How to Take Cash Out of Your Credit Card

Contents

How to take cash out of your credit card? It’s easy! Just follow these simple steps and you’ll be able to get cash from your credit card in no time.

Checkout this video:

Introduction

Most credit cards will allow you to withdraw cash from an ATM, although you will usually be charged a fee for doing so. The amount you can withdraw may also be limited.

In order to take cash out of your credit card, you will need to find an ATM that accepts your card. Once you have found an ATM, you will need to insert your card into the machine and enter your PIN. After that, you will need to select the ‘Withdrawal’ option and choose the amount of money that you want to withdrawn.

What is a cash advance?

A cash advance is a service provided by most credit card and charge card issuers. The service allows cardholders to withdraw cash, either through an ATM or over the counter at a bank or other financial institution, up to a certain limit in a day or period.

Cash advances usually incur a fee, as well as a higher interest rate than purchases made with the card. For this reason, it is advisable to only use this service in cases of emergency.

How to take a cash advance

Most credit cards will allow you to take a “cash advance” by using your credit card at an ATM or by going to a bank to get cash against your credit limit. Taking a cash advance is different from making a purchase with your credit card, and it generally carries different terms. Here’s what you need to know about taking a cash advance on your credit card:

-Cash advances usually come with a higher interest rate than your standard purchase APR.

-You may be charged a fee for taking a cash advance, which can be a flat fee or a percentage of the amount withdrawn.

-There is no grace period for cash advances, so interest begins accruing immediately.

-Your cash advance limit is typically lower than your overall credit limit.

If you’re in need of quick cash, taking a cash advance from your credit card may be tempting. Just be sure to consider the cost before you withdraw any funds.

Fees and interest

If you take a cash advance on your credit card, you will typically be charged a higher interest rate than you would for purchases. In addition, most credit card issuers charge a cash advance fee, which is typically a percentage of the amount of cash you withdraw. For example, if your cash advance fee is 3% and you withdraw $100 from an ATM, you will be charged $3 in fees.

There are also a few other things to keep in mind when taking a cash advance on your credit card:

– You will typically have a lower credit limit for cash advances than for purchases.

– Interest on cash advances begins accruing immediately, so it’s important to pay off your balance as soon as possible.

– Many credit card issuers do not allow you to take a cash advance on your credit card if it has been closed or if it is nearing its expiration date.

How to avoid cash advance fees

Most credit cards will allow you to withdraw cash from an ATM or bank teller, but they almost always charge a fee for doing so. The fee is usually a percentage of the total cash advance, with a minimum fee of around $5. So, if you take out a $100 cash advance, you might have to pay a $5 fee, which works out to an APR of about 500%.

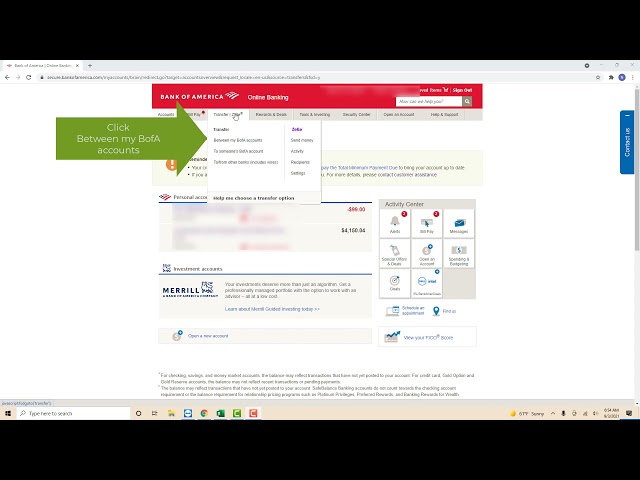

There are ways to avoid these fees, though. Some cards will waive the cash advance fee if you use your credit card at an ATM in their network. And some banks will let you transfer money from your credit card to your checking account for free. If you have to take out a cash advance, it’s best to plan ahead and find a way to avoid the fees.

Tips for using cash advances

When you’re in a pinch and need access to cash quickly, you may be considering a cash advance from your credit card. However, there are a few things you should know before taking out a cash advance, as they can be expensive and may hurt your credit score.

Here are a few tips for using cash advances:

-Know the fees. Cash advances come with high fees, so you’ll want to make sure you know what you’re being charged before you take one out.

-Limit the amount you borrow. Only borrow what you absolutely need, as the fees can add up quickly if you borrow more than necessary.

-Repay the loan as soon as possible. Since cash advances typically come with higher interest rates than regular credit card purchases, it’s important to repay the loan as soon as possible to avoid accruing too much interest.

-Be mindful of your credit score. Taking out a cash advance can hurt your credit score, so if you’re planning on applying for a loan or other type of credit in the near future, you may want to reconsider taking out a cash advance.

Conclusion

There are a few different ways to take cash out of your credit card. You can either do a cash advance, which is where you withdraw cash from your credit card account using your PIN at an ATM, or you can do a balance transfer, which is where you transfer part of your credit card balance to another account.

Taking cash out of your credit card is generally not a good idea, as it will typically have a high interest rate and you will have to pay fees. If you absolutely need to take cash out of your credit card, make sure you use the money wisely and pay it back as soon as possible.