What is a Collegiate Loan?

Contents

A Collegiate Loan is a student loan that helps cover the cost of college or career school. If you’re thinking about taking out a loan to help pay for school, this is the loan for you!

Checkout this video:

What is a Collegiate Loan?

A collegiate loan is a type of loan that is specifically designed for college students. It can be used for tuition, books, and other education-related expenses. The interest rate on a collegiate loan is typically lower than the interest rate on a traditional loan.

What are the different types of collegiate loans?

There are four main types of collegiate loans:

-Federal Loans: This type of loan is funded by the government and has a fixed interest rate. The government also offers income-driven repayment plans and loan forgiveness programs for federal loans.

-Private Loans: Private loans are not funded by the government and typically have a variable interest rate. Some private lenders offer repayment plans and loan forgiveness programs, but these vary by lender.

-Parent PLUS Loans: Parents can take out this type of loan to help pay for their child’s education. Parent PLUS loans have a fixed interest rate and the repayment terms are set by the lender.

-Graduate PLUS Loans: Graduate or professional students can take out this type of loan to help pay for their education. Graduate PLUS loans have a fixed interest rate, and the repayment terms are set by the lender.

What are the benefits of a collegiate loan?

Lower interest rates: Interest on federal student loans is set by Congress, and the rates are typically lower than those on private loans.

The option to start repaying your loan later: You don’t have to begin repaying most federal student loans until after you leave college or university or drop below half-time enrollment.

Potentially easier repayment: There are several repayment plans available for federal student loans that can make your monthly payment more manageable. For example, the Income-Based Repayment Plan and the Pay As You Earn Plan both limit your monthly payments to a percentage of your income, and if you still have a balance remaining on your loan after making 20 or 25 years of qualifying monthly payments, the remaining balance may be forgiven.

No parent or cosigner is required: Unlike private loans, you don’t need a parent or cosigner to get a federal student loan.

What are the drawbacks of a collegiate loan?

There are a few potential drawbacks to collegiate loans that students should be aware of before taking out a loan. First, loans must be repaid with interest, which can add up over time and increase the total amount you have to repay. Second, if you miss or make late payments on your loan, you may incur fees or damage your credit score. Finally, if you default on your loan (fail to make payments for 270 days or more), your lender can take legal action against you, including wage garnishment and seizure of tax refunds.

How to Apply for a Collegiate Loan

The first step in applying for a collegiate loan is to fill out the Free Application for Federal Student Aid, or the FAFSA. This will give you an estimate of how much money you may be eligible to receive from the government. Next, you will need to fill out a loan application with your chosen lender. Be sure to read over the terms and conditions carefully before signing anything.

How to fill out the FAFSA

The first step in applying for federal student aid is to fill out and submit a Free Application for Federal Student Aid (FAFSA®) form. The FAFSA form becomes available each year on October 1. You’ll use the FAFSA form to apply for federal student loans and grants, as well as any state or college aid programs that require FAFSA information.

To complete the 2019–20 FAFSA form, you (and your parents, if you’re a dependent student) will need:

-Your Social Security number

-Your parents’ Social Security numbers (if you’re a dependent student)

-Your driver’s license number (if you have one)

-Your 2018 federal income tax returns, W-2s, and other records of money earned. If you’re selected for verification, you may also be asked to submit business and farm records, untaxed income records, and investment records.

-Bank statements and records of investments (if any)

-Records of untaxed income (if any)

-An FSA ID to sign electronically

How to find a lender

There are a few things you should take into account when you’re looking for a collegiate loan. The type of loan, the interest rate, and the repayment terms are all important factors to consider. But perhaps one of the most important things to look at is the lender.

When you’re taking out a loan, you’re essentially entering into a partnership with the lender. You’re trusting them to provide you with the money you need, and they’re trusting you to pay it back. So it’s important that you find a lender that you can trust.

There are a few ways to do this. You can ask around for recommendations from people you know and trust. You can also read online reviews from other borrowers. And finally, you can check out the Better Business Bureau website to see if there have been any complaints filed against the lender.

Once you’ve found a few potential lenders, it’s time to compare rates and terms. This is where things like interest rates and repayment terms come into play. It’s important to find a loan that has terms that you can afford and that will fit your needs.

Once you’ve found a few potential lenders, take some time to compare rates and terms before making your final decision.

