How to Take a Loan Out of Your 401k

Contents

How to take a loan out of your 401k – If you’re in need of some extra cash, you may be considering taking a loan out of your 401k. Here’s what you need to know about how to do it.

Checkout this video:

Introduction

A 401(k) loan is money that you borrow from your 401(k) account. To take a loan out of your 401(k), you generally need to repay it within five years, although there are some exceptions. The biggest benefit of taking out a 401(k) loan is that you don’t have to pay taxes on the money you borrow.

However, there are some drawbacks to taking out a 401(k) loan. For example, if you leave your job, you may have to repay the loan immediately. Additionally, if you don’t repay the loan as agreed, the IRS may treat the outstanding balance as a distribution, which means you will have to pay taxes on the money you borrowed.

If you’re considering taking out a 401(k) loan, there are a few things you need to know before doing so. This article will discuss how 401(k) loans work and whether or not they are a good idea for you.

How to take a loan out of your 401k

A 401k loan is a great way to get the money you need without having to pay taxes or fees. You can borrow up to $50,000 or half of your 401k balance, whichever is less. The interest rate on a 401k loan is usually lower than a personal loan or credit card. You will have to pay the loan back within five years, but you can usually make payments directly from your paycheck.

What is a 401k?

A 401k is a retirement savings plan sponsored by an employer. It lets workers save and invest a piece of their paycheck before taxes are taken out. Taxes are not paid on the money until it is withdrawn from the account.

401ks are one of the most popular ways to save for retirement. According to the latest data from the Investment Company Institute, 83 million Americans participate in 401k plans.

The money in a 401k can be used to buy a house, pay for college, start a business, or cover other expenses. Withdrawing money from a 401k is called “taking a loan.”

How does a 401k loan work?

You may be able to borrow money from your 401k plan, but there are rules and regulations that you need to be aware of before taking a loan from your retirement savings.

How does a 401k loan work?

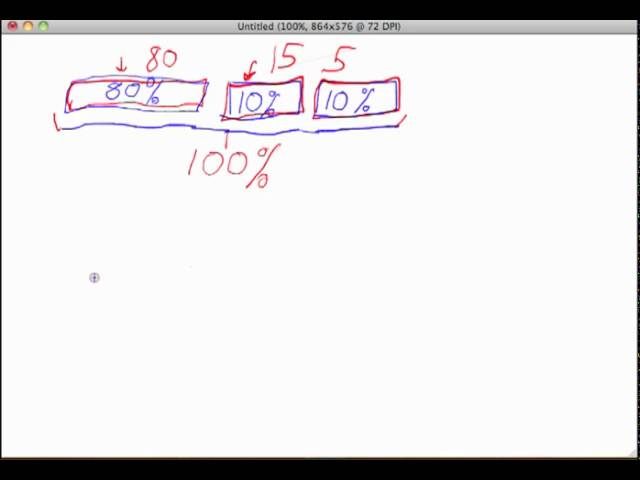

When you take out a loan from your 401k, you are borrowing money from yourself. The money is withdrawn from your 401k account and games you a fixed interest rate. You will have 5 years to repay the loan, unless you use the money for a down payment on a house, in which case you have up to 15 years to repay the loan.

The biggest downside of taking a loan from your 401k is that if you leave your job for any reason (including being fired or laid off), you will usually have to repay the entire loan within 60 days or it will be considered a withdrawal and subject to taxes and penalties.

Before taking a loan from your 401k, make sure that you understand the rules and regulations regarding repayment. It’s also important to make sure that you won’t need the money in your retirement account for its intended purpose – retirement!

What are the benefits of a 401k loan?

A 401k loan can come with some attractive benefits, such as:

-You don’t have to go through a credit check to qualify for the loan.

-The interest you pay on the loan goes back into your retirement account.

-There are typically no fees associated with taking out a 401k loan.

There are also some potential drawbacks to consider, such as:

-If you leave your job, you may have to repay the loan in full within 60 days or face paying taxes and penalties on the unpaid balance.

-Your loan payments will reduce the balance of your retirement account, which could impact how much money you have available in retirement.

-You may be subject to a 10% early withdrawal penalty if you are under age 59½ and you cannot repay the loan when due.

What are the drawbacks of a 401k loan?

Before taking a loan from your 401k, it’s important to understand the drawbacks. First, if you leave your job for any reason (even if it’s just to retire), you will typically have to pay the loan back within 60 days. If you can’t repay the loan, it will be considered a withdrawal and you will be subject to ordinary income taxes plus a 10% early withdrawal penalty.

Another downside of a 401k loan is that you are effectively borrowing from yourself. This means that you are missing out on the potential growth of your investments while you are repaying the loan. And, if you can’t repay the loan, not only will you owe taxes on the withdrawal, but you will also lose out on the earnings that could have accumulated had the money remained invested.

Finally, it’s important to remember that a 401k loan is not a true loan. This means that there is no credit check and no collateral is required. This may seem like a good thing, but it also means that if you default on the loan, there is no legal recourse for the lender (your employer). So, if you do decide to take a loan from your 401k, make sure that you will be able to repay it.

Conclusion

Now that you know how to take a loan out of your 401k, remember to keep the following things in mind:

-You will owe taxes and penalties if you default on the loan

-You will have to pay the loan back with interest

-Taking a loan from your 401k can be a good way to get access to money in an emergency, but you should exhaust all other options first

-Make sure you understand the terms of the loan and can afford the monthly payments before you sign anything