How to Qualify for a USDA Loan

Contents

If you’re looking to buy a home in a rural or suburban area with no down payment, a USDA loan could be an option for you.

Checkout this video:

Overview of the USDA Loan program

The USDA Loan program is a government-backed loan program available to eligible borrowers in rural and suburban areas. USDA Loans offer flexible terms and competitive rates, making them a great option for borrowers who may not qualify for a conventional loan.

To qualify for a USDA Loan, borrowers must meet certain eligibility requirements, including income, employment, and property location requirements. Borrowers must also have a satisfactory credit history and sufficient income to repay the loan.

For more information on the USDA Loan program, including how to apply, please visit the USDA website.

Property eligibility requirements

To qualify for a USDA loan, the property you purchase must be in an eligible rural area as defined by the USDA. To find out if your desired area is part of the USDA property eligibility list, visit their website and enter the address. If you don’t live in an eligible area, you may still qualify for a loan if you meet certain income requirements.

In order to qualify for a USDA loan, you must also meet credit score and income requirements. The credit score requirements are lower for a USDA loan than for a conventional mortgage, and the income requirements are generally more flexible. To learn more about these guidelines and to see if you qualify, visit the USDA website.

Income eligibility requirements

In order to qualify for a USDA loan, your household income must be less than 80% of the area’s median income.

In order to qualify for a USDA loan, your household income must meet the following guidelines:

-Your household’s total income must be less than 80% of the area’s median income.

-A family of four in New York City, for example, would need to have an annual combined income of less than $77,000 to meet the guidelines for a USDA loan in most parts of the city.

-The size of your household also affects your eligibility. A one-person household will need to have an income below $47,000, for example, while a four-person household would need to have an combined income below $77,000.

-Income from all sources is considered when determining eligibility for a USDA loan. This includes not just wages from full-time or part-time employment, but also child support, alimony, Social Security benefits, and any other form of regular payment you receive on a monthly basis.

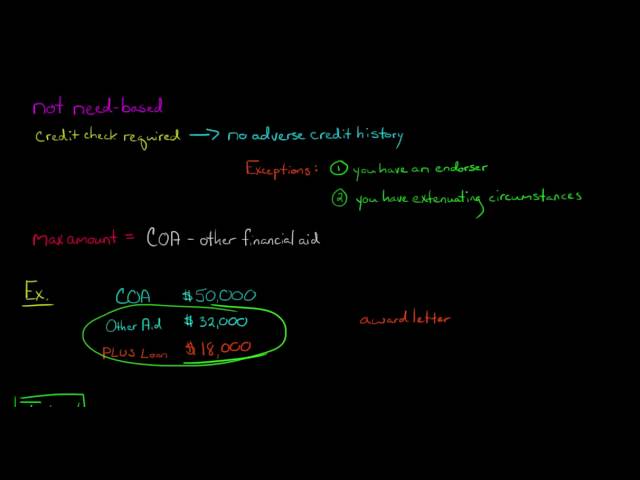

Loan amount and repayment terms

USDA loans are for 30 years, and the interest rate is fixed. The USDA guarantees the loan, so there is no mortgage insurance, even though the loan amount may exceed 80% of the property value. Since there is no monthly mortgage insurance with a USDA loan, the monthly payment will be lower than it would be with an FHA or conventional loan.

How to apply for a USDA Loan

To apply for a USDA loan, you must:

-be a U.S. citizen or permanent resident alien

-have a valid Social Security Number

-be of legal home buying age (18+)

-demonstrate adequate financial resources to meet the loan obligations, including income, debts, and any other financial obligations

-have a property for the loan to be secured by (this can be an existing home, manufactured home, or new construction)

-be within the USDA loan income limits for your area

-meet credit guidelines set by the lender