What Is a Secondary Mortgage Loan?

Contents

Check out this blog post to learn everything you need to know about secondary mortgage loans, including what they are, how they work, and more!

Checkout this video:

Introduction

A secondary mortgage loan is a loan that uses the borrower’s home as collateral. The loan is also known as a home equity loan. If the borrower defaults on the loan, the lender may foreclose on the home.

A secondary mortgage loan can be a great way to finance the purchase of a second home or investment property. It can also be used to consolidate debt or make home improvements.

Secondary mortgage loans typically have higher interest rates than primary mortgage loans, and they often have shorter terms. There are several types of secondary mortgage loans, including home equity lines of credit, home equity loans, and cash-out refinance loans.

When you are considering taking out a secondary mortgage loan, it is important to compare offers from multiple lenders to get the best terms and rates.

What Is a Secondary Mortgage Loan?

A secondary mortgage loan is a loan that uses the borrower’s home as collateral. The loan is a second loan that is taken out on top of the primary mortgage loan. The secondary mortgage loan is sometimes also called a home equity loan or a home equity line of credit.

What Is a Mortgage?

A mortgage is a loan from a bank or other lender that helps a borrower purchase real estate. The property may be residential or commercial, and the mortgage can be for a primary residence, vacation home, investment property or commercial real estate.

What Is a Primary Mortgage?

A primary mortgage is the original loan that you use to purchase a home. This is the loan that you typically make monthly payments on for 15 or 30 years, depending on your loan terms. If you decide to refinance your home at some point, you can take out a new mortgage — called a secondary mortgage — using your home as collateral.

What Is a Secondary Mortgage?

A secondary mortgage is a loan taken out on a property that is already serving as collateral for another loan. In other words, it’s a mortgage taken out on a home that’s already being used as security for another mortgage.

Types of Secondary Mortgage Loans

A secondary mortgage loan is a loan that is secured by the home equity of the borrower. The borrower can use the loan for any purpose, but the lender may have restrictions on how the money is used. Secondary mortgage loans are usually for a shorter term than the primary mortgage and have a higher interest rate.

Home Equity Lines of Credit (HELOCs)

A home equity line of credit, or HELOC, is a type of home equity loan that allows you to borrow money against the equity in your home. Equity is the difference between the appraised value of your house and the balance of your mortgage. Your home serves as collateral for the loan. A HELOC typically has a variable interest rate and allows you to borrow money over a specified period of time, usually up to 10 years. At the end of this “draw period,” you may either repay the loan in full or convert it to a fixed-rate loan.

Home Equity Loans

A home equity loan is a specific type of second mortgage. A second mortgage is any loan secured by the value of your home that you have in addition to your primary mortgage. Home equity loans are often used to finance major expenses such as home repairs, medical bills, or college education.

A home equity loan is a lump sum loan, which means you get the entire amount of the loan in one initial payment. Home equity loans typically have fixed interest rates and are paid back in monthly installments over the life of the loan.

Lenders will usually allow you to borrow up to 85% of your home’s value, minus any outstanding primary mortgage balance. So if your home is worth $300,000 and you still owe $200,000 on your primary mortgage, you could potentially qualify for a home equity loan of $40,000. Keep in mind that this is just an estimate – actual lending limits may vary based on factors such as your credit score and debt-to-income ratio.

Reverse Mortgages

A reverse mortgage is a loan against your home that you do not have to repay for as long as you live there.

With a reverse mortgage, you can borrow against the equity in your home. The money you receive can be used for anything, including paying off your existing mortgage if you have one.

With a reverse mortgage, you are not required to make monthly payments and the loan does not come due as long as you live in your home.

If you own your home outright, or if you have a low mortgage balance that can be paid off with the proceeds from the reverse mortgage, you may be able to obtain enough money to pay off your mortgage and have additional funds left over.

You will not have to make any monthly payments on the loan and the loan will not come due as long as you live in your home.

However, interest will accrue on the loan balance, and it will be added to the loan balance each month.

