What Is Aams In Finance?

Contents

- What is AAMS in finance?

- What are the benefits of AAMS?

- How can AAMS help you become a better investor?

- What are the risks associated with AAMS?

- How can you use AAMS to your advantage?

- What are the different types of AAMS?

- Which type of AAMS is right for you?

- How can you get started with AAMS?

- What are the challenges associated with AAMS?

- What are the future prospects of AAMS?

If you’re in the finance industry, you’ve probably heard of AAMS. But what is it, exactly? AAMS is the Association for the Advancement of Modeling and Simulation. It’s a professional organization that promotes the use of modeling and simulation in various fields, including finance.

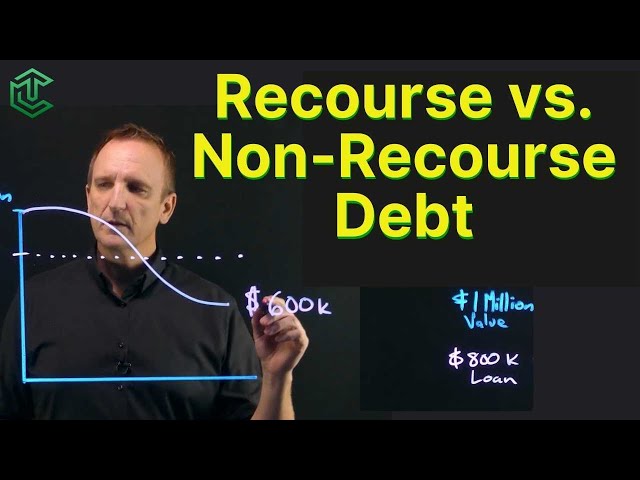

Checkout this video:

What is AAMS in finance?

The Association for the Advancement of Management Science (AAMS) is a professional organization dedicated to the advancement of management science. Management science is a field of study that uses mathematical and statistical methods to solve problems in business, economics, and operations research. AAMS members include academics, researchers, practitioners, and students from around the world.

What are the benefits of AAMS?

There are many benefits to utilizing the services of an AAMS. Perhaps the most obvious benefit is the increased efficiency and potential for greater profits. By automating manual processes, you can free up your staff to focus on more important tasks, such as generating new business or developing relationships with existing clients. In addition, by using an AAMS to monitor and manage your portfolios, you can minimize risk and maximize returns.

How can AAMS help you become a better investor?

Asset Allocation and Modern Portfolio Theory (AAMS) is a system that helps investors construct portfolios that are well diversified and have the potential to earn the highest return for the least amount of risk.

The system relies on several key concepts, which are described below.

1) Diversification: This is the process of spreading your investments across a variety of asset classes, industries, and geographical regions. By investing in a diversified manner, you minimize your exposure to any one particular risk.

2) Risk Tolerance: This refers to your willingness to stomach losses in pursuit of higher returns. An investor with a high risk tolerance may be more willing to invest in volatile assets, while an investor with a low risk tolerance may prefer safer investments.

3) Modern Portfolio Theory: This is an investment framework that demonstrates how diversification can help you achieve your desired level of return while minimizing your overall risk.

4) Asset Allocation: This is the process of dividing your portfolio among different asset classes (e.g., stocks, bonds, cash). The right asset allocation for you will depend on your goals, time horizon, and risk tolerance.

AAMS can be used by both individual investors and financial professionals. If you’re working with a financial advisor, they can help you determine what asset allocation and investment mix is right for you.

What are the risks associated with AAMS?

An AAMS is a type of financial instrument that is used to provide protection against the loss of value in a portfolio of assets. This type of protection is known as downside risk protection. AAMSs are often used by institutional investors, such as pension funds, to protect against the risk of losses in their portfolios.

AAMSs are typically issued by banks and other financial institutions. The issuer of an AAMS will guarantee to pay the holder of the AAMS a certain amount of money if the value of the underlying portfolio falls below a certain level. The level at which the payment is triggered is known as the barrier.

There are two types of AAMSs: puttable and non-puttable. Puttable AAMSs give the holder the right, but not the obligation, to sell the underlying assets back to the issuer at a pre-determined price. Non-puttable AAMSs do not have this feature.

