What Is The 72 Rule In Finance?

Contents

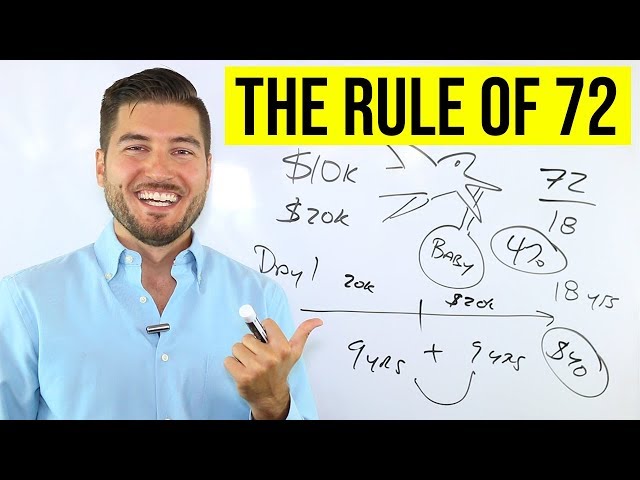

The 72 Rule is a simple way to calculate how long it will take for your money to double given a certain interest rate.

Checkout this video:

Introduction

In finance, the 72 rule is a method of calculating the amount of time it takes for an investment to double given a fixed rate of return. To use the 72 rule, simply divide 72 by the interest rate you are expecting to earn on your investment. For example, if you expect to earn an annual return of 6% on your investment, it would take 72 ÷ 6 = 12 years for your investment to double.

The 72 rule is a useful tool for estimating how long it will take for an investment to grow, but it is important to remember that it is only an estimate. The actual amount of time it takes for an investment to double can vary depending on a number of factors, such as the actual rate of return earned and inflation.

What is the 72 Rule?

The 72 Rule is a financial principle that states that the amount of time it takes for an investment to double can be estimated by dividing 72 by the compound annual growth rate (CAGR). The CAGR is the rate of return that would make an investment grow at a constant rate over time.

For example, if an investment has a CAGR of 8%, it would take approximately 9 years for it to double in value (72/8 = 9). Similarly, if an investment has a CAGR of 10%, it would take approximately 7.2 years for it to double in value (72/10 = 7.2).

The 72 Rule is a helpful tool for estimating how long it will take for an investment to reach a certain goal. It can also be used to compare the potential growth of different investments. For example, if one investment has a CAGR of 8% and another has a CAGR of 10%, the 72 Rule indicates that the second investment will grow at a faster rate and reach its goal sooner.

Investors should keep in mind that the 72 Rule is only an estimate and that actual results may differ from what is predicted. This is because investments do not always grow at a constant rate and there is always some risk involved.

How does the 72 Rule work?

The 72 Rule is a simple way to estimate how long it will take for your money to double at a given interest rate. All you need to do is divide 72 by the interest rate you expect to earn on your investment. For example, if you expect to earn an 8% return on your investment, you will double your money in about 9 years (72/8 = 9).

While the 72 Rule is a helpful guideline, it is important to remember that it is only an estimate. Your actual results may differ depending on a number of factors, including the actual interest rate you earn, inflation, and fees or other charges associated with your investment.

What are the benefits of the 72 Rule?

The 72 Rule is a simple way to understand the relationship between interest rates and the time it takes to double your money. The rule says that if you divide 72 by the interest rate you’re earning on your investment, you’ll get the number of years it will take to double your money. For example, if you’re earning 10% interest, it will take 7.2 years (72/10) to double your money.

The 72 Rule is a helpful tool because it shows how important it is to invest in something with a higher interest rate. The higher the interest rate, the faster your money will grow. And, of course, the longer you have to invest, the more time your money has to grow.

What are the drawbacks of the 72 Rule?

