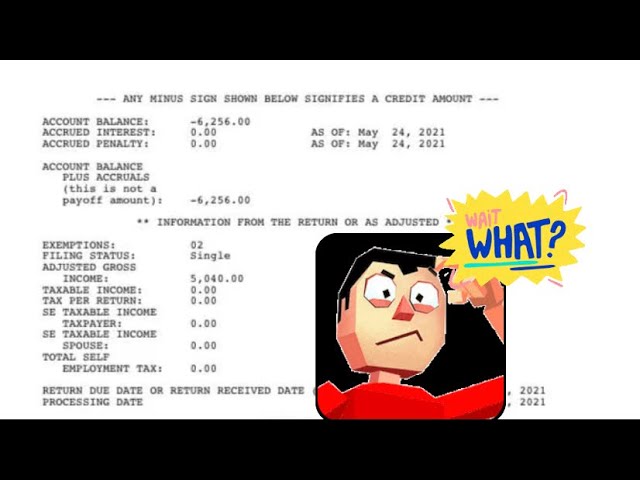

What Does “Credit to Your Account” Mean on an IRS Transcript?

Contents

If you’re looking at your IRS transcript and see the phrase “credit to your account,” it means that you have a balance owed to the IRS. This could be because you’ve paid more taxes than you owed for the year, or because you’ve been issued a refund.

Checkout this video:

Introduction

The Internal Revenue Service (IRS) issues two types of transcripts: return transcripts and account transcripts. Return transcripts show most line items from the tax return as it was originally filed, including any accompanying forms and schedules. Account transcripts show changes that were made after the return was filed. These changes can include items such as penalties, interest, changes in the amount of tax owed, or payments made on the account.

The “credit to your account” line on an IRS transcript can refer to either type of transcript. For a return transcript, it means that the IRS has processed the return and applied any refund or Ernst & Young may be required to pay to the taxpayer. For an account transcript, it means that a payment has been applied to the taxpayer’s account.

What is a Tax Transcript?

A tax transcript is a summary of your tax return information. The IRS issues two types of transcripts:

-Account transcripts show the line items from your tax return as well as changes made after you filed, plus any balance due.

-Return transcripts show most of the line items from your tax return.

What is “Credit to Your Account”?

The term “credit to your account” means that the IRS has applied a payment to your account. This could be a payment that you made, or it could be a refund that you received. If you see this on your IRS transcript, it means that the payment has been applied and is no longer outstanding.

How to Get a Transcript

If you need a transcript for mortgage purposes or to verify your tax return information, the IRS recommends ordering it online. You can also order by phone or mail.

To get a transcript online, you’ll need to create an account with the IRS. Once you’re logged in, you can select the type of transcript you need and the time frame you need it for. The IRS will then mail the transcript to the address they have on file for you.

If you order by phone, you can call 800-908-9946 and follow the prompts to order a transcript. You’ll need to provide your Social Security number, date of birth, filing status, and the mailing address where you want the transcript sent.

To order by mail, you’ll need to fill out Form 4506T-EZ. You can get this form on the IRS website or by calling 800-829-1040. Once you’ve filled out the form, mail it to the address listed on the form.

How to interpret a Transcript

The IRS issues two types of transcripts – tax return and account. A tax return transcript shows personal information plus information entered on the tax return, such as marital status, type of return filed, adjusted gross income, etc. An account transcript shows changes that have been made to the account after the tax return was processed.

“Credit to your account” on a tax return transcript means that the IRS has processed the tax return and applied any refund or payment to the taxpayer’s account. This can also be called a “No change” transcript.

What if There are Errors on my Transcript?

If you find errors on your transcript, you should contact the IRS. You can do this by phone, letter, or by visiting your local IRS office. Be sure to have your transcript handy when you contact them, so that you can point out the errors.

Conclusion

In conclusion, the phrase “credit to your account” on an IRS transcript means that the IRS has processed your tax return and that the amount you are owed is being applied to your account. This is different from a refund, which is an actual payment that is sent to you. If you have any questions about your account or what a credit to your account means, you should contact the IRS directly.