How to compare lenders

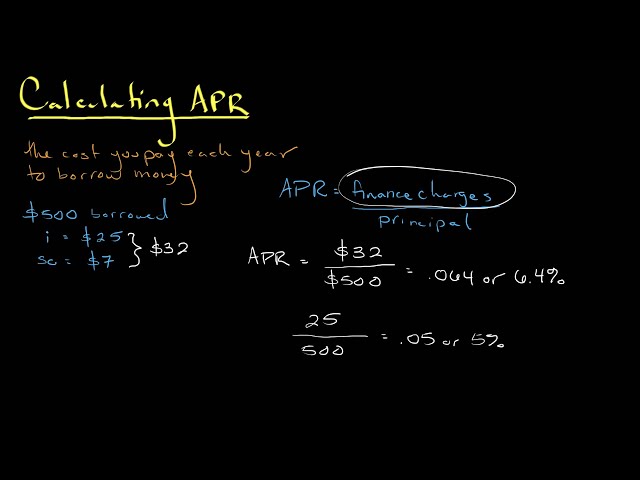

There are a few things to consider when comparing lenders for a collegiate loan. The first is the interest rate. Make sure to compare the annual percentage rate (APR) and not just the interest rate. The APR includes any fees that may be associated with the loan, so it will give you a more accurate idea of the true cost of the loan.

Another thing to consider is the repayment term. This is the amount of time you have to repay the loan, and it can range from 5 to 20 years. A longer repayment term will result in lower monthly payments, but you will end up paying more in interest over the life of the loan. A shorter repayment term will have higher monthly payments, but you will save money on interest in the long run.

Finally, make sure to consider any discounts or perks that each lender offers. Some lenders may offer a 0.25% discount if you enroll in automatic payments, for example. Others may offer special rates or terms for certain groups of borrowers, such as military members or students attending certain schools.

Repaying Your Collegiate Loan

When you receive a collegiate loan, it is important to understand the terms of repayment. You will be responsible for repaying your loan, with interest, after you graduate or leave school. The repayment period can last up to 10 years. You can make payments while you are in school, but it is not required. It is important to know when your first payment is due and how much you will need to pay each month.

What is the grace period?

The grace period is the time you have after you graduate, leave school, or drop below half-time enrollment before you must begin repaying your federal student loans. The grace period gives you time to get financially settled and to select a repayment plan. For most federal student loans, the grace period is six months.

What are the different repayment options?

There are several repayment options available for federal student loans, and your loan servicer will work with you to select the option that best suits your needs. The standard repayment plan is a 10-year repayment plan that provides fixed monthly payments. Under this plan, you will repay your loan in full within 10 years.

The graduated repayment plan is also a 10-year repayment plan, but your payments will start out low and increase every two years. The advantage of this plan is that your monthly payments will be lower in the beginning, which can help you manage your expenses when you are just starting out in your career. However, because your payments will increase over time, you will ultimately pay more in interest than under the standard repayment plan.

The extended repayment plan is a 25-year repayment plan that offers fixed or graduated monthly payments. This option is only available for certain types of loans, and you must have a high debt-to-income ratio to qualify. Under this plan, you will pay more in interest over the life of the loan than under the standard or graduated plans, but your monthly payments will be lower.

The income-based repayment (IBR) plan sets your monthly payment at an amount that is intended to be affordable based on your income and family size. Your payment under this option will never be more than the payment would have been under the 10-year standard repayment plan. If you make timely payments for 25 years, any remaining balance on the loan will be forgiven. This option is only available for certain types of loans, and you must have a high debt-to-income ratio to qualify.

The income-contingent repayment (ICR) plan is an option for Direct Loans only. Under this option, your monthly payment is based on your annual income, family size and total amount of Direct Loans (not including PLUS Loans). As your income increases or decreases or as family size changes, so does the amount of each monthly payment – providing flexibility if circumstances change down the road during repaying period . If you make timely payments for 25 years and meet other requirements , any remaining balance on qualifying Direct Loans will be forgiven . Like IBR , IBRPlan Payment calculator can give you an estimate of what your monthly payment could be under ICR .

What are the consequences of defaulting on a loan?

If you are unable to make your monthly payments or if you default on your loan, there will be consequences. These can include the following:

-Your loan will go into collections. This means that a third party will be hired to collect the money you owe. The company they hire may contact you frequently and use aggressive tactics to get you to pay.

-Your credit score will be impacted. This can make it difficult for you to borrow money in the future, buy a car or a house, or even get a job.

-You will owe additional fees and costs. These can add up quickly, making it even more difficult to repay your loan.

-The government may withhold your tax refund.

-Your wages may be garnished. This means that your employer will withhold a portion of your paycheck and send it directly to the lender.

-You may lose your eligibility for future federal student aid.

Defaulting on your loan is not something to take lightly. It can have a major impact on your life both now and in the future. If you are struggling to make your payments, there are options available to help you before it gets to that point. Contact your lender as soon as possible to discuss these options and find something that works for you