The loan balance will also increase each year as the value of your home increases.

When you die, sell your home, or move out of your home permanently, the loan must be repaid. If the sale of your home does not generate enough money to repay the loan balance, your heirs will not be responsible for paying any amount that is owed on the loan.

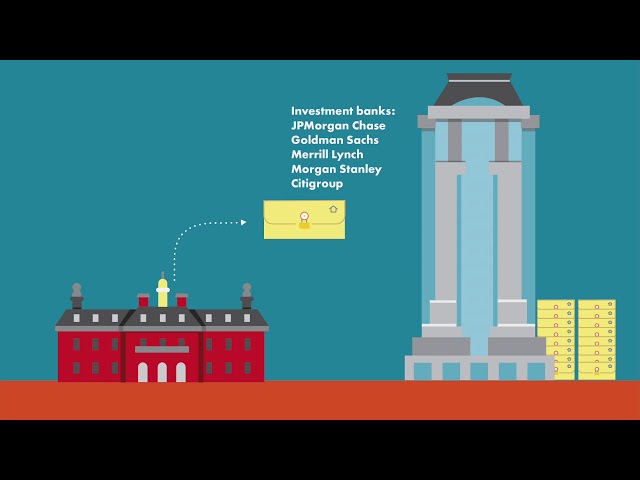

How to Get a Secondary Mortgage Loan

A secondary mortgage loan is a loan that is used to collateralize the primary loan. In other words, it is a loan that is taken out using the equity in your home as collateral. Secondary mortgage loans are also known as home equity loans or home equity lines of credit (HELOCs).

There are a few things to keep in mind if you’re thinking of taking out a secondary mortgage loan:

– The interest rate on a secondary mortgage loan is usually higher than the interest rate on a primary mortgage loan. This is because the risk to the lender is higher – if you default on your loan, they may not be able to recoup all of their losses by selling your home.

– Secondary mortgage loans can be used for any purpose – there are no restrictions on how you can use the money you borrow. However, keep in mind that if you use the money for something other than improving your home, you may end up paying more in interest over time.

– You will likely need to have good credit and equity in your home in order to qualify for a secondary mortgage loan.

Pros and Cons of Secondary Mortgage Loans

A secondary mortgage loan is a mortgage loan that is in second position on the same property as another primary mortgage loan. The loan is subordinate to the first mortgage loan in the event of foreclosure. In other words, the first mortgage loan will be paid off first in the event of foreclosure and the secondary mortgage loan will be paid off second.

Pros

Secondary mortgage loans can be a great way to get the money you need for a variety of purposes. Here are some of the pros of taking out a secondary mortgage loan:

-You can get a loan for a larger amount than you could with a primary mortgage loan.

-The interest rate on a secondary mortgage loan is often lower than the rate on a primary mortgage loan.

-The terms of a secondary mortgage loan are often more flexible than the terms of a primary mortgage loan.

-You may be able to get a tax deduction for the interest you pay on a secondary mortgage loan.

Cons

Even though a secondary mortgage loan can give you the financial flexibility to buy a home, there are some potential drawbacks to consider before taking out this type of loan.

One of the biggest disadvantages of a secondary mortgage loan is that it likely will come with a higher interest rate than your primary mortgage loan. This is because your lender views you as a higher-risk borrower since you already have another outstanding loan.

Another potential downside of a secondary mortgage loan is that it could lengthen the amount of time it takes you to pay off your overall mortgage debt. This is because you’re effectively starting from scratch with two separate loans, both of which will accrue interest over time.

If you’re considering taking out a secondary mortgage loan, be sure to carefully weigh the pros and cons before making a decision.

Conclusion

In summary, a secondary mortgage loan is a loan that is taken out against a property that is already being used as collateral for another loan. The most common type of secondary mortgage loan is a home equity loan, which allows homeowners to borrow against the equity they have built up in their home. Home equity loans can be used for any purpose, including home improvements, debt consolidation, and investment purposes.