How to Increase Your Credit Limit With Wells Fargo

Contents

If you’re a Wells Fargo customer, you may be wondering how to increase your credit limit. Here’s a quick guide on what you need to do.

Checkout this video:

Research your credit limit

Your credit limit is the maximum amount of money that you’re allowed to borrow from a lender. It’s important to know what your credit limit is so that you can avoid going over it and damaging your credit score. You can increase your credit limit by asking your lender for a credit limit increase, or by using a credit card with a high credit limit.

Know your credit score

No matter which credit card issuer you have, you’re going to need a good credit score to get a high credit limit. A FICO® Score above 670 is considered good, 740 and above is considered very good, and a score of 800 and above is considered excellent. If you don’t know your score, you can check it for free on Wells Fargo’s website.

If you have a good or excellent credit score, you’ll likely be approved for a higher credit limit. If your score is fair or poor, you may still be approved for a Wells Fargo credit card but your credit limit will likely be lower.

Know your credit utilization rate

Your credit utilization rate is the percentage of your credit limit that you use each month. For example, if your credit limit is $1,000 and you spend $500 in a month, your credit utilization rate would be 50%.

Ideally, you want to keep your credit utilization rate below 30% to maintain a good credit score. If you can keep it below 10%, that’s even better. Here’s why:

Credit scoring models (like the FICO® Score*) take into account how much of your available credit you’re using. The more of your available credit you’re using, the more it will hurt your score.

Keeping a low credit utilization rate is one way to show lenders that you’re a responsible borrower who uses only a small portion of the credit available to you. This can help improve your chances of getting approved for new loans and lines of credit in the future.

Request an increase in your credit limit

If you have a good history of responsible credit management with Wells Fargo, you may be able to request an increase in your credit limit. By requesting a credit limit increase, you may be able to make larger purchases, which can help you in the long run. Requesting a credit limit increase is a simple process, and you can do it online or over the phone.

Call customer service

The best way to request an increase to your credit limit is to call customer service. When you call, be prepared to answer questions about your current financial situation and why you need a higher credit limit. customer service will likely also pull your credit report to verify your current credit standing. If approved, you should see an increase in your credit limit within a few days.

Request an increase online

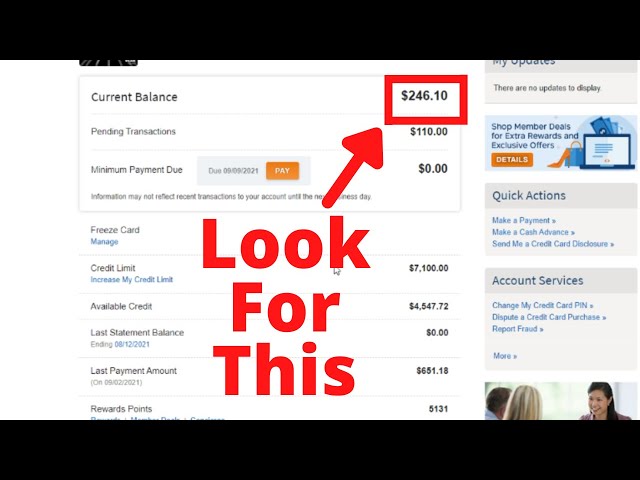

If you have a Wells Fargo credit card, you may be able to request a credit limit increase online. To do so, log in to your account and navigate to the “Request a Credit Limit Increase” page. From there, you will need to provide some personal information, such as your name, address, and Social Security number. You will also need to provide some financial information, such as your annual income and monthly housing payment. Once you have provided all of the required information, you will be able to submit your request.

Use a credit limit increase to improve your credit score

If you have a good relationship with your credit card issuer, you may be able to get a credit limit increase. This can help you improve your credit score in a couple of ways. First, a credit limit increase can lower your credit utilization ratio, which is the second most important factor in your credit score. Second, a credit limit increase can help you build a longer credit history, which can also help your credit score.

Keep your credit utilization rate low

One of the most important factors in your credit score is your credit utilization rate. This is the percentage of your credit limit that you are using at any given time. For example, if you have a credit card with a limit of $1,000 and you currently have a balance of $500, your credit utilization rate would be 50%.

Ideally, you want to keep your credit utilization rate below 30%. This shows lenders that you are using your credit responsibly and that you are not maxing out your cards. If you can keep your credit utilization rate low, it will help improve your credit score.

One way to keep your credit utilization rate low is to increase your credit limit. If you have a credit card with a limit of $1,000 and you increase it to $2,000, your credit utilization rate would drop to 25% even if you kept the same balance of $500. This would be a good way to improve your credit score.

Of course, you need to be careful with this strategy. If you increase your credit limit and then start charging more on your card, you could end up with a higher balance and a higher credit utilization rate. You need to be sure that you can control your spending before you increase your credit limit.

Use your credit limit increase wisely

If you’re approved for a credit limit increase, be sure to use the extra credit wisely. An easy way to do this is to keep your credit card balance at 30% or less of your new credit limit. This will help improve your credit score by showing that you’re using a lower percentage of your available credit. It may also help you avoid paying interest on your balance if you carry a balance from month to month.