The main risk associated with AAMSs is that they may not provide enough downside protection if the markets fall sharply. This can happen if the barrier is set too low or if there are sudden and unexpected changes in market conditions. Investors should carefully consider these risks before investing in an AAMS.

How can you use AAMS to your advantage?

Asset and liability management (A&L) is a strategic process that aims to align an organization’s financial goals with its operational capabilities. The goal of A&L management is to balance an organization’s assets and liabilities in order to optimize performance, minimize risk, and maximize shareholder value.

In order to achieve these objectives, organizations must first identify and assess the risks associated with their assets and liabilities. Once risks have been identified and assessed, organizations can develop and implement strategies to mitigate or transfer these risks. Finally, organizations must continuously monitor and adjust their A&L management strategies in response to changes in the market or the organization’s own operations.

An important tool in A&L management is asset/liability modeling (ALM). ALM is a quantitative approach that uses mathematical models to analyze the relationships between an organization’s assets and liabilities. These models can be used to simulate different A&L management scenarios in order to identify the optimal strategy for a given situation.

AAMS is a software application that helps financial institutions manage their asset and liability portfolios. AAMS provides users with powerful tools for data analysis, risk assessment, and portfolio optimization. With AAMS, users can create custom asset/liability models that are tailored to their specific needs. In addition, AAMS offers a wide range of pre-built models that can be used out-of-the-box or customized as needed.

What are the different types of AAMS?

Asset-backed securities are financial instruments that are backed by a pool of assets. The most common type of asset-backed security is a mortgage-backed security, which is backed by a pool of mortgages. Other types of asset-backed securities include auto loans, credit card receivables, and student loans.

Which type of AAMS is right for you?

If you work in the financial industry, you have probably heard of AAMS. But what is AAMS? Asset and money management software, or AAMS, is a program that helps businesses keep track of their assets and finances. Depending on the features offered, AAMS can automate different financial tasks such as tracking invoices, managing payroll, and creating financial reports.

There are different types of AAMS, so it is important to choose the right one for your business. Here are some of the most common types of AAMS:

-Invoicing software: This type of AAMS helps businesses track invoices and payments. It can also generate reports on revenue and expenses.

-Payroll software: This type of AAMS automates payroll tasks such as calculating taxes and employee paychecks. It can also track employee vacation days and sick days.

-Financial reporting software: This type of AAMS generates reports on a company’s financial status. It can be used to create balance sheets, income statements, and cash flow statements.

Choosing the right type of AAMS will depend on your business’s needs. Do you need help with invoicing? Do you need a payroll solution? Do you need to generate financial reports? Once you know what your business needs, you can choose the right type of AAMS for your business.

How can you get started with AAMS?

AAMS is an automated system that lets you manage your account and place trades without the need for a broker. You can set up AAMS with a brokerage firm or with a financial institution that offers this service. Once you have an account, you can use AAMS to buy and sell stocks, bonds, and other securities. AAMS is available to both individuals and institutions.

What are the challenges associated with AAMS?

Adversewerke Asset Management System (AAMS) is a software application used by financial institutions to manage portfolios of investments. It is designed to automate and streamline the investment management process, from asset allocation and portfolio construction to performance measurement and risk management.

AAMS offers a number of benefits to its users, including increased efficiency, improved decision-making, and better risk management. However, the system is not without its challenges. Chief among these is the need for ongoing maintenance and updates. As the investment landscape changes, so too must the AAMS system. This can be a costly and time-consuming endeavor, particularly for smaller financial institutions. Additionally, AAMS requires a certain level of expertise to operate effectively. Financial professionals who are not familiar with the system may find it difficult to navigate and may make mistakes that could lead to losses.

What are the future prospects of AAMS?

Asset and liability management (ALM) is a dynamic process whereby institutions manage their balance sheet in order to increase returns and/or reduce risk. The aim is to ‘match’ the assets and liabilities, so that the institution can withstand any potential adverse changes in market conditions.

AAMS is an important tool for financial institutions as it helps them to monitor and manage their risks. It is a regulated activity in many jurisdictions and there are strict rules which institutions must follow.

The future prospects for AAMS are positive as it is an essential tool for managing risk in the current financial environment. It is likely that regulation will continue to increase in this area, meaning that more financial institutions will need to adopt AAMS in order to remain compliant.