What Does PMT Mean in Finance?

Contents

- What is PMT in finance?

- What are the benefits of PMT in finance?

- What are the drawbacks of PMT in finance?

- How can PMT be used in financial planning?

- What are some tips for using PMT in finance?

- What are some common mistakes made with PMT in finance?

- How can PMT be used to improve financial literacy?

- What are some other resources for learning about PMT in finance?

- How can I get more help with PMT in finance?

- What does the future hold for PMT in finance?

If you’re new to the world of finance, you may have come across the term “PMT” and wondered what it means. PMT is short for “payment,” and it refers to any regular payment made on a loan or other debt.

When you take out a loan, you agree to make regular payments to the lender until the loan is paid off. These payments are typically made on a monthly basis, and each payment is known as a “PMT.”

Checkout this video:

What is PMT in finance?

PMT is a technical term used in finance that stands for “Payment.” PMT generally refers to regularly scheduled payments made on a loan, such as a mortgage or car loan. The payment amount includes both the principal (the initial amount borrowed) and the interest (the fee charged for borrowing the money).

What are the benefits of PMT in finance?

Benefits of PMT include:

-Helping you choose investments that are right for you

-Diversifying your portfolio

-Building a solid foundation for your financial future

What are the drawbacks of PMT in finance?

There are several drawbacks of PMT in finance. First, it does not account for the time value of money, meaning that it does not take into account the fact that money received now is worth more than money received in the future. Second, it assumes that all cash flows are equal, when in reality they may be very different. Finally, it does not account for risk, meaning that it does not take into account the fact that some cash flows may never be received.

How can PMT be used in financial planning?

PMT, or the payment amount, is a key concept in financial planning. It represents the periodic payment required to pay off a loan over a set period of time. The payment schedule and amount are determined by the terms of the loan agreement.

PMT can also be used to calculate the affordability of a loan. This is done by dividing the total loan amount by the number of payments required to pay it off. This will give you the monthly payment amount.

You can use PMT to estimate your monthly mortgage payments, car loan payments, or any other type of loan payment. You can also use it to calculate how much you need to save each month to reach your financial goals.

If you’re not sure how to calculate PMT, there are many online calculators that can help. Just be sure to input all of the relevant information, such as the loan amount, interest rate, and repayment period.

What are some tips for using PMT in finance?

The PMT function is a financial function that returns the periodic payment for a loan. You can use the PMT function to find out how much you will need to pay for a loan over time. The PMT function can be used for both annuity payments and long-term debt payments.

To use the PMT function, you will need to know the following information:

-The interest rate on the loan

-The number of payments that will be made

-The amount of the loan

-The present value of the loan

-The future value of the loan

Once you have this information, you can use the PMT function to calculate your periodic payment.

What are some common mistakes made with PMT in finance?

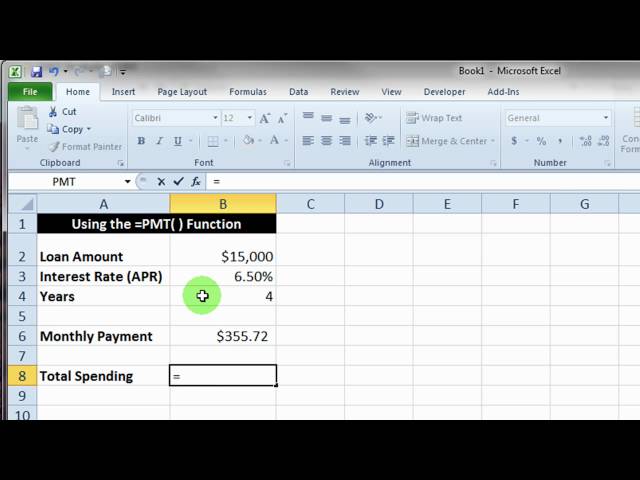

PMT, or the “payment” function, is one of the most important functions in Excel for anyone working with loans or other types of repayment agreements. The PMT function calculates the periodic payment for a loan or annuity, given the loan’s interest rate, the number of periods, and the loan amount.

Unfortunately, there are a few common mistakes that people make when using this function. Here are some tips to avoid making these mistakes yourself:

– Make sure you input the correct interest rate. The interest rate should be input as a decimal (for example, 0.05 for 5%), not as a percentage (5%).

– Make sure you input the correct number of periods. This should be the total number of payments you will make over the life of the loan. For example, if you have a 30-year mortgage with monthly payments, you would input 360 for the number of periods.

– Be careful not to confuse the “interest rate” and “periods” arguments. It’s easy to accidentally reverse these when inputting them into the PMT function. Just remember that the interest rate goes first (i.e., PMT(rate, periods, loan amount)).

– If you’re working with an annual loan or annuity (i.e., one where payments are made once per year), make sure to input 1 for the “periods” argument rather than 12 (i.e., PMT(rate, 1, loan amount)).

How can PMT be used to improve financial literacy?

PMT, or the Payment Amount, is the amount of each individual periodic payment made on a loan. The periodic payments are typically made monthly, but may also be bi-weekly or annually depending on the loan contract. PMT is one of the four primary elements used in finance to calculate loans and other repayments. The other three elements are the Interest Rate, Principal Loan Amount, and Loan Term.

Improved financial literacy can help individuals and families make more informed decisions about loans and other types of credit. It can also help people understand how to use PMT to their advantage. For example, knowing how to calculate PMT can help people budget for their monthly loan payments and make sure they do not miss any payments. Additionally, understanding how PMT works can help people negotiate better terms on loans, such as a lower interest rate.

What are some other resources for learning about PMT in finance?

In addition to this article, there are a few other great resources for learning about PMT in finance.

The first is to check out the tutorials on the website Investopedia. They have a really great series of articles and videos that explain different financial concepts in simple, easy-to-understand language.

Another great resource is textbooks. If you’re taking a college class or just want to learn more about finance on your own, there are plenty of textbooks available that can teach you about PMT and other financial concepts. your local library or bookstore should have several options available.

Finally, if you want to get started learning about PMT right away, there are a few online calculators that can help you understand how the concept works. This calculator from InvestingAnswers is a great place to start.

How can I get more help with PMT in finance?

PMT is an abbreviation for “payment,” and it refers to a specific type of financial transaction. In the context of borrowing, a PMT is a periodic payment made by a borrower to a lender. PMTs are typically made on a regular basis, such as monthly or yearly, and they are used to repay the principal (the amount borrowed) plus interest. In some cases, PMTs may also include other fees or charges, such as insurance premiums.

What does the future hold for PMT in finance?

Predictive maintenance (PMT) is an area of Food and Drink (F&D) focused on using data and analytics to predict when equipment will need maintenance or repair. By predicting when equipment will need to be serviced, PMT can help food and drink manufacturers avoid unplanned downtime and improve overall equipment reliability.

PMT is already being used in a number of different industries, but it is still relatively new to the food and beverage industry. As such, there is no clear consensus on what the future holds for PMT in finance. Some experts believe that PMT will become an essential part of food and beverage manufacturing, while others believe that it will remain a niche area.