What Does Credit Balance Mean?

Contents

If you’re confused about your credit balance, you’re not alone. Many people don’t understand what this term means, and as a result, they don’t know how to interpret their credit report. In this blog post, we’ll explain what a credit balance is and how it can impact your credit score.

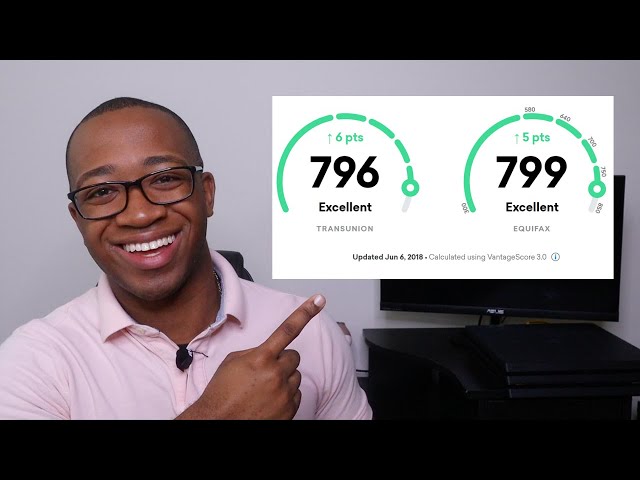

Checkout this video:

What is a credit balance?

A credit balance is an amount owed to a person or organization. It is the opposite of a debit, which would be an amount owed by a person or organization.

A credit balance can arise in many different situations. For example, if a customer returns merchandise to a store, the store might issue a credit balance on the customer’s account. Or, if a utility company overcharges a customer, the customer might receive a credit balance on their account.

In both of these cases, the customer would be owed money by the store or utility company. The customer would have a “credit balance” on their account with that organization.

There are many ways to use or apply a credit balance. The customer might choose to apply it to future purchases, or they might ask for a refund of the money owed. Or, in some cases, the organization may choose to let the credit balance remain on the account indefinitely.

It’s important to understand that a credit balance is not the same thing as “credit” in the sense of borrowing money. A credit balance is an amount that is owed to you, whereas “credit” refers to borrowing money from someone else.

How do credit balances occur?

Credit balances can occur for a number of reasons. Perhaps you overpaid your bill, or you were the recipient of a refund. Whatever the case may be, a credit balance is simply an amount of money that is owing to you by the company.

What are the consequences of having a credit balance?

If you have a credit balance on your account, it means that you have paid more than the amount you owe. This can happen for a variety of reasons, including overpayment, refunds, or adjustments.

While having a credit balance may not seem like a big deal, it can actually have some consequences. For one thing, you may not be able to use your full credit limit. Additionally, your credit score could be negatively affected if you carry a balance for too long.

If you do have a credit balance, be sure to keep an eye on it and make a payment as soon as possible. This will help avoid any negative consequences and help keep your finances healthy.

How can you get rid of a credit balance?

The best way to get rid of a credit balance is to pay it off as soon as possible. You can also contact your credit card company and ask them to remove the balance. If you have a credit card with a high interest rate, you may want to consider transferring the balance to a different credit card.