What is a HECM Loan?

Contents

If you’re considering a Home Equity Conversion Mortgage (HECM) loan, you probably have a lot of questions. What is a HECM loan? How does it work? What are the benefits?

In this blog post, we’ll answer all of your questions about HECM loans so you can make an informed decision about whether this type of loan is right for you.

Checkout this video:

What is a HECM Loan?

A HECM loan is a home equity conversion mortgage. It’s a type of reverse mortgage that allows you to cash in on your home equity. With a HECM loan, you can receive a lump sum of cash, a line of credit, or monthly payments.

What is a HECM?

A Home Equity Conversion Mortgage (HECM) is a government-backed mortgage loan for senior homeowners. With a HECM loan, borrowers can tap into their home equity to finance their retirement, make home repairs, or pay for other expenses.

HECM loans are different from traditional mortgages in a few key ways:

-HECM loans are available to homeowners age 62 and older.

-HECM loans are repaid when the borrower dies or sells the home.

-HECM loans have no minimum credit score requirements.

-HECM loans have adjustable interest rates, which means that the interest rate on the loan can go up or down over time.

If you’re a senior homeowner interested in using your home equity to supplement your retirement income, a HECM loan might be right for you.

What are the benefits of a HECM loan?

A Home Equity Conversion Mortgage (HECM), also known as a Reverse Mortgage, is a home loan that allows homeowners 62 years of age and older to convert all or a portion of their home equity into tax-free cash.

There are several benefits of a HECM loan:

1) There are no monthly mortgage payments required with a HECM loan; however, the borrower is still responsible for paying taxes and insurance on the property.

2) The funds from a HECM loan can be used for any purpose, including home improvements, paying off debt, or supplementing retirement income.

3) HECM loans do not have to be repaid until the borrower no longer occupies the property as their primary residence. At that time, the loan can be repaid by selling the property, or by using personal funds or other assets. If the sales proceeds are not enough to repay the loan balance, the lender will simply forgive the remaining balance.

What are the eligibility requirements for a HECM loan?

To be eligible for a Home Equity Conversion Mortgage (HECM) backed by the Federal Housing Administration (FHA), borrowers must meet the following requirements:

-Be at least 62 years old

-Own the home outright, or have a low mortgage balance that can be paid off at closing with proceeds from the HECM loan

-Occupy the property as a primary residence

-Show evidence of financial responsibility

-Not have been convicted of a felony or crime involving moral turpitude

In addition, the home must meet FHA standards and be approved for HECM insurance.

How does a HECM Loan work?

A Home Equity Conversion Mortgage (HECM) loan is a government-backed mortgage program that allows seniors to cash in on the equity in their homes. Seniors can use a HECM to pay for living expenses, medical bills, or other debts. The loan is repaid when the borrower dies, sells the house, or moves out of the house.

How is the loan amount determined?

The loan amount for a HECM is determined by several factors, including the age of the youngest borrower, the value of your home, and current interest rates.

You can generally borrow up to 60% of your home’s value, but this amount may be less depending on your age and the value of your home.

How do HECM loans work with other types of mortgages?

A home equity conversion mortgage (HECM) loan is a type of home loan that allows you to convert a portion of the equity in your home into cash. With a HECM loan, you can borrow against the equity in your home without having to sell your home or take on additional monthly payments.

HECM loans are available to homeowners 62 years of age or older who have significant equity in their homes. If you qualify for a HECM loan, you can use the money you borrow for any purpose, including:

-Paying off your existing mortgage

-Paying for home repairs or renovations

-Paying for medical expenses

-Covering the costs of long-term care

-Supplementing your income during retirement

What are the repayment options for a HECM loan?

There are three primary ways to repay a HECM loan:

1. Standard Repayment Plan – Borrower pays back the loan’s principal plus interest over time. The monthly payment amount is determined when the loan is originated and will remain the same throughout the life of the loan.

2. Modified Repayment Plan – Borrower pays back the loan’s principal plus interest and an additional amount each month to pay off the loan faster. The monthly payment amount is determined when the loan is originated and will remain the same throughout the life of the loan.

3. Tenure Repayment Plan – Borrower pays only interest on the loan for as long as they live in their home. The monthly payment amount is determined when the loan is originated but will fluctuate based on changes in interest rates.

What are the risks of a HECM Loan?

