What Is Loan Processing and How Does It Work?

Contents

- Loan Processing Defined

- The loan process begins when the borrower submits a loan application to the lender

- The lender will then review the loan application and supporting documentation to determine if the borrower meets their lending criteria

- If the borrower does meet the lender’s criteria, the loan will then be sent to a loan processor

- The Loan Processor’s Role

- Underwriting

- Closing

Loan processing is the term used to describe the various steps that go into approving and disbursing a loan. It can be a long and complicated process, but understanding how it works can help you navigate the loan process more effectively.

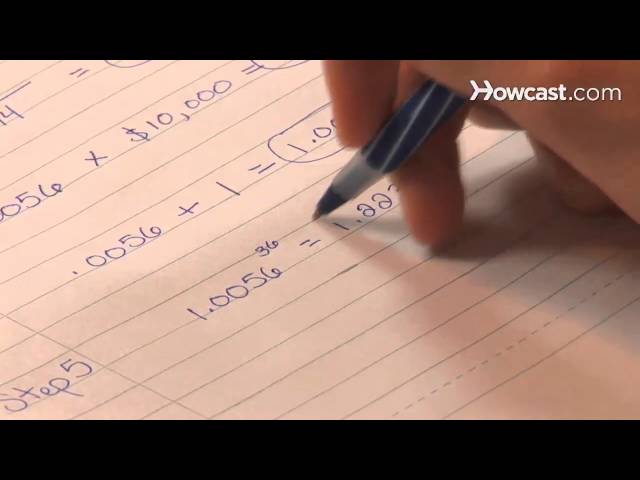

Checkout this video:

Loan Processing Defined

Loan processing is the process of verifying and preparing loan documentation for approval. The loan processor works closely with the loan officer to ensure all documentation is accurate and meets the guidelines of the lending institution. The loan processor is also responsible for ordering all necessary documentation, such as appraisal reports and title insurance.

The loan process begins when the borrower submits a loan application to the lender

The loan process begins when the borrower submits a loan application to the lender. The lender will then order a credit report on the borrower to determine his or her creditworthiness. In addition, the lender will order an appraisal of the property being purchased to ensure that it is worth at least as much as the loan amount. Once the credit report and appraisal have been received, the lender will determine whether or not to approve the loan.

If the loan is approved, the next step is for the borrower to sign a promissory note promising to repay the loan. The promissory note will include information such as the interest rate, repayment schedule, and any penalties for late payments. Once the promissory note has been signed, the loan processing is complete and the funds will be disbursed to the borrower.

The lender will then review the loan application and supporting documentation to determine if the borrower meets their lending criteria

Loan processing is the process a lender uses to determine if a borrower meets their guidelines and to complete the steps necessary to approve and fund a loan. The specific loan process may vary slightly by lender, but generally includes these stages:

-Application: Borrowers complete a formal loan application and provide supporting documentation, such as pay stubs, tax returns, and bank statements.

-Pre-approval: The lender will review the loan application and supporting documentation to determine if the borrower meets their lending criteria. If so, they will provide the borrower with a pre-approval letter indicating how much they are qualified to borrow.

-Processing: The loan processor will verify the information in the loan application, order a credit report, and prepare a Loan Origination System (LOS) submission for underwriting.

-Underwriting: The underwriter will review all of the information in the processing file to determine if the loan meets their guidelines. They may request additional information from the borrower or loan processor before making a decision.

-Approval/closing: If the loan is approved by underwriting, closing documents will be prepared and sent to the borrower for signing. Once signed, these documents are returned to the lender or closing agent along with any required fees or down payment funds. The loan is then funded and disbursed to the borrower.

If the borrower does meet the lender’s criteria, the loan will then be sent to a loan processor

Loan processing is the term used to describe all of the steps that must be completed before a lender can disburse funds to a borrower. Loan processing begins when the borrower submits their loan application to the lender.

The lender will then pull the borrower’s credit report and verify their employment and income. If the borrower does meet the lender’s criteria, the loan will then be sent to a loan processor.

