How to Qualify for a Student Loan

Contents

If you’re looking for information on how to qualify for a student loan, this post is for you. We’ll cover the eligibility requirements and the steps you need to take to get started.

Checkout this video:

Introduction

In order to qualify for a student loan, you must first complete the Free Application for Federal Student Aid (FAFSA). The FAFSA becomes available each year on October 1st, and you will need to submit it in order to be considered for financial aid for the upcoming school year. Be sure to complete the FAFSA as early as possible, as some aid is distributed on a first come, first served basis.

Once you have submitted your FAFSA, your school will send you a financial aid award letter that outlines all of the aid you are eligible to receive. If you have been approved for a student loan, it will be listed in your award letter.

If you decide that you would like to take out a loan, your next step is to complete a Master Promissory Note (MPN). The MPN is a legal document that states you agree to repay your loan according to the terms and conditions outlined therein. Once you have completed and signed your MPN, your loan will be processed and the funds will be sent to your school.

It is important to remember that taking out a student loan is a serious responsibility. You will be required to repay your loans even if you do not finish your program of study, are unable to find employment after graduation, or experience other financial difficulties. Before taking out a loan, make sure that you understand all of the terms and conditions and are confident that you will be able to repay it.

How to Qualify for Student Loans

There are a few eligibility requirements you’ll need to meet before you can qualify for a student loan. In order to qualify, you’ll need to be a U.S. citizen or permanent resident, have a valid Social Security number, and be enrolled in an eligible degree or certificate program at an eligible school. You’ll also need to be registered with the Selective Service if you’re a male between the ages of 18 and 25. If you meet all of these requirements, you should be able to qualify for a student loan.

Fill out the FAFSA

FAFSA stands for Free Application for Federal Student Aid. Completing and submitting the FAFSA is required in order to qualify for any type of financial aid, including federal student loans. The form is used to determine your eligibility for need-based aid, which is awarded based on your (and your family’s) ability to pay for college.

You can submit the FAFSA online at fafsa.gov, or you can request a paper copy from your financial aid office. You’ll need to provide some basic information about yourself and your family, as well as your most recent tax return. If you or your parents haven’t filed taxes yet, you can use an estimate of your income.

Keep in mind that you’ll need to submit a new FAFSA every year you’re in college, as your family’s financial situation may change from year to year.

Get a cosigner

Student loans are a type of financial aid that must be repaid, with interest. If you’re having trouble qualifying for a private student loan on your own, you may want to get a cosigner. A cosigner is someone who agrees to pay back your loan if you can’t or don’t.

To get a cosigner, start by asking someone who knows you well and has good credit, such as a parent or grandparent. If they’re willing to cosign your loan, have them fill out and sign the cosigner agreement form from your chosen lender. Once they’ve done that, your loan application process will continue as usual.

Keep in mind that even if you have a cosigner, you’re still responsible for repaying your student loans. So make sure you understand the terms of your loan before you agree to anything.

Apply for scholarships and grants

-Fill out the Free Application for Federal Student Aid (FAFSA): This is required for any type of federal or state aid, as well as many need-based scholarships. The form becomes available each year on October 1 for the upcoming academic year.

-Complete the CSS Profile: In addition to the FAFSA, some colleges require the College Scholarship Service Profile (CSS Profile) from students seeking institutional or merit-based aid. Like the FAFSA, this form becomes available each year on October 1.

-Look for outside scholarships: In addition to aid offered by the government and your college, there are many private scholarships available to help students pay for school. You can search for scholarships on sites like Fastweb and Chegg.

Conclusion

The best way to qualify for a student loan is to start by filling out the Free Application for Federal Student Aid (FAFSA). This form will give you an idea of what types of loans you may be eligible for and how much money you can borrow.

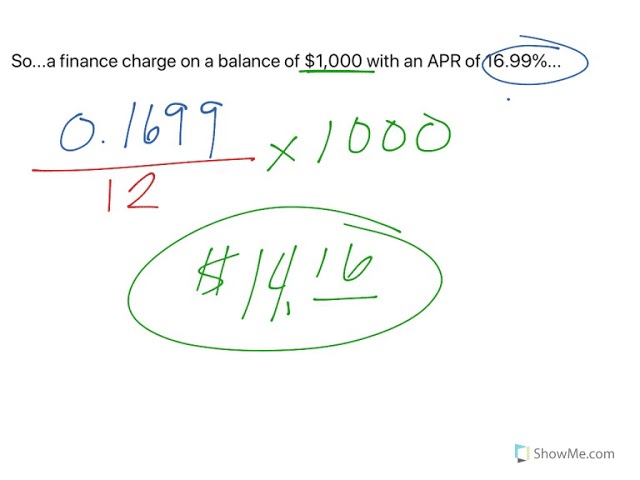

Once you have your FAFSA results, you can start shopping around for student loans. Be sure to compare interest rates, repayment terms, and other loan features before you choose a lender.

If you have any questions about qualifying for a student loan, be sure to speak with a financial aid counselor at your school. They will be able to help you understand your options and make the best decision for your needs.