What Does CVV Mean on a Credit Card?

Contents

If you’ve ever been asked for your CVV code when shopping online, you might be wondering what it is and why it’s needed. In this post, we’ll explain what a CVV code is and how it helps to keep your credit card safe.

Checkout this video:

CVV Basics

CVV stands for card verification value. It is a 3 or 4 digit number on your credit or debit card that provides a security measure when making online purchases. If a website is asking for your CVV, it is likely a legitimate site. When you provide your CVV, the website will verify that the number is valid and that the card is active. This helps to prevent fraud and keep your information safe.

What is a CVV?

A CVV (Card Verification Value) is a code printed on your credit card that provides additional security when making purchases online or over the phone. The code is unique to your card and is separate from the card number, so it provides an extra level of protection if your card number falls into the wrong hands.

When making a purchase online or over the phone, you will be asked to provide the CVV code as proof that you have the physical card in your possession. This helps to prevent fraudsters from using stolen card numbers to make unauthorized purchases.

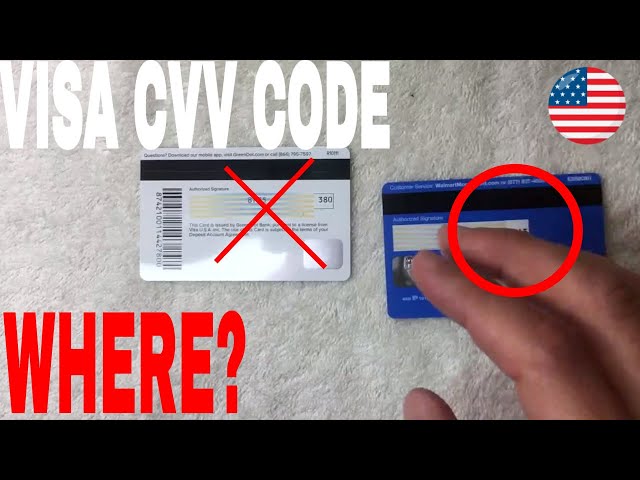

The CVV code is typically printed on the back of your credit card, along with your card number and expiration date. For Visa, Mastercard and Discover cards, the CVV code is three digits long. For American Express cards, it is four digits long and it is printed on the front of the card above the card number.

If you are ever unsure of where to find your CVV code, you can always call your credit card issuer for help.

How is a CVV different from a credit card number?

Every credit card has a unique number, which is used to identify the card and its owner. This number is typically16 digits long and is printed on the front of the card. The CVV, or card verification value, is a three- or four-digit number that is also printed on the card. It is generally printed on the back, near the signature strip.

The CVV is not your credit card number, so it cannot be used to make purchases. Instead, it is used as an additional security measure to verify that you are indeed the rightful owner of the card. When you make an online purchase, you will typically be asked to provide your credit card number, expiration date and CVV code. The merchant will then use this information to process your payment.

Some credit cards also have a unique identifier called a dynamic CVV or dCVV. This number is generated each time you use your card for a purchase, making it harder for thieves to use stolen information to make fraudulent purchases.

How do I find my CVV?

On Visa®, Mastercard®, and Discover® credit cards, the CVV number is the last three-digit number on the signature panel on the back of your card. On an American Express® card, it is the four-digit code located on the front right above the card number.

For your security, we can only provide account information on CVV over the phone if you call us and we are able to verify your identity.

CVV Security

CVV stands for “Card Verification Value,” and it’s used as a security feature to help verify that you are in possession of your credit card. This code is not stored on the card’s magnetic stripe or chip, so it can’t be duplicated. It’s important to know your CVV code and to keep it safe.

Why is CVV security important?

CVV stands for Card Verification Value. It is a 3 or 4 digit number that is printed on your credit card. The CVV is used to verify that you have the physical credit card in your possession and that you are not using a stolen credit card number.

When you make an online purchase, the CVV is used as an additional security measure to ensure that you are the authorized user of the credit card. If someone else were to get ahold of your credit card number, they would not be able to complete a purchase without also having the CVV.