A Home Equity Conversion Mortgage (HECM) loan is a type of home loan that allows you to cash in on the equity in your home. This can be a great way to get extra money for retirement or other expenses, but there are some risks to consider before you apply for a HECM loan. In this section, we’ll go over some of the risks of a HECM loan so that you can make an informed decision about whether or not this type of loan is right for you.

What are the fees associated with a HECM loan?

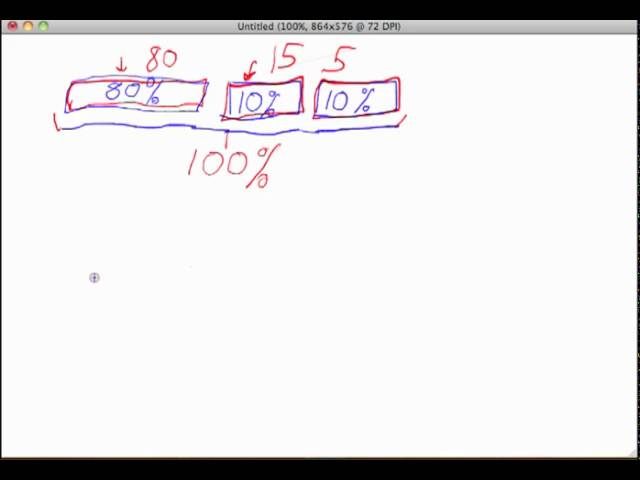

There are many fees associated with a Home Equity Conversion Mortgage (HECM) loan, including origination fees, appraisal fees, mortgage insurance premiums, and servicing fees. Some of these fees can be paid upfront at closing, while others are added to the loan balance or paid monthly.

Origination fee: This is a one-time fee charged by the lender to cover the costs of processing and originating the loan.

Appraisal fee: An appraiser will need to assess the value of your home to determine how much equity you have available to borrow. The appraisal fee can range from $300 to $500.

Mortgage insurance premium (MIP): All HECM loans require mortgage insurance, which protects the lender in case of default. The MIP is usually around 2% of the loan amount and is either paid upfront or added to the loan balance.

Servicing fee: This is an ongoing fee charged by the lender to cover the costs of servicing the loan, such as processing payments and responding to customer inquiries. Servicing fees can add up to $30 per month.

What are the risks of taking out a HECM loan?

A Home Equity Conversion Mortgage (HECM) loan is a type of reverse mortgage that allows you to convert your home equity into cash. With a HECM loan, you don’t have to make monthly mortgage payments, but you are still responsible for paying property taxes and insurance. If you fail to pay these, the lender can foreclose on your home.

HECM loans also have a few other risks to consider:

· You could end up owing more than your home is worth if the value of your home declines and you still have a balance on your loan.

· If you or your heirs want to sell the property in the future, the loan must be paid off first. If the sale proceeds aren’t enough to cover the balance, your heirs will be responsible for paying it off.

· You may not have enough money left over after paying off the loan to cover other expenses in retirement.

Before taking out a HECM loan, it’s important to understand all of the risks involved so that you can make an informed decision about whether this type of loan is right for you.

What are the alternatives to a HECM loan?

A HECM loan is a great option for seniors who want to tap into the equity in their homes, but it’s not the only option. There are several alternatives to a HECM loan that may be more suitable for your needs.

Reverse mortgages have come under fire in recent years, and with good reason. They can be expensive and there are some risks involved. But if you understand the costs and risks associated with a HECM loan, you can decide if it’s the right choice for you.

Here are some alternatives to a HECM loan:

1) Home equity line of credit (HELOC)

A HELOC is a revolving line of credit that you can use as needed. You only pay interest on the amount of credit you use, and you can pay it back at any time.

2) Cash-out refinance

A cash-out refinance allows you to tap into the equity in your home by refinancing your mortgage for more than you currently owe and taking the difference in cash. This is a good option if you need a lump sum of cash for things like home improvements or medical expenses.

3) Reverse mortgage modification

If you have a reverse mortgage, you may be able to modify the terms to make it more affordable. This could involve extending the term of the loan or getting a new loan with lower interest rates.

4) Personal loans

Personal loans are another option if you need cash. They can be used for anything you want, and they typically have lower interest rates than credit cards. You may be able to get a personal loan from your bank or credit union, or there are several online lenders that offer personal loans.