What Does Refinance Mean on a Car Loan?

Contents

When you refinance a car loan, you replace your current loan with a new one. This can be done for a number of reasons, but the most common is to get a lower interest rate. This can save you money over the life of the loan, and may help you pay off your loan faster.

Checkout this video:

Introduction

When you refinance a car loan, you’re essentially taking out a new loan to pay off your existing car loan. You might do this for a number of reasons, including to get a lower interest rate, to change the length of your loan term or to tap into the equity you’ve built up in your vehicle.

What is Refinancing?

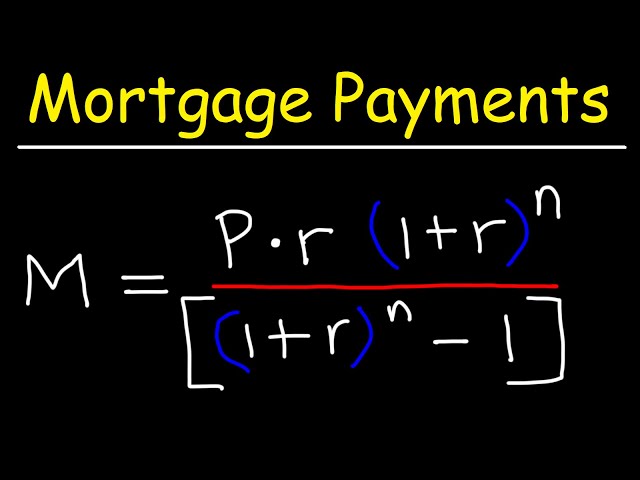

Refinancing is the process of replacing an existing loan with a new loan that has different terms. The new loan may have a lower interest rate, a different repayment schedule, or a different term length. borrowers can refinance their loans for several reasons, but most people do it in order to save money on interest payments.

When you refinance your car loan, you are essentially taking out a new loan to pay off the balance of your existing loan. The new loan may have different terms than your original loan, such as a lower interest rate or monthly payment. Refinancing can be a great way to save money on your car loan, but it’s important to understand the pros and cons before you make a decision.

There are a few things to consider before you refinance your car loan:

-Your credit score: Your credit score will impact the interest rate you receive on your new loan. If your credit score has improved since you took out your original loan, you may be able to qualify for a lower interest rate, which could save you money over the life of your loan.

-Your current interest rate: If you currently have a high interest rate, refinancing may help you save money. However, if your current interest rate is already low, it may not make sense to refinance.

-The amount of time left on your loan: If you have several years left on your original loan, refinancing may extend the life of your loan and cost you more in the long run. On the other hand, if you only have a few months left on your original loan, refinancing could help you save money in interest payments and allow you to pay off your loan sooner.

-The fees associated with refinancing: There are typically fees associated with refinancing a car loan, such as an application fee and a prepayment penalty fee. These fees can add up quickly, so be sure to compare them against the potential savings from refinancing before making a decision.

How Does Refinancing Work?

Refinancing a car loan simply means that you are taking out a new loan with a different lender to pay off your existing car loan. This usually happens when you find a lender that is willing to give you a lower interest rate or better terms than your current lender. It can save you money in the long run by lowering your monthly payments, and it can also help you pay off your loan faster.

Here’s how it works:

1. You apply for a new loan with a different lender.

2. The new lender pays off your existing loan.

3. You start making payments to the new lender.

Refinancing can be a good idea if you qualify for a lower interest rate or better terms. It’s important to compare offers from multiple lenders to make sure you’re getting the best deal possible. Keep in mind that there may be fees associated with refinancing, so make sure you factor those into your decision.

Pros and Cons of Refinancing

Refinancing your car loan can save you money if you qualify for a lower interest rate. It can also help you change the terms of your loan, such as the length of the loan, to better suit your needs. However, there are some risks to refinancing, including the potential to extend the life of your loan and to end up owing more money than you did before you refinanced.

When you refinance a car loan, you replace your existing car loan with a new one from a different lender. You may be able to get a lower interest rate on the new loan, which can save you money over the life of the loan. You may also be able to change the terms of the loan, such as the length of the loan or the type of interest rate (fixed or variable).

There are some risks to refinancing your car loan. If you extend the life of your loan when you refinance, you may end up making more total payments and paying more in interest than if you had kept your original loan. If market interest rates rise after you refinance, you may end up with a higher interest rate than if you had kept your original loan. And if you borrow more money when you refinance than what your car is worth (also known as being “upside down” or “underwater”), then it will be even harder to sell or trade in your car later on.

How to Refinance

When you refinance, you may be able to lower your car payments by extending the term of your loan or by getting a lower interest rate. You can also get cash out from the equity you have in your car. However, keep in mind that this could increase the overall cost of your loan and put your car at risk if you can’t make the payments.

To refinance your car loan, you’ll need toapply for a new loan with a lender and use the proceeds to pay off your existing loan. You may be able to do this through the same lender that currently holds your loan, or you may need to shop around for a new lender.

When you refinance, be sure toconsider all of the costs involved, such as application fees, closing costs and any prepayment penalties that may apply to your current loan. You’ll also want to compare interest rates and terms to find the best deal possible.

If you decide to refinance, be sureto do so with caution. By extending the term of your loan, you could end up paying more in interest over time. And if you take out cash from your equity, be sure you have a plan in place to repay the funds so you don’t put your car at risk.

When to Refinance

If you’re happy with your current car loan terms and interest rate, there’s no need to refinance. But if you’re looking to save money on your car loan, refinancing may be a good option.

There are a few things to consider before refinancing your car loan, such as:

– how much time is left on your current loan

– what the interest rate will be on your new loan

– what fees you’ll have to pay to get the new loan

If you have a good credit score, you may be able to qualify for a lower interest rate than what you currently have. Refinancing at a lower interest rate could save you money over the life of the loan.

You may also want to consider refinancing if you have a high interest rate and you want to save money on your monthly payments. If you refinance at a lower interest rate, your monthly payments could go down. However, you may end up paying more in interest over the life of the loan if you extend the term.

Before you refinance your car loan, compare offers from multiple lenders to make sure you’re getting the best deal possible.

Conclusion

Refinancing your car loan can be a great way to save money on your monthly payments, reduce the total amount of interest you pay on your loan, or even. Although it can be a great idea to refinance, it’s important to make sure you understand what you’re getting into before signing on the dotted line. In this article, we’ll take a look at what refinancing means and how it could affect your car loan.