What is Credit Card Fraud?

Contents

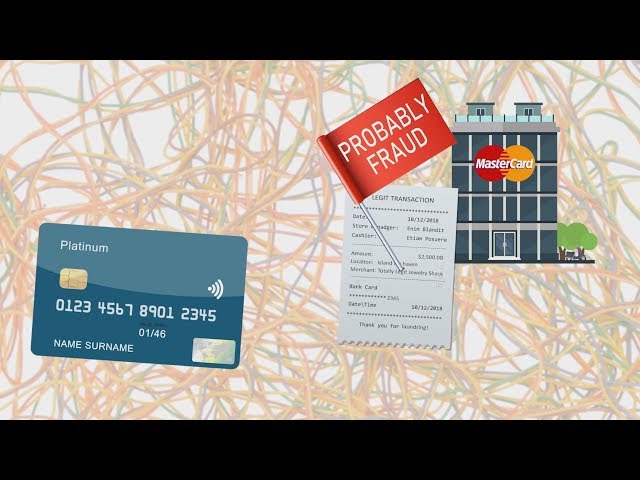

Credit card fraud is a type of identity theft that involves using someone else’s credit card to make unauthorized charges. If you suspect that you’ve been a victim of credit card fraud, it’s important to act quickly to minimize the damage. This blog post will explain what credit card fraud is and how you can protect yourself from it.

Credit Card Fraud?’ style=”display:none”>Checkout this video:

Introduction

Credit card fraud is a type of financial fraud that involves the unauthorized use of a credit card to make purchases or withdraw cash. Credit card fraud can occur in a number of ways, including account takeover, skimming, and phishing.

What is Credit Card Fraud?

Credit card fraud is a type of identity theft that occurs when someone uses your personal information, such as your credit card number or bank account information, without your permission to make unauthorized charges or withdraw funds.

In most cases, credit card fraud is perpetrated by someone you know, such as a family member, friend, or coworker. However, it can also be done by strangers, such as when your credit card information is stolen in a data breach. No matter who commits the fraud, it can have a serious impact on your finances and your credit score.

How Does Credit Card Fraud Happen?

Credit card fraud can happen in a number of ways. Sometimes, criminals will get ahold of your credit card information and use it to make unauthorized charges. Other times, they may use your credit card information to apply for a new credit card or take out a loan in your name.

There are several ways that criminals can get your credit card information. They may “skim” your credit card information by using a special device that reads the magnetic stripe on your credit card. They may also obtain your credit card information by hacking into a business’s computer system that stores customer credit card information. Or, they may simply steal your wallet or purse that contains your credit card.

If you suspect that you have been the victim of credit card fraud, there are some steps you should take right away. First, you should contact the three major credit reporting agencies (Equifax, Experian, and TransUnion) and request that they place a fraud alert on your file. This will make it more difficult for someone to open new accounts in your name. You should also contact the issuer of your credit card and let them know what has happened. They will cancel your current credit card and issue you a new one with a new account number. Finally, you should file a report with the Federal Trade Commission (FTC) and/or the police.

Who is Responsible for Credit Card Fraud?

While credit card fraud is certainly a crime, it’s important to understand that there are different types of credit card fraud, and not all of them are created equal. For example, some types of fraud are perpetrated by the cardholder, while others are the result of identity theft.

Cardholders are responsible for any unauthorized charges that they make on their own credit card. This type of fraud is often caused by stolen cards or account information, and it can be difficult to recover from if you’re not careful.

Identity theft is another form of credit card fraud that can be just as damaging, if not more so. This type of fraud occurs when someone uses your personal information – like your name, Social Security number, or credit card number – to open new accounts or make unauthorized charges in your name. Identity theft can be especially difficult to recover from because it can take months or even years to clear your name and repair your credit.

If you suspect that you’ve been the victim of credit card fraud, it’s important to take action immediately. Contact your credit card issuer and file a police report as soon as possible. By taking these steps, you can help protect yourself from further damage and begin the process of rebuilding your credit.

How to Prevent Credit Card Fraud

There are a few simple steps you can take to help prevent credit card fraud. First, never give your credit card number to anyone who calls you on the phone. Second, be very careful when using your card online. Make sure you are using a secure site, and never enter your credit card information into an email. Finally, keep an eye on your statements and report any suspicious activity to your credit card company right away. By taking these precautions, you can help protect yourself from credit card fraud.

How to Report Credit Card Fraud

If you believe your credit card number has been used fraudulently, or if you find unauthorized charges on your credit card statement, report it to your credit card issuer immediately. You should also file a report with the Federal Trade Commission (FTC).

The first thing you should do is contact your credit card issuer and let them know that you suspect fraud. Your issuer will then investigate the charges and will usually refund any unauthorized charges. In some cases, your issuer may require you to provide documentation to support your claim of fraud.

You should also file a complaint with the FTC. The FTC does not resolve individual complaints, but they use the information from complaints to investigate fraud and take action against companies that are breaking the law.

Reporting credit card fraud is important because it can help protect you from further financial loss and it can also help the authorities catch and prosecute criminals.

Conclusion

While there are many different types of credit card fraud, they all have one thing in common: They involve the unauthorized use of your credit card to make purchases or withdraw cash. If you suspect that your credit card has been used fraudulently, you should report it to your card issuer immediately. By law, you are not responsible for any unauthorized charges on your card, but you may be required to pay a replacement fee if your card is cancelled or reissued as a result of fraud.

There are several things you can do to protect yourself from credit card fraud, including keeping your credit card in a safe place, never giving out your credit card number to anyone, and monitoring your credit card statements for unauthorized charges. You can also sign up for alerts from your card issuer that will let you know if there is suspicious activity on your account. By taking these precautions, you can help ensure that your credit card information stays safe and secure.