What Furniture Stores Use Snap Finance?

Contents

- What is Snap Finance?

- How does Snap Finance work?

- What are the benefits of using Snap Finance?

- How to use Snap Finance at furniture stores?

- What furniture stores use Snap Finance?

- How to qualify for Snap Finance?

- What is the application process for Snap Finance?

- What are the terms and conditions of Snap Finance?

- How to make payments with Snap Finance?

- How to cancel Snap Finance?

If you’re looking for a furniture store that offers Snap Finance , you’re in luck. We’ve compiled a list of some of the best furniture stores that use Snap Finance so you can get the furniture you need without breaking the bank.

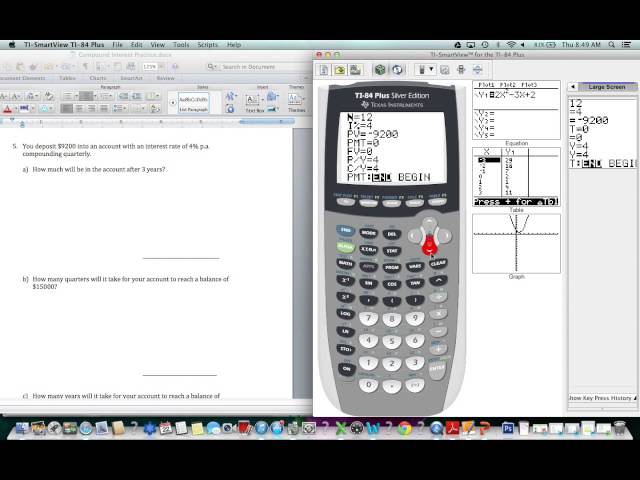

Checkout this video:

What is Snap Finance?

Snap Finance is a company that provides financing for furniture and other home items. They have a wide variety of partners that they work with, and you can find their financing options at many different stores. You can use Snap Finance to finance anything from a new sofa to a new television, and they offer both short-term and long-term financing options.

How does Snap Finance work?

Snap Finance is a financial services company that offers point-of-sale financing to consumers. The company partners with furniture stores, allowing customers to finance their purchases through the store.

Snap Finance offers two financing options: a traditional loan and a lease-to-own agreement. With a traditional loan, customers make monthly payments over a period of time until the loan is paid off. With a lease-to-own agreement, customers make monthly payments for a set period of time, after which they have the option to purchase the item for a pre-determined price.

Snap Finance does not require a down payment or cosigner, and there are no hidden fees or penalties. Customers can apply for financing online or in-store, and will receive a decision instantly. If approved, customers can use their financing immediately to make their purchase.

What are the benefits of using Snap Finance?

Snap Finance offers a number of benefits for furniture stores that choose to use their financing options. First, Snap offers financing for customers with bad credit, which can help increase sales. Second, Snap offers furniture stores a way to increase their average order size by offering financing for larger purchases. Third, Snap offers stores a way to improve their customer service by offering financing options that allow customers to make smaller, more manageable payments.

How to use Snap Finance at furniture stores?

Snap Finance is a great way to finance your furniture purchases. You can use Snap Finance at many different furniture stores, and it’s easy to use. Simply find a store that accepts Snap Finance, and then fill out an application. Once you’re approved, you’ll have a line of credit that you can use at that store. You can use your line of credit to finance any purchase, and you’ll have up to 18 months to pay it back.

What furniture stores use Snap Finance?

Snap Finance is a lending company that offers financing for furniture, mattresses, tires, and more. They have a simple application process and offer interest-free financing for up to 18 months.

So, what furniture stores use Snap Finance? Here is a list of some of the most popular stores that accept Snap Finance:

– Ashley Furniture

– Rooms To Go

– Mattress Firm

– Levin Furniture

– Discount Tire

How to qualify for Snap Finance?

To qualify for Snap Finance, you will need to have a regular source of income and a good credit history. You will also need to be a US citizen or resident. If you meet these criteria, you should be able to apply for financing through Snap Finance.

What is the application process for Snap Finance?

The application process for Snap Finance is simple and straightforward. First, you will need to fill out an online application form. Once you have submitted your form, a representative from Snap Finance will contact you to discuss your financing options.

Once you have been approved for financing, you will need to provide Snap Finance with some basic information about the furniture you wish to purchase. After that, you will be able to choose a payment plan that fits your budget and needs.

What are the terms and conditions of Snap Finance?

Snap Finance is a financial service that offers financing for furniture and other items. The terms and conditions of Snap Finance vary depending on the store that you use it at, but in general, you will need to have good credit to qualify for financing. Financing through Snap Finance can be a great way to get the furniture that you need, but you should be aware of the terms and conditions before you agree to anything.

How to make payments with Snap Finance?

Snap Finance is a financing option that furniture stores offer to customers. This means that you can finance your purchase with Snap Finance and make payments over time. There are a few things to know about how Snap Finance works before you decide to use it.

First, when you use Snap Finance, you will be given a credit limit. This is the maximum amount of money that you can borrow from Snap Finance. You will need to make sure that the purchase you want to finance is within this credit limit.

Next, you will need to make monthly payments to Snap Finance. These payments will be interest-bearing, so the sooner you pay off your balance, the less interest you will pay overall. It is important to make your payments on time each month in order to avoid late fees and damage to your credit score.

Finally, furniture store policies on returns and exchanges may be different if you have used Snap Finance. Be sure to ask about the store’s policy before making your purchase.

Snap Finance can be a great option if you need help financing a furniture purchase. Just be sure to understand how it works before using it so that you can avoid any surprises down the road.

How to cancel Snap Finance?

To cancelSnapFinance, you will need to reach out to their customer service team. You can do this by emailing [email protected], or by calling 1-855-441-3996.