What Is a Credit Line on a Credit Card?

Contents

A credit line is the maximum amount of credit that a financial institution extends to a customer.

Credit Line on a Credit Card?’ style=”display:none”>Checkout this video:

What is a credit line?

A credit line is the borrowing limit that a financial institution extends to a customer. A credit line can be used for many different purposes, including making purchases, transferring balances, and taking cash advances. The credit limit is the maximum amount that can be borrowed against the line of credit.

How is a credit line different from a credit limit?

A credit line is the total amount of credit that a financial institution will extend to a borrower. A credit limit is the maximum amount of credit that a borrower can use at one time.

A credit line may be revolving, which means that the borrower can periodically access the full amount of the credit line, or it may be non-revolving, which means that the borrower can only access a portion of the credit line at one time.

Credit limits are usually set by financial institutions based on factors such as the borrower’s credit history, income, and debts. Credit lines may be increased or decreased by financial institutions at any time, and borrowers may be asked to explain why they need access to a larger credit line.

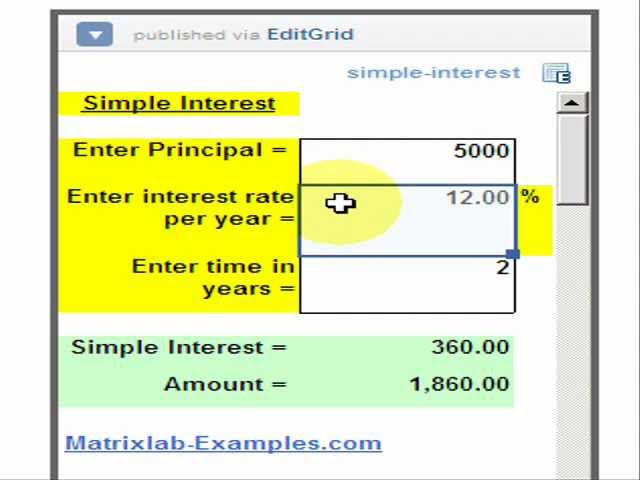

How is a credit line determined?

A credit line on a credit card is the maximum amount that you can spend in a day, month, or cycle. Your credit line is determined by your credit card issuer and is based on your creditworthiness. If you have a good credit history, you may be able to get a higher credit line.

What factors are considered when determining a credit line?

There are a few different factors that go into determining your credit line, and they can vary depending on the issuer. In general, though, your credit score is going to be the biggest factor. Other things that might be considered include your income, your employment history, and how long you’ve been using credit.

How can you increase your credit line?

A credit line is the maximum amount that you’re allowed to spend on your credit card in a given billing cycle. Your credit card issuer will typically give you a credit line based on your creditworthiness. If you have a good credit history, you may be able to get a higher credit line. There are a few things that you can do to try to increase your credit line.

What are some ways to increase your credit line?

There are a few things you can do to try to increase your credit line. You can:

-Call your credit card issuer and ask for a higher limit. Be prepared to explain why you deserve a higher limit, such as having made all of your payments on time or having a higher income.

-Apply for a new credit card with a higher limit. This will give you an instant boost in available credit, but it will also add another monthly payment to your budget.

-Get aSecured Credit Card. A secured credit card requires you to put down a deposit equal to your desired credit limit. This deposit acts as collateral in case you default on your payments, so issuers are generally more willing to approve these types of cards for people with poor or limited credit history. Once you’ve used the card responsibly for awhile, you may be able to transition to an unsecured card and get your deposit back.

What are the benefits of having a high credit line?

A credit line is the maximum amount of credit that a financial institution extends to a borrower. A high credit line indicates to lenders that you’re a low-risk borrower, which can lead to more favorable loan terms and rates. A high credit line can also help you build your credit score.

What are some benefits of having a high credit line?

There are several benefits of having a high credit line. For one, it can help improve your credit score. A high credit line shows that you’re a responsible borrower and that you’re capable of managing a large amount of debt. Additionally, a high credit line can give you more financial flexibility in the event of an emergency. If you have a low credit line and you need to make a large purchase, you may have to put down a deposit or pay extra fees. Having a high credit line can help you avoid those situations.