What is Credit Repair and How Does it Work?

Contents

If you’re considering credit repair, it’s important to understand what it is and how it works. This guide will give you the basics.

Credit Repair and How Does it Work?’ style=”display:none”>Checkout this video:

Introduction

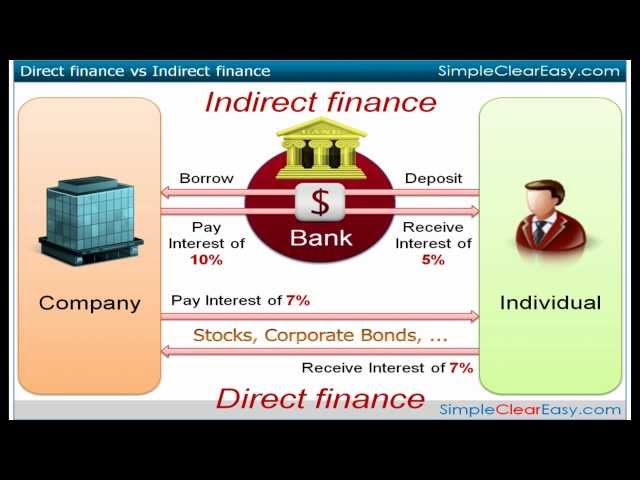

Credit repair is the process of fixing your credit reports so as to improve your credit score. This can be done by disputing errors on your reports, paying down your debts, and improving your payment history.

There are many companies that offer credit repair services, but you can also do it yourself. If you decide to do it yourself, you will need to get a copy of your credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) and review it for errors. Once you identify any errors, you will need to dispute them with the credit bureau in writing.

If you have negative entries on your credit report that are accurate, you can try to negotiate with the creditor to have them removed or changed. For example, if you have a late payment on your report, you can try to negotiate with the creditor to have it removed or changed to reflect that you paid on time.

Making on-time payments and keeping your debt levels low will also help improve your credit score over time.

What is credit repair?

Credit repair is the process of fixing your credit report to improve your credit score. This can be done by disputing errors, removing negative items, and adding positive information to your report.

Fixing your credit report is important because it can help you get a better interest rate on a loan, qualify for a mortgage, and even get a job. If you have bad credit, it can be difficult to accomplish these things. Credit repair can help you improve your credit so that you can achieve your financial goals.

How does credit repair work?

Credit repair is the process of fixing poor credit standing that may have been caused by unfair or inaccurate reporting. Credit repair is a legal process governed by federal law, also known as the Fair Credit Reporting Act (FCRA). This act gives consumers the right to dispute any and all items on their credit report that they feel are inaccurate, misleading, unverifiable, or irrelevant.

If the credit bureau agrees with the consumer, they will remove the disputed item from the report. If the credit bureau does not agree with the consumer, they will send a notice of correction to explain why the item remains on the report.

There are many credit repair companies that claim they can improve your credit standing, but it’s important to know that you have all the same rights under FCRA and can actually do much of the work yourself at little or no cost.

The benefits of credit repair

There are many benefits to credit repair, including the ability to improve your credit score, the opportunity to reduce or eliminate derogatory marks on your credit report, and the potential to obtain new lines of credit.

Credit repair can help you improve your credit score in a number of ways. First, by correcting errors on your credit report, you can remove negative items that are weighing down your score. Second, by taking steps to improve your payment history and credit utilization, you can show creditors that you’re serious about paying your debts on time and using credit responsibly.

In addition to improving your credit score, credit repair can also help you reduce or eliminate derogatory marks on your credit report. These marks can include items such as late payments, collections accounts, charge-offs, and bankruptcies. By taking steps to remove these negative items, you can give yourself a fresh start and improve your chances of obtaining new lines of credit in the future.

The drawbacks of credit repair

Credit repair can be a lengthy and expensive process, with no guarantee of success. In addition, many credit repair services use questionable or illegal tactics, which can result in further damage to your credit report and score. Finally, if you do successfully improve your credit score, you may find that it does not last for long.

How to find a reputable credit repair company

When you have bad credit, it can feel like you’re stuck in a never-ending cycle of debt. Every time you try to get ahead, something comes up that puts you right back where you started. If this sounds familiar, you might want to consider credit repair.

Credit repair is the process of fixing your credit report so that it more accurately reflects your current financial situation. This can include removing negative items that are inaccurate or outdated, as well as adding positive information that will improve your score.

There are a number of companies that offer credit repair services, but not all of them are created equal. It’s important to do your research before choosing a company to work with, so that you can be sure you’re getting the best possible service.

Here are a few things to look for when choosing a credit repair company:

-A company that offers a free consultation so that you can get an idea of what they can do for you without Commitment

-A company that has experience helping people with similar financial situations to yours

-A company that is transparent about their fees and what they include

-A company that offers a money-back guarantee if they don’t deliver on their promises

following these tips will help you find a reputable credit repair company that can help you get your finances back on track.

How to repair your credit on your own

There is no simple answer to the question, “How can I repair my credit on my own?”

Many people try to repair their credit on their own by taking on extra jobs or working overtime to pay off debts. While this can help you make some headway, it will not be enough to improve your credit score significantly. The best way to repair your credit on your own is to take some time to learn about credit and how it works.

Once you understand how credit works, you can then begin to take steps to improve your own creditworthiness. This may include paying down debts, maintaining a good payment history, and using credit wisely. By taking these steps, you can begin to see a significant improvement in your credit score over time. However, it is important to remember that repairing your credit is a long-term process; it will take time and patience to see the results you want.

Conclusion

Credit repair is the process of correcting errors and negative information on your credit report in order to improve your credit score. This can be done by disputing incorrect information with the credit bureau, correcting errors on your own credit report, or using a professional credit repair service.

While there is no guarantee that credit repair will improve your credit score, it can be an effective way to remove inaccurate or harmful information from your credit report. By taking steps to repair your credit, you can improve your chances of getting approved for loans and other forms of credit in the future.