There are a few drawbacks to the 72 Rule. First, it does not account for inflation. Inflation will reduce the purchasing power of your money, so you will need more money than the 72 Rule suggests to maintain your standard of living in retirement. Second, the 72 Rule assumes that you will earn a fixed rate of return on your investments. In reality, investment returns can be volatile, so you may need to adjust your expectations if your actual returns are lower than expected. Finally, the 72 Rule does not account for any changes in your lifestyle or spending habits during retirement. If you plan to travel or make other significant purchases in retirement, you may need to save more than the 72 Rule suggests.

Who is the 72 Rule suitable for?

The 72 Rule is a personal finance rule that suggests that the amount of time required to double your money can be estimated by dividing 72 by your rate of return. The rule applies to any sum of money, whether it’s an investment, a savings account, or a pension.

The 72 Rule is most useful for long-term investments, such as retirement saving, where the focus is ongrowth rather than immediate income. It can also be helpful for planning purposes, as it provides a rough estimate of how long it will take for an investment to reach a certain value.

For example, if you are saving for retirement and you expect to receive a 7% annual return on your investments, the 72 Rule suggests it will take approximately 10 years (72 divided by 7) for your money to double.

The 72 Rule is a simplified way of estimating the effect of compound interest and should not be used as a replacement for more detailed financial planning. It’s also important to remember that investment returns are never guaranteed, so the actual time it takes to double your money may be more or less than the estimate provided by the 72 Rule.

How can I implement the 72 Rule?

The 72 Rule is a simple way to determine how long it will take for an investment to double given a certain expected rate of return. The rule states that you will take the number 72 and divide it by the expected rate of return. The answer will give you the number of years it will take for your money to double.

For example, if you expect your investments to grow by 7% annually, it would take 10 years for your money to double according to the 72 Rule (72/7 = 10). If you want to achieve a faster doubling time, you need to find investments with a higher expected rate of return.

Of course, the 72 Rule is just a guideline and there are no guarantees in investing. However, it can be a helpful tool when evaluating different investment options and planning for your financial future.

What are some alternative rules?

The 72 rule is a simple way to estimate how long it will take for your money to double at a given interest rate. To use the 72 rule, divide 72 by the stated interest rate. For example, if you are earning 7% interest, your money will double in approximately 10 years (72/7 = 10.29).

While the 72 rule is a useful tool, it is important to remember that it is only an estimate. There are other formulas that can be used to calculate the doubling time of your money, such as the Rule of 70 and the Rule of 100.

The Rule of 70

The Rule of 70 is very similar to the 72 rule, but it allows you to estimate the doubling time with a smaller number (70 instead of 72). To use the Rule of 70, divide 70 by the stated interest rate. For example, if you are earning 7% interest, your money will double in approximately 10 years (70/7 = 9.86).

The Rule of 100

The Rule of 100 is another way to estimate the doubling time of your money. To use the Rule of 100, divide 100 by the stated interest rate. For example, if you are earning 7% interest, your money will double in approximately 14 years (100/7 = 14.29).

Conclusion

The 72 Rule is a simple way to calculate how long it will take for your money to double at a given interest rate. Just divide 72 by the interest rate you expect to earn on your investment and you have your answer. For example, if you expect to earn an 8 percent return on your money, you can expect it to double in 9 years (72 / 8 = 9).

The rule is a shortcut that assumes you will reinvest all of your earnings at the same interest rate. In reality, things are rarely that simple. Nevertheless, the rule is a useful tool for anyone trying to get a handle on how different interest rates can impact their bottom line.

Further reading

The 72 Rule is a simple way to calculate how long it will take for your money to double given a certain interest rate. The rule is named after the number of years it takes for an investment to double at a rate of 8%, which is considered to be a good return on investment. The formula is:

interest rate

————-

72

For example, if you are earning 9% interest on your investments, it will take 8 years for your money to double (9% divided by 72 equals 0.125, or 8 years). This rule can be used for any interest rate, not just 8%.