How to Remove Paid Collections From Your Credit Report

Contents

If you have paid off a collection and want to remove it from your credit report, you’ll need to follow a few steps. Find out what to do and how it can help your credit score.

Checkout this video:

What are paid collections?

Paid collections are items that have been reported to the credit bureaus as being delinquent, but have since been paid in full. While these items will still appear on your credit report, they will be marked as “paid” and will no longer have a negative impact on your credit score.

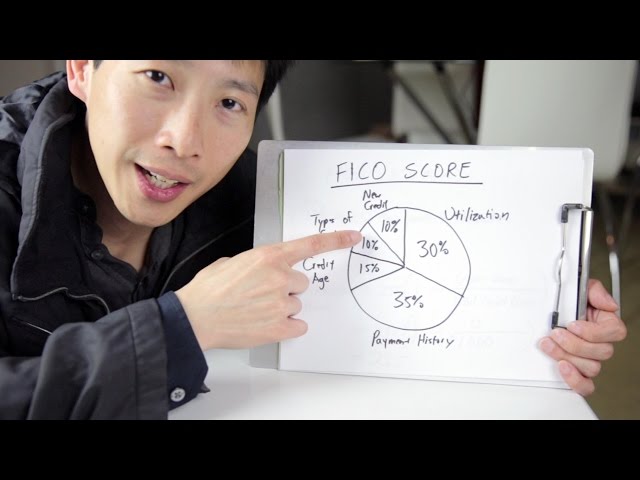

However, even though paid collections are no longer considered negative, they can still be harmful to your credit score. This is because credit scoring formulas place more emphasis on recent behavior, and a paid collection is still an indication that you have struggled to pay your bills in the past.

For this reason, it is often worth taking the time to remove paid collections from your credit report. While it’s not always easy, there are a few different strategies you can use to improve your chances of success:

1) dispute the item with the credit bureau: If you believe that the collection is inaccurate or does not belong to you, you can file a dispute with the credit bureau. The bureau will then investigate and if they find that the information is indeed inaccurate, they will remove it from your report.

2) negotiate with the creditor: If the debt is accurate but you believe that you should not have to pay it, you can try negotiating with the creditor. Often times creditors are willing to delete paid collections from your report in exchange for payment – especially if you agree to pay in full.

3) use a Goodwill letter: If you have a good history with the creditor and/or you believe that there are extenuating circumstances surrounding the debt (e.g., you were going through a difficult time financially when it was incurred), you can try sending a goodwill letter. In this letter, you explain whyyou believethe collection should be removed and ask for their cooperation. While there’s no guarantee that this will work, it’s often worth a try.

How do paid collections affect your credit score?

When a borrower pays off a delinquent debt that has been forwarded to a collection agency, the status of that account changes from “unpaid” to “paid”. However, the account will still appear on the borrower’s credit report as a paid collection.

While the collection will no longer show as unpaid, it will still be factored into the calculation of the borrower’s credit score. This is because a paid collection is still considered to be negative information, and can therefore damage a borrower’s credit score.

The good news is that there are steps that borrowers can take to remove paid collections from their credit report. By taking these steps, borrowers can improve their credit score and improve their chances of being approved for loans and other forms of financing in the future.

How to remove paid collections from your credit report

dispute the debt with the collection agency

If you find a paid collection on your credit report, you might be able to get it removed by disputing the debt with the collection agency.

The collection agency will have to prove that the debt is yours and that you agreed to pay it. If they can’t do that, then the debt will be removed from your credit report.

You can dispute the debt yourself or hire a credit repair company to do it for you.

negotiate a pay for delete agreement

If you have a paid collection on your credit report, you may be able to negotiate a pay for delete agreement with the collection agency. Under this agreement, you would agree to pay the collection in full in exchange for the agency removing the collection from your credit report. This is an ideal solution if you are trying to improve your credit score and can afford to pay off the debt in full.

Before you attempt to negotiate a pay for delete agreement, make sure that the collection agency is willing to work with you. Some agencies may be open to this type of arrangement, while others may not be interested. You should also make sure that you have the financial resources available to pay off the debt in full. Once you have confirmed these two things, you can begin negotiating with the agency.

If you are able to successfully negotiate a pay for delete agreement, make sure that you get everything in writing before you make any payments. This will protect you in case the agency does not fulfill their end of the bargain. Once everything is finalized, pay off the debt as agreed and then request confirmation from the agency that the debt has been removed from your credit report.

wait for the collection to fall off your credit report

According to the Fair Credit Reporting Act (FCRA), a paid collection should drop off your credit report seven years from the date of the first missed payment that led up to the collection.

If you want to remove a paid collection from your credit report before seven years have passed, you can do so by requesting “goodwill deletions” or “pay for delete” agreements with the collection agency.

With a goodwill deletion, you simply write a goodwill letter to the collection agency asking them to remove the entry from your credit report. There is no guarantee they will agree to do so, but it’s worth a shot.

With a pay for delete agreement, you agree to pay the collections agency in exchange for them removing the entry from your credit report. Again, there is no guarantee they will agree to this, but it’s worth negotiating if you have the money to pay off the debt.