What Is a Plus Loan?

Contents

A Plus Loan is a federal student loan available to parents and guardians of dependent undergraduate students. Plus Loans can help pay for education expenses not covered by other financial aid.

Checkout this video:

What is a Plus Loan?

A Parent PLUS Loan is a federal student loan that a parent can take out to help pay for their child’s education. The interest rate on Parent PLUS Loans is fixed, and the repayment terms are flexible. You can use a Parent PLUS Loan to pay for any education-related expenses, including tuition, fees, room and board, books and supplies, and other miscellaneous expenses.

Parents can apply for a Parent PLUS Loan by completing the Free Application for Federal Student Aid (FAFSA®) form. If you’re approved for a loan, you’ll need to complete a Master Promissory Note (MPN) before your loan funds can be disbursed. You can also choose to have your payments deferred while your child is in school or during certain other periods of enrollment.

How to Apply for a Plus Loan

The first step in applying for a PLUS Loan is to complete a Free Application for Federal Student Aid (FAFSA®) form. You’ll need your and your child’s federal tax information or tax returns, plus bank statements and investment records, if applicable.

To apply for a PLUS Loan, you’ll also need to complete a Master Promissory Note (MPN). An MPN is a legal document in which you promise to repay your loan(s). You can complete an MPN at StudentLoans.gov.

Types of Plus Loans

There are two types of PLUS Loans: the Parent PLUS Loan and the Grad PLUS Loan. Both are federal student loans that can help pay for your child’s education after high school.

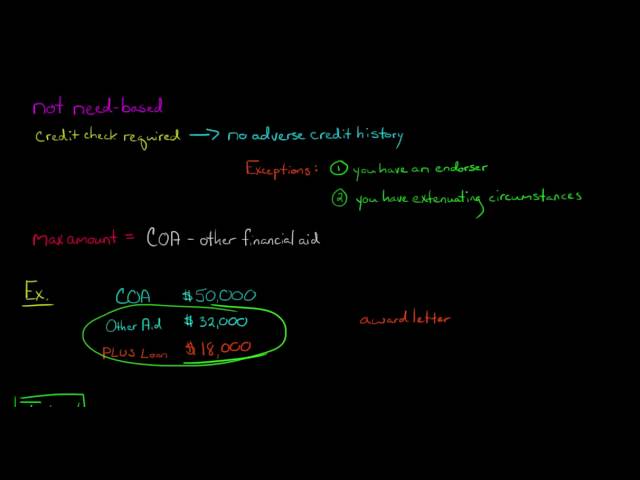

The Parent PLUS Loan is a federal loan that parents can use to help pay for their child’s education. Parents can borrow up to the full cost of their child’s education, minus any other financial aid their child receives.

The Grad PLUS Loan is a federal loan that graduate and professional students can use to help pay for their education. Graduate and professional students can borrow up to the full cost of their education, minus any other financial aid they receive.

Benefits of a Plus Loan

A Parent PLUS Loan is a federal loan that allows parents to borrow money for their child’s education. Parent PLUS Loans can be used for undergraduate and graduate programs, and there is no limit to the amount that can be borrowed.

There are several benefits of taking out a Parent PLUS Loan, including:

-The ability to borrow enough money to cover the full cost of attendance

– competitive interest rates

– flexible repayment terms

-no origination or default fees

Disadvantages of a Plus Loan

While PLUS loans can help make college more affordable for parents and graduate students, there are some disadvantages to consider before taking out this type of loan. First, PLUS loans have a higher interest rate than Stafford loans, so you’ll end up paying more in interest over the life of the loan. Additionally, PLUS loans are not eligible for federal loan forgiveness programs, so if you’re planning on pursuing a public service career, you may want to look into other types of loans. Finally, if you have credit problems, you may not be able to get a PLUS loan at all – in order to qualify, you must have a good credit history.