What Can the EIDL Loan Be Used For?

Contents

The Economic Injury Disaster Loan (EIDL) is a loan offered by the Small Business Administration (SBA) to small businesses and private non-profit organizations that have been affected by a disaster.

The EIDL loan can be used to cover a variety of expenses, including working capital, inventory, and accounts receivable. The loan can also be used to cover the cost of repairs to damaged property.

Checkout this video:

What is the EIDL Loan?

The EIDL loan is a government-backed loan that can provide small businesses with up to $2 million in funding. The loan can be used for a variety of purposes, including:

-Working capital

-To pay fixed debts

-To pay suppliers

-To support ongoing operations

How Can the EIDL Loan Be Used?

The EIDL loan can be used for a number of different things. It can be used to pay for inventory, marketing expenses, employee salaries, and other general business expenses. It can also be used to help with the cost of business interruption due to the coronavirus. Let’s take a closer look at how the EIDL loan can be used.

To Pay for Ordinary and Necessary Business Expenses

The EIDL loan can be used to pay for a wide range of ordinary and necessary business expenses. This includes, but is not limited to:

-Payroll costs

-Employee salaries

-Employee benefits

– Rent or mortgage payments

-Utility payments

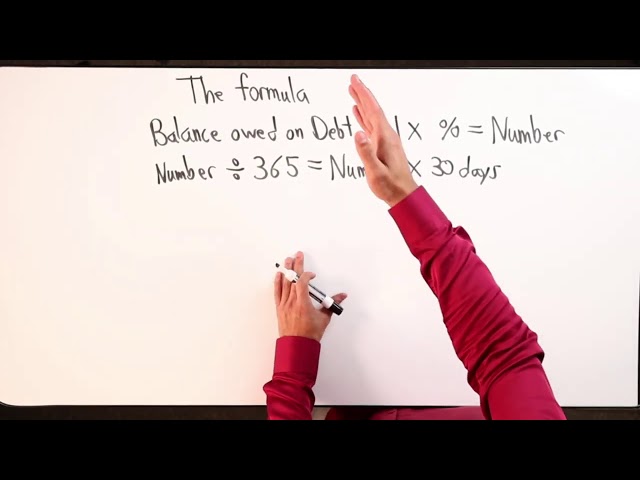

-Interest on any other outstanding debt obligations

To Refinance an SBA EIDL

The emergency EIDL loan can be used to refinance an SBA EIDL that was made between January 31, 2020 and April 3, 2020. You must have used the EIDL loan for its intended purpose, which is to help you meet working capital needs as a result of the disaster.

What Cannot Be Paid for With an EIDL Loan?

The EIDL loan is a loan that is available to small businesses and agricultural businesses that have been affected by COVID-19. The loan can be used for working capital, to pay for inventory, or to pay for other business expenses. However, there are some things that the loan cannot be used for. In this section, we will cover what cannot be paid for with an EIDL loan.

Personal Expenses

The EIDL loan cannot be used for personal expenses. The SBA’s regulations specifically exclude the following expenses:

-Payments on loans from other lenders

-Stocking new inventory

-Paying dividends to shareholders or owners

-Refinancing long-term debt

-Relocating a business

Political Activities

Political activities are not allowed to be funded by an EIDL loan. This includes any activities that promote, support, or oppose any political candidate or party. Additionally, any lobbying activities or attempting to influence legislation through grassroots campaigns would also be prohibited.

How to Apply for an EIDL Loan

EIDL loans can be used for a variety of purposes, including working capital, inventory, and business interruption costs. The loan can also be used to cover the costs of repairing or replacing damaged property.

How to Use the EIDL Loan Portal

The EIDL loan portal is a website that allows small businesses to apply for and receive emergency loans from the US government. The loans are intended to help businesses pay for expenses such as rent, utilities, payroll, and other essential operating costs.

To use the EIDL loan portal, business owners will first need to create an account with the Small Business Administration (SBA). Once they have done so, they will be able to log in and begin the application process.

The application process requires business owners to provide basic information about their business, such as its size, revenue, and expenses. They will also need to provide financial information such as their credit score and bank account balance.

After the application is complete, the SBA will review it and determine whether or not the business is eligible for an EIDL loan. If approved, the loan will be deposited into the business owner’s bank account within a few days.