximum interest rate for 504 loans is 10.75%, with terms up to 20 years.

Interest rates on conventional bank loans can vary depending on the size of the loan, the creditworthiness of the borrower and the type of loan. For example, small business loans from banks tend to have lower interest rates than credit card loans.

The average interest rate for a small business loan from a bank is around 4% to 13%, depending on the size of the loan, the creditworthiness of the borrower and other factors. Credit card interest rates are typically much higher, around 12% to 30%.

How to Get the Best Interest Rate on a Business Loan

The average interest rate for a business loan depends on a number of factors, including the type of loan, the lender, the size of the loan, and your creditworthiness.

For small business loans, the average interest rate is usually between four and seven percent. For larger loans, the rate can be ten percent or higher. The best way to get the most favorable interest rate is to have good credit and to shop around among multiple lenders.