How to Qualify for Student Loan Forgiveness

Contents

Get the most up-to-date information on student loan forgiveness programs and how to qualify.

Checkout this video:

Introduction

The Public Service Loan Forgiveness Program (PSLF) is a federal program that forgives the remaining balance on your Direct Loans after you make 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Qualifying Payments

To qualify for PSLF, you must make 120 monthly payments on your Direct Loans after October 1, 2007, under a qualifying repayment plan while working full-time for a qualifying employer. Only payments made after you begin working full-time for a qualifying employer count toward the 120 required monthly payments.

Qualifying Repayment Plans

The following repayment plans qualify for PSLF:

-Standard Repayment Plan: You’ll have fixed monthly payments for up to 10 years.

-Graduated Repayment Plan: Your payment will start low and increase every 2 years; you’ll have this plan for up to 10 years.

-Extended Repayment Plan: You’ll have fixed or graduated monthly payments for up to 25 years. If you borrowed solely under the FFEL program, you must consolidate your loans into a Direct Consolidation Loan to qualify for this plan.

Pay As You Earn Repayment Plan (PAYE): Your monthly payment amount will be 10% of your discretionary income; you must have received your first disbursement of a Direct Loan on or after Oct. 1, 2011, to qualify for this plan. If you borrowed solely under the FFEL program, you must consolidate your loans into a Direct Consolidation Loan to qualify for this plan.

Income-Based Repayment Plan (IBR): Your monthly payment amount will be 10% or 15% of your discretionary income; you must have received your first disbursement of a Direct Loan on or after July 1, 2009, to qualify for this plan with the lower payment percentage, or July 1, 2014, to qualify with the higher percentage. If you borrowed solely under the FFEL program, you must consolidate your loans into a Direct Consolidation Loan to qualify for this plan.

Income-Contingent Repayment Plan (ICR): Your monthly payment amount will be the lesser of 20% of your discretionary income or what you would pay using a fixed 12-year repayment plan adjusted according to your income; all borrowers are eligible regardless of when they first took out their loan.

consolidate all of their federal student loans into one Direct Consolidation Loan if they wish to enroll in an income-driven repayment plan or extended repayment plan in order to make their required 120 qualifying payments while employed full time by a public service organization

What is Student Loan Forgiveness?

The term “student loan forgiveness” can refer to several different things. Most people think of student loan forgiveness as getting rid of (discharging) your student loan obligation so you don’t have to make any more payments on your loans.

Loan forgiveness happens under certain circumstances, such as:

-Making regular payments for a certain number of years (this is called “public service loan forgiveness”)

-Having your loan forgiven due to your job (this is common for certain types of jobs, such as teaching)

-Having your loan forgiven due to a disability

student loan forgiveness is not the same as student loan consolidation or student loan refinancing. These are completely different things.

Consolidating your loans means combining multiple loans into one big loan with one monthly payment. This can help you save money on interest and make your monthly payments more manageable, but it doesn’t make your overall student loan debt go away.

Refinancing your loans means taking out a new loan to pay off your old loans. This allows you to get a lower interest rate and could help you save money on interest over the life of your loans, but it doesn’t get rid of your overall student loan debt either.

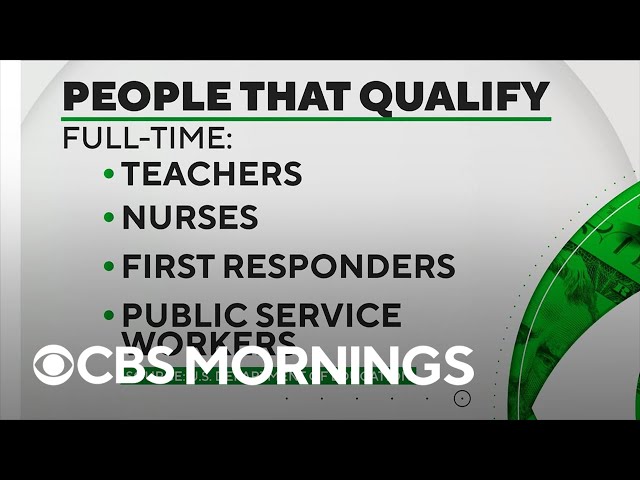

Who is Eligible for Student Loan Forgiveness?

The first step to getting your student loans forgiven is understanding if you’re eligible. While there are many programs out there that offer forgiveness, they each come with their own qualifications. Here are some of the most common eligibility requirements:

-You must be employed by a qualifying employer. This employer could be a government organization, a non-profit, or a private company that offers student loan repayment assistance as part of their employee benefits package.

-You must have made 120 qualifying monthly payments on your student loans. This equates to 10 years of payments if you’re on the standard 10-year repayment plan. If you’re on an income-driven repayment plan, you may be eligible for forgiveness after 20 or 25 years of payments, depending on the program.

-Your student loan payments must have been made in full and on time. If you have any outstanding delinquent or defaulted loans, you will not be eligible for forgiveness.

If you meet these qualifications, you may be eligible for student loan forgiveness through one of the many forgiveness programs offered by the federal government or your lenders.

How to Apply for Student Loan Forgiveness

The first place to start is with your loan servicer. You can find contact information for your loan servicer on the myedd.ed.gov website or by logging in to “My Federal Student Aid.” You will need to provide your name, Social Security number, date of birth, and the name of the school you attended when you contact your loan servicer.

If you are not sure whom your loan servicer is, you can also call the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243) or 1-319-337-5665 (TDD) and they will help you get in touch with your loan servicer.

Once you have contacted your loan servicer, you will need to fill out and submit a Loan Forgiveness Application. This form is also available on the myedd.ed.gov website or by logging in to “My Federal Student Aid.”

There is no fee to apply for student loan forgiveness, but there may be fees associated with consolidating your loans. You should contact your loan servicer for more information about fees associated with consolidation.

If you have questions about consolidation, repayment plans, or anything else related to student loans, you can also contact the Federal Student Aid Information Center at 1-800-4FEDAID (1-800-433-3243).

Conclusion

The best way to ensure you qualify for student loan forgiveness is to stay educated on the process and on your repayment options. There are many programs available that can help you lower your monthly payments and get out of debt quicker. Some of these programs even offer full or partial loan forgiveness.

The most important thing you can do is stay aware of your repayment status and keep accurate records of all correspondence with your loan servicer. If you have any questions, don’t hesitate to reach out to a student loan attorney or other student loan expert for guidance.