What is a Tax Credit for Health Insurance?

Contents

If you’re looking for a way to lower your taxes and get some help with your health insurance costs, you may be wondering if there’s a tax credit for health insurance. The answer is yes, there is! Here’s what you need to know about this tax break.

Checkout this video:

What is a Tax Credit?

A tax credit is a dollar-for-dollar reduction in the tax you owe. For example, if you owe $1,000 in taxes and you have a $1,000 tax credit, your tax bill is reduced to $0.

What is a tax credit?

A tax credit is a dollar-for-dollar reduction in the income tax you owe. For example, if you owe $1,000 in federal taxes and you have a $1,000 tax credit, your net tax liability is zero.

What are the different types of tax credits?

There are two types of tax credits available to help offset the cost of health insurance: premium tax credits and cost-sharing reduction subsidies.

Premium tax credits lower the amount you have to pay for your monthly health insurance premium. Cost-sharing reduction subsidies help reduce the amount you have to pay for deductibles, copayments, and coinsurance.

You may be eligible for one or both types of tax credits, depending on your income and the type of health insurance coverage you choose.

How do tax credits work?

A tax credit is a dollar-for-dollar reduction in the taxes you owe. For example, if you owe $1,000 in federal taxes and you have a $1,000 tax credit, your tax bill would be zero.

Most tax credits are available only to people with low or moderate incomes. There are a few tax credits that are available to people regardless of their income.

Here’s how tax credits work:

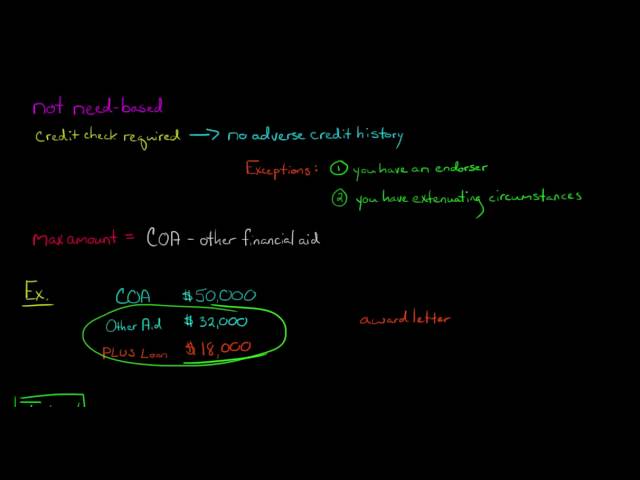

The amount of the credit is based on your income and family size.

You claim the credit when you file your taxes.

If the credit is more than the taxes you owe, you’ll get a refund for the difference.

If the credit is less than the taxes you owe, you’ll still owe taxes, but you’ll owe less than if you didn’t have the credit.

Credits are different from deductions and exemptions. Deductions reduce the amount of income that’s taxed, while exemptions reduce the amount of tax that’s owed on your taxable income.

What is a Health Insurance Tax Credit?

A tax credit is a tax benefit that allows you to reduce the amount of taxes you owe. The amount of the credit is based on a percentage of your income. For example, if you owe $1,000 in taxes and you have a tax credit of 10%, you would only owe $900. The health insurance tax credit is a tax credit that helps you pay for health insurance. If you qualify, you can get a tax credit of up to 50% of the cost of your health insurance premium.

What is a health insurance tax credit?

A tax credit is a dollar-for-dollar reduction in the amount of taxes you owe. For example, if you owe $1,000 in taxes and you have a $1,000 tax credit, your tax bill would be reduced to $0.

The tax credit for health insurance is available to certain taxpayers who purchase health insurance through the Health Insurance Marketplace. If you qualify for the credit, you can choose to have it applied to your monthly premium payments or receive it when you file your taxes.

To qualify for the health insurance tax credit, you must meet certain income and other requirements. For example, you must not be eligible for affordable coverage through an employer or government program like Medicaid or Medicare.