The loan processor will collect all of the necessary documentation from the borrower and prepare it for underwriting. Once underwriting has approved the loan, it will be sent to closing where the borrower will sign all of the necessary paperwork and disbursement of funds will take place.

The Loan Processor’s Role

Loan processing is the process of verifying and reviewing a loan application to determine whether the borrower meets the eligibility requirements. The loan processor’s role is to ensure that all the required documentation is in order and that the loan meets the guidelines set by the lender. The loan processor will also work with the borrower to get any missing information.

The loan processor’s role is to collect and verify the borrower’s information and documentation

The loan processor’s role is to collect and verify the borrower’s information and documentation. The loan processor works closely with the borrower, real estate agent, and lender to obtain all of the necessary paperwork. Once all of the documentation has been collected, the loan processor will review it for completeness and accuracy. If everything is in order, they will forward the file to the underwriter for further review.

Once all of the information and documentation has been collected and verified, the loan processor will then submit the loan to underwriting

The loan processor’s role is to ensure that all of the information and documentation related to a loan application is complete and accurate. Once all of the required information has been collected and verified, the loan processor will then submit the loan to underwriting.

The underwriter will review the loan application and supporting documentation to determine if the borrower meets all of the lending criteria. If the loan is approved, the underwriter will issue a commitment letter stating their conditions for funding the loan. The loan processor will then work with the borrower to gather any additional required information and documentation, and will ultimately package and submit the loan for final approval.

Underwriting

Loan processing is the process of verifying and approving a loan application. The first step of loan processing is underwriting, which is when the lender reviews the borrower’s financial information to determine whether or not they are eligible for the loan.

The underwriter’s role is to determine if the borrower meets the lender’s guidelines for the loan

The underwriter’s role is to determine if the borrower meets the lender’s guidelines for the loan. The underwriter reviews the loan file to make sure all required documentation has been received and to verify the information provided by the borrower. The underwriter also verifies that the borrower has the ability to repay the loan.

The underwriter makes a decision to approve, deny or suspend the loan. If the loan is approved, the underwriter will issue a commitment letter to the lender. The commitment letter states that if all conditions in the letter are met, the underwriter will provide final approval for the loan. If the loan is suspended, there are usually conditions that need to be met before final approval can be given. If the loan is denied, then no further action can be taken and the borrower will need to look for another lender.

If the borrower does meet the lender’s guidelines, the loan will be approved and the borrower will be notified

Loan processing is the process a lender uses to determine whether a loan applicant meets their qualifications for a loan. It also includes verifying all of the information on the loan application, such as employment history, income, debts, and credit history.

After the initial loan application is completed, the loan processor will review it to make sure all of the necessary information has been provided. They will then follow up with the borrower to get any missing information. Once all of the information has been collected, the loan processor will compile it into a package and send it to the underwriter.

The underwriter is the person who determines whether or not the loan meets the lender’s guidelines. If the borrower does meet the lender’s guidelines, the loan will be approved and the borrower will be notified. If they do not meet the guidelines, they may be denied for the loan or asked to provide additional information.

Closing

Loan processing is the process of assessing a loan application and determining whether the applicant is eligible for the loan. Loan processing typically involves a number of steps, including a credit check, an assessment of the applicant’s employment history, and an evaluation of the applicant’s financial history. The loan processor will also verify the applicant’s collateral, if any, and determine whether the loan is likely to be repaid.

The closing is the final step in the loan process

After you have been approved for a loan, the lender will schedule a date for the closing. The closing is when you (the borrower) and the lender sign the loan documents and officially make the deal.

The closing usually takes place at the office of a lawyer or notary public, and it is at this meeting that you will pay any remaining fees and charges associated with the loan (such as the appraisal fee, inspection fee, etc.). You will also need to bring any required documents with you to the closing, such as your driver’s license or passport.

Once all of the paperwork is signed and all of the fees are paid, you will be given the keys to your new home!

At the closing, the borrower will sign the loan documents and the loan will be funded

At the closing of a loan, the borrower will sign the loan documents and the loan will be funded. The borrower will then have to make monthly payments to the lender, which will include interest and principal. The length of the loan, the interest rate, and other terms will be determined by the lender.