What Credit Score Is Needed To Rent An Apartment In 2021?

Contents

What credit score is needed to rent an apartment in 2021? That’s a great question! Here at [name of blog], we’re dedicated to helping our readers understand all things credit-related.

We did some research and compiled a list of the credit score requirements for various apartment complexes around the country. Check it out to see where you stand!

Checkout this video:

The Importance of Credit Scores

A credit score is a number that represents your creditworthiness. It is used by lenders to determine whether or not you are a good candidate for a loan. A good credit score means you are more likely to be approved for a loan and get a lower interest rate. A bad credit score can make it difficult to rent an apartment or get a loan.

Why do landlords check credit scores?

There are a few reasons landlords might check credit scores. For one, it can give them an idea of how responsible a tenant is likely to be. A good credit score indicates that a person is good at managing their finances and paying their bills on time, which is something that landlords want in a tenant. Additionally, landlords may use credit scores as a way to weed out applicants who are high-risk, such as those with a history of not paying rent on time or those with a lot of debt. By checking credit scores, landlords can avoid putting themselves in a situation where they are more likely to have problems with their tenants.

What is a good credit score?

There is no definitive answer to this question, as different landlords and property management companies have different standards. However, a good rule of thumb is that you will need a credit score of at least 650 to rent an apartment. If your score is below this threshold, you may still be able to rent an apartment, but you may have to pay a higher security deposit or find a cosigner.

How to Rent an Apartment with Bad Credit

Get a cosigner

The best way to rent an apartment with bad credit is to get a cosigner. A cosigner with good credit can vouch for you and help you get approved for an apartment. Make sure you choose a cosigner wisely, as they will be responsible for the rent if you can’t pay.

Another option is to look for apartments that don’t require a credit check. These are usually smaller, independent businesses rather than large apartment complexes. You may have to pay a higher security deposit, but it will be worth it if you can get approved.

You can also try to improve your credit score before you apply for an apartment. This may take some time, but it will increase your chances of getting approved. Some things you can do to improve your credit score include paying your bills on time, maintaining a good credit history, and using less of your available credit.

Find a no-credit-check apartment

If you’re looking for an apartment and have bad credit, your options may be limited. Many landlords rely on credit checks as part of their screening process, so if your credit is not in good standing, you may have a hard time finding a place to rent.

That said, there are some apartments out there that don’t require a credit check. These are typically lower-priced units that are aimed at people with bad credit or no credit history. You may have to pay a higher deposit or rent in advance, but it’s possible to find an affordable place to live without having to pass a credit check.

No-credit-check apartments are not always easy to find, but there are some resources that can help you locate them. Here are a few places to start your search:

-Apartment Guide: This website has a section specifically for listings of no-credit-check apartments. You can search by location and price range to find a place that fits your needs.

-Rent.com: This website also has a section for no-credit-check apartments. You can search by city and state to find listings in your area.

-MyNewPlace: This website has a listing service that includes no-credit-check apartments. You can sign up for free and receive email alerts when new listings become available.

Pay a higher security deposit

Most landlords require a security deposit before moving in, which is typically one month’s rent. If you have bad credit, you may be asked to pay a higher security deposit, usually equal to two months’ rent. You may also be asked to get a guarantor, which is someone who agrees to pay your rent if you default on it.

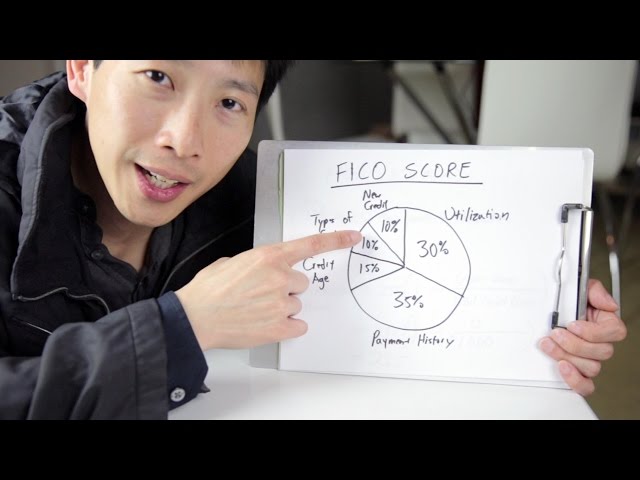

How to Improve Your Credit Score

It’s important to know your credit score before beginning your apartment search. A credit score is a number that landlords use to determine how likely you are to pay rent on time. The higher your credit score, the easier it will be to find an apartment. There are a few things you can do to improve your credit score, such as paying your bills on time, maintaining a good credit history, and using a credit monitoring service.

Check your credit report for errors

Your credit score is a very important number. It is used by landlords to determine if you are a good risk for renting an apartment. If your credit score is low, you may have trouble finding a place to live. There are a few things you can do to improve your credit score.

One of the best things you can do is to check your credit report for errors. You are entitled to one free credit report per year from each of the three major credit reporting agencies. Check your report carefully to make sure all the information is accurate. If you find an error, contact the credit bureau and ask them to correct it.

You can also improve your credit score by paying your bills on time and keeping your debt under control. If you have a lot of debt, try to pay it down as much as possible. You should also avoid opening new lines of credit and only use credit when you absolutely need it. By following these tips, you can improve your credit score and make it easier to rent an apartment in the future.

Make all your payments on time

One of the most important things you can do to improve your credit score is to make all your payments on time. This includes your rent, Utilities, Credit cards, auto loans, and any other type of bill you may have.

Late payments can have a major negative impact on your credit score, and can stay on your report for up to seven years. If you have any difficulty making ends meet, contact your creditors as soon as possible to work out a payment plan.

Setting up automatic payments is a great way to ensure that you never miss a payment, and can help reduce stress levels. Many creditors will also offer a small discount for enrolling in automatic payments.

Use a credit monitoring service

If you decide to use a credit monitoring service, be sure to choose one that is reputable and has a good track record. There are many services out there that claim to be able to improve your credit score, but not all of them are effective. Some credit monitoring services will provide you with a list of creditors that you need to contact in order to disputes items on your report. However, this is something that you can do on your own for free.

FAQs

Credit scores are just one factor that rental property owners and managers consider when reviewing a rental application. A credit score is a numerical expression of a person’s creditworthiness. A credit score is used by lenders to determine whether a person is a good candidate for a loan. A credit score is also used by landlords to determine whether a person is a good candidate for a rental agreement.

Can I rent an apartment with no credit history?

It is possible to rent an apartment with no credit history, but it may be more difficult than if you had a good credit score. Many landlords and property managers require a credit check as part of their screening process, so you may need to provide other documentation to prove that you are a responsible tenant. Additionally, you may be required to pay a higher security deposit or rent in advance.

Can I rent an apartment with a low credit score?

It is possible to rent an apartment with a low credit score, although it may be more difficult to find a landlord who is willing to rent to you. You may also be required to pay a higher security deposit or rent in advance. If you have a low credit score, it is important to explain your situation to potential landlords and show them that you are working to improve your credit.

How can I find out my credit score?

There are a few different ways that you can find out your credit score. One way is to contact a credit reporting agency, such as Experian or TransUnion, and request a copy of your credit report. Another way is to use a credit monitoring service, such as Credit Karma or Mint, which will give you your credit score for free. Finally, you can also check your credit score on your financial institution’s website – many banks and credit card companies now offer this service to their customers.