For this reason, it is important to keep your CVV number safe and secure. Do not store your CVV number in a place where it could be easily found or stolen (such as on a sticky note attached to your credit card). When making online purchases, be sure that the website is secured with SSL encryption before entering your CVV number.

What are some common CVV security threats?

While card-not-present fraud rates have been on the rise in recent years, much of this increase can be attributed to online shoppers becoming more sophisticated and better able to recognize potentially fraudulent activity. In addition, many online retailers have implemented more stringent security measures to protect their customers’ information.

However, there are still a few common CVV security threats that you should be aware of:

1. Phishing scams: Many scammers attempt to collect CVV information by sending out fake emails or text messages that claim to be from a legitimate company. These messages often include a link to a fake website that looks identical to the real thing. When shoppers enter their CVV information on these fake sites, the scammers can then use it to make fraudulent purchases.

2. Skimming devices: Another common way that thieves collect CVV information is by attaching skimming devices to ATMs and other card reader machines. When unsuspecting shoppers use their cards at these machines, their CVV information is collected and stored on the devices. The thieves can then retrieve this information and use it to make fraudulent purchases.

3. Data breaches: One of the most common ways that criminals obtain CVV information is by taking advantage of data breaches at large companies. In many cases, these companies do not encrypt their customers’ data, which means that it can be easily accessed by hackers. Once hackers obtain this data, they can use it to make fraudulent purchases online or over the phone.

How can I protect my CVV?

You can help protect your CVV by keeping your card in a safe place away from prying eyes and by not writing your CVV on the card or on anything that is kept with your card. You should also never give your CVV to anyone who calls you unsolicited and claims to be from a legitimate company — even if they say they need it for “security purposes.” If you are ever unsure about whether or not a call is legitimate, hang up and call the customer service number on the back of your card to verify.

CVV Uses

The CVV, or card verification value, on a credit card is a three- or four-digit number printed on the card. It is not encoded on the magnetic stripe and is therefore not present when the card is swiped at a point of sale. The CVV is used to verify that the customer has the credit card in their possession.

How is CVV used?

When you’re making a purchase online, the owner of the site will ask for your credit or debit card number, as well as other identifying information. But have you ever wondered what the little three- or four-digit code on the back of your card is for? That’s your card’s CVV.

CVV stands for card verification value, and it serves as an additional security measure for online and phone purchases. When you provide your CVV, the merchant verifies that you actually have the physical credit or debit card – and not just someone who has memorized another person’s card information.

For Visa, Mastercard, and Discover cards, the CVV is a three-digit code on the back of your card, to the right of your signature strip. For American Express cards, it is a four-digit code on the front of your card, above the card number. The CVV code is important – don’t ever give it out to anyone who calls and asks for it!

What are some common CVV uses?

The CVV, or card verification value, is a 3- or 4-digit number printed on your credit card. It’s used as an additional security measure to verify your identity when making online or over-the-phone purchases.

Some common CVV uses include:

-Making online or over-the-phone purchases

-When you sign up for a new account with a retailer

-When you add a new credit card to your account with a retailer

-When you make a purchase using a credit card at a retail location

What are some CVV tips?

Here are some tips to remember when using your CVV:

-TheCVV is not your card’s PIN number. Do not enter your PIN number when prompted for a CVV.

-When shopping online, always look for the https:// in the URL of the website you’re on. This indicates that the site is secure and that your information will be encrypted.

-If a website does not have https:// in the URL, do not enter your CVV on that site.

-Some websites may ask you to enter your CVV more than once. This is usually for security purposes and to ensure that you are the one making the purchase.

-When using your CVV at a brick-and-mortar store, make sure that you can see the cashier enter your CVV into the system. If you can’t see what they’re doing, ask them to do it in front of you.

-Never give your CVV over email or chat. A reputable company will never ask for this information via these channels.

-Keep track of where you use your CVV. If you notice any unauthorized charges on your card, this will help you narrow down where the information may have been stolen from.