How to Lease a Car with Bad Credit

Contents

If you have bad credit, you may think that leasing a car is out of the question. But there are a few things you can do to improve your chances of getting approved. Follow these tips and you may be able to lease a car with bad credit.

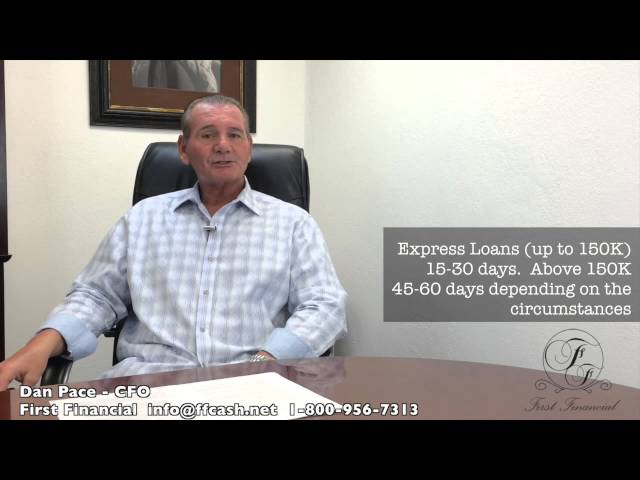

Checkout this video:

Know your credit score

Your credit score is one of the most important factors in determining whether or not you will be approved for a car lease. A bad credit score can make it difficult to lease a car, but it is not impossible. There are a few things you can do to improve your chances of being approved, such as knowing your credit score and having a down payment.

If you have bad credit, you may still be able to lease a car if you have a cosigner with good credit. You may also be required to put down a larger down payment than someone with good credit. If you are considering leasing a car with bad credit, it is important to shop around and compare offers from different lenders.

Find the right dealership

The first step is to figure out which dealerships in your area work with people who have bad credit. You can either ask around or look online. Once you have a few options, it’s time to start doing some research.

Check out the dealerships’ websites and see what kind of cars they have in their inventory. If you have a specific car in mind, make sure they have it. If you don’t have a specific car in mind, browse their selection and see if anything catches your eye.

It’s also a good idea to read reviews of the dealerships before you make a decision. See what other people who have bad credit have to say about their experience. Look for reviews that talk about the quality of the cars, the friendliness of the staff, and the ease of the leasing process.

Once you’ve found a few dealerships that look promising, it’s time to start visiting them in person.

Get pre-approved for financing

There are a few things you can do to increase your chances of being approved for a lease with bad credit. Start by getting pre-approved for financing from a lender that specializes in bad credit auto loans. This will give you a sense of what kind of interest rate and monthly payment you can expect.

Next, be sure to shop around for the best deal. Get quotes from multiple dealerships and compare the terms of each offer. Remember to negotiate! Many dealerships are willing to work with customers with bad credit, so don’t be afraid to ask for a better interest rate or monthly payment.

Finally, be sure to have a down payment ready. A larger down payment will increase your chances of being approved for a lease, and it will also lower your monthly payments. If you can’t afford a large down payment, consider trading in another vehicle or working with a cosigner.

Have a down payment

Paying a down payment is one of the best ways to reduce the overall cost of your car lease. A typical car lease will require a down payment that is equal to the value of your first monthly payment, but you may be able to negotiate a lower down payment. If you have bad credit, you may need to make a larger down payment in order to get approved for a lease.

Another way to reduce the cost of your car lease is to trade in your old car. If you have equity in your old car, you can use it as a down payment towards your new lease. This will reduce the amount of money that you need to finance, and it may help you get approved for a lease with bad credit.

If you don’t have enough money for a down payment, there are still options available to you. Many leasing companies will allow you to finance your down payment, which will increase your monthly payments but may help you get into a new car sooner. You can also look into lease programs that allow you to make low or no down payments. These programs may require higher monthly payments or mileage limits, but they can help you get into a new car without having to come up with a large sum of cash upfront.

Have a trade-in

If you have a vehicle that you’re looking to trade in, you may be able to use it as equity to offset some of the cost of your new car lease. When you go to the dealership, be sure to bring along all the paperwork related to your trade-in, as well as any documents that show its current market value. This will help you get the best possible deal on your lease.

Be prepared to pay a higher interest rate

One of the first things you should know is that if you have poor credit, you’re going to be paying a higher interest rate to lease a car. This is because the leasing company is taking on more of a risk by leasing to you. In order to offset this risk, they’re going to charge you a higher interest rate.

The second thing you should know is that you’re going to need to put down a larger security deposit. This deposit is usually equal to one or two months’ worth of payments, so it can be quite substantial. The good news is that this deposit is refundable, so you’ll get it back once your lease is up.

Another thing to keep in mind is that your monthly payments are going to be higher with bad credit. This is because the leasing company will want to make sure they’re getting their money’s worth out of the deal. They don’t want to end up having to repossess the car because you can’t make your payments, so they’re going to charge you a bit extra each month just to be safe.

Finally, you should know that it’s still possible to get a good deal on a car lease even if you have bad credit. It might take some extra work on your part, but it’s definitely possible. The key is to shop around and compare offers from different leasing companies. Don’t just take the first offer that comes your way – make sure you compare everything before making a decision.