What is a RHS Loan?

Contents

RHS loans are low-interest loans available to low- and very low-income homeowners for the repair, rehabilitation, or improvement of their homes.

Checkout this video:

What is a RHS Loan?

The Rural Housing Service (RHS) is an agency within the United States Department of Agriculture (USDA). RHS loans are specifically for low- and very-low-income individuals and families seeking to purchase, build, or repair a home in a rural area.

There are two types of RHS loans available: direct and guaranteed. Direct loans are made by the RHS directly to eligible borrowers, while guaranteed loans are made by private lenders but guaranteed by the RHS.

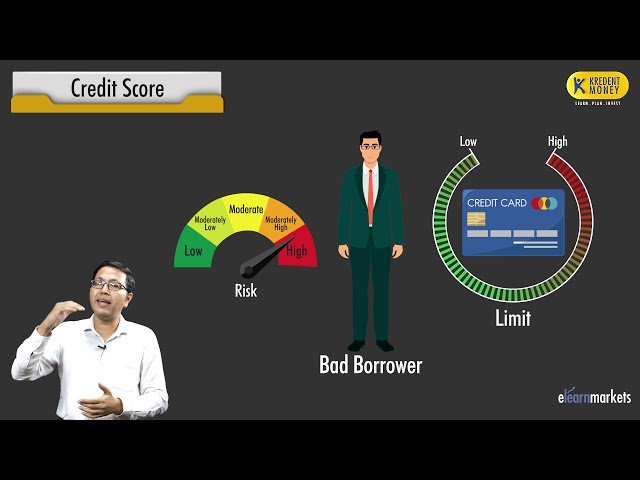

To be eligible for an RHS loan, applicants must have a satisfactory credit history, sufficient income to meet loan payments, and demonstrate a willingness to repay the loan. In addition, applicants must purchase or be building a home in a rural area as defined by the RHS.

RHS loans can be used for a variety of purposes, including purchasing or repairing a home, purchasing land for building a home, making improvements to existing housing, or making repairs and improvements to rental housing owned by low-income individuals or families.

For more information about RHS loans and eligibility requirements, please visit the Rural Housing Service website.

How do I qualify for a RHS Loan?

There are a few requirements you’ll need to meet in order to qualify for a RHS loan. First, you must be a U.S. Citizen or Permanent Resident Alien. You must also have a credit score of 620 or higher, and demonstrate the ability to repay your loan. Additionally, you must have adequate income andemployment history, as well as meet all other eligibility requirements set forth by the RHS program.

What are the benefits of a RHS Loan?

The benefits of a RHS Loan are:

-RHS Loans are available to eligible rural homeowners to help them repair, improve, or modernize their home.

-Loans are available for up to 20 years at a low fixed interest rate.

-There is no minimum loan amount, and you can use the loan for almost any type of work, including but not limited to: repairs, renovations, new construction, energy efficiency improvements, and much more.

-There is no prepayment penalty, so you can pay off your loan early if you choose.

-You may be able to roll the cost of the appraisal into your loan amount.

How do I apply for a RHS Loan?

RHS loans are available through the Department of Agriculture. The loan is made available to low- and very-low income households in order to help them improve their living conditions. RHS loans can be used for a variety of purposes, including repairing or improving homes, or building new homes.

To apply for a RHS loan, you will need to contact the USDA Rural Development office in your state. You can find a list of state offices here: https://www.rd.usda.gov/contact-us/state-offices. Once you have located the office in your state, you will need to provide them with proof of your income, as well as any other required documentation.