What Does Secondary Review Mean for PPP Loan?

Contents

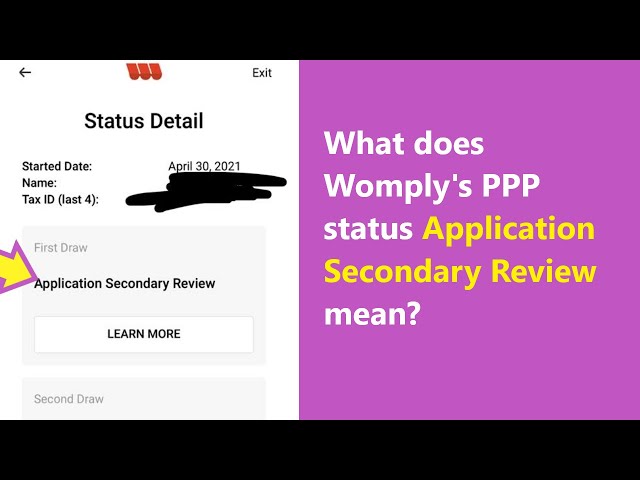

If you’re a small business owner who has applied for a Paycheck Protection Program (PPP) loan, you may be wondering what secondary review means.

In short, secondary review is the process by which the Small Business Administration (SBA) reviews your loan application to ensure that you meet all of the eligibility requirements.

This review can take some time, but it’s important to make sure that you understand all of the requirements before you move forward with your loan.

Checkout this video:

What is a secondary review?

A secondary review is an evaluation of a business’s PPP loan application by the SBA after the business has already been approved for the loan by a lender. The purpose of the secondary review is to ensure that the business meets all of the requirements for the PPP loan program and that the loan was properly approved by the lender.

If the SBA finds that a business does not meet all of the requirements for the PPP loan program, or that the loan was not properly approved by the lender, it may require the business to repay some or all of the loan. The SBA may also impose other penalties, such as fines or suspension from the program.

What does it mean for PPP loan?

A secondary review of your PPP loan means that the SBA will take another look at your loan application and supporting documentation. This review is in addition to the initial review that your lender conducted when you applied for the loan.

The SBA may conduct a secondary review if they have questions about your loan application or if they believe that you may not have complied with the PPP requirements. If the SBA finds that you did not comply with the program requirements, they could ask you to repay some or all of the loan.

If you are asked to participate in a secondary review, it is important to respond promptly and fully to any requests for information from the SBA. You should also consult with an experienced PPP loan attorney to help you navigate this process and protect your rights.

How can I get a secondary review?

If you are interested in getting a secondary review of your PPP loan, you can contact your lender directly to see if they offer this service. Some lenders may require that you send in additional documentation or information before they can begin the review process.

What are the benefits of a secondary review?

A secondary review is an assessment of your PPP loan application by a SBA-approved lender. This type of review is typically conducted for borrowers who are seeking a larger loan amount or who may pose a higher risk to the lender.

The benefits of a secondary review are that it can provide you with more certainty about your loan amount and terms, and can help you avoid problems down the road. A secondary review can also help you get a lower interest rate on your loan.