What Effect Did the Use of Credit Have on the Economy in the 1920s?

Contents

The 1920s was a decade of great prosperity in the United States. The economy was booming and people were using credit to buy more goods and services than ever before. This increased demand for goods and services helped to spur even more economic growth.

However, the use of credit also had some negative effects on the economy. One of the most significant problems was that people were buying more than they could actually afford. This led to a lot of debt and eventually to the stock market crash of

Checkout this video:

The Use of Credit in the 1920s

The 1920s was a decade of great change in the United States. One of the biggest changes was the way that people used credit. In the 1920s, the use of credit became more common and more accepted. This had a big effect on the economy.

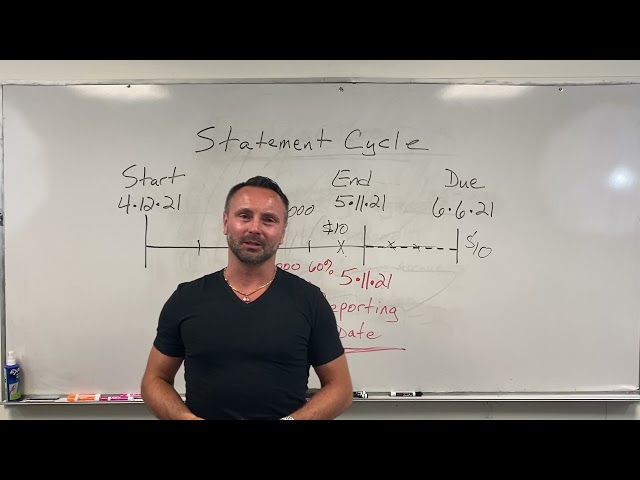

The use of credit in the 1920s increased

While the use of credit certainly increased in the 1920s, it is important to note that this was not the only factor that led to the economic downturn of the decade. Other factors included a stock market bubble, easy access to credit, and over-leveraging by businesses and consumers.

The use of credit in the 1920s led to more buying on credit

In the 1920s, the use of credit became more common, and more people began buying on credit. This led to a increase in consumer spending, which in turn led to an increase in economic activity. The use of credit also helped to fuel the stock market speculation that occurred during the late 1920s.

The use of credit in the 1920s led to more debt

The use of credit in the 1920s led to more debt and a higher cost of living. Credit was used to purchase items that were not essential, such as cars and jewellery. This led to people defaulting on their loans and the economy suffering as a result.