If you qualify for the health insurance tax credit, the amount of the credit will depend on your income and family size. The lower your income, the higher your tax credit will be.

The health insurance tax credit can help make coverage more affordable for people who need it. If you think you might qualify for the tax credit, visit Healthcare.gov to learn more and apply.

How does a health insurance tax credit work?

A tax credit is a dollar-for-dollar reduction in the taxes you owe. With a health care tax credit, you can get help paying for health insurance premiums.

The premium tax credit is available to people with moderate incomes who purchase their own health insurance through the Health Insurance Marketplace. If you qualify, you can choose how much of the credit you want applied to your premium each month, or you can have the entire amount paid in advance to your insurer to lower your out-of-pocket costs.

You’ll need to file a federal income tax return to claim the premium tax credit. If you’ve taken advance payments of the premium tax credit, reconcile that amount when you file your return. You do this by noting any difference between the amount of credit paid in advance and the amount of credit you’re actually entitled to receive based on your final annual income.

If you didn’t take advance payments of the premium tax credit, and you qualify for the credit, you can claim it on your return. You must file a tax return even if you don’t normally file one.

What are the benefits of a health insurance tax credit?

The health insurance tax credit is a subsidy that can help you pay for your health insurance premiums. If you qualify, you can receive a tax credit worth up to $3,750 per year ($94.50 per week). This tax credit can be used to reduce your monthly premium payments, or it can be applied to your health insurance deductible or other out-of-pocket costs.

In order to qualify for the health insurance tax credit, you must:

-Be enrolled in a qualified health plan through the Health Insurance Marketplace

-Have household income between 100% and 400% of the federal poverty level

-Not be eligible for other types of health coverage, such as Medicare, Medicaid, or Tricare

If you qualify for the health insurance tax credit, you will need to file a federal income tax return in order to claim the credit. For more information about the health insurance tax credit, please visit the HealthCare.gov website.

How to Get a Health Insurance Tax Credit

The health insurance tax credit is a refundable tax credit for eligible individuals and families who enroll in a qualified health plan. The credit is available to taxpayers who do not have access to affordable employer-sponsored coverage, Medicare, Medicaid, or other forms of health coverage. To be eligible for the credit, you must have a household income between 100 and 400 percent of the federal poverty level.

How to get a health insurance tax credit

If you enroll in a health insurance plan through the Marketplace, you may be able to get a tax credit to lower your monthly premium. To qualify, you must:

-Have a household income that’s between 100-400% of the federal poverty level for your family size (for 2021 coverage, that’s $12,880 for an individual or $27,000 for a family of four)

-Not have access to other affordable coverage, including through a job

-Not be eligible for Medicaid or Medicare

You’ll find out if you qualify for the tax credit when you apply for coverage through the Marketplace.

How to apply for a health insurance tax credit

The first step to apply for a health insurance tax credit is to gather your documents. You will need your most recent tax return, your health insurance policy, and your health insurance bill. You will also need to know your household income and the number of people in your family.

Once you have all of your documents, you will need to fill out an application form. The form will ask for basic information about you and your family, as well as information about your health insurance policy. Once you have filled out the form, you will submit it to the government agency that handles tax credits.

The government agency will review your application and determine if you are eligible for a tax credit. If you are eligible, they will calculate the amount of the credit and send you a check or direct deposit the money into your bank account.

What are the requirements for a health insurance tax credit?

In order to be eligible for the health insurance tax credit, you must:

-Be enrolled in a qualified health plan offered through the Health Insurance Marketplace

-Not be eligible for other affordable coverage, such as Medicare, Medicaid, Children’s Health Insurance Program (CHIP), or job-based health insurance

-Have a household income that’s at least 100 but no more than 400 percent of the federal poverty level for your family size

-File a federal tax return

If you meet all of the above requirements, you’ll automatically get the credit when you file your taxes for the year. The amount of the credit is based on your income and family size.