How to Increase Your Chase Credit Limit

Contents

If you’re looking to increase your Chase credit limit, there are a few things you can do to improve your chances. Follow these tips and you may be able to get the credit limit increase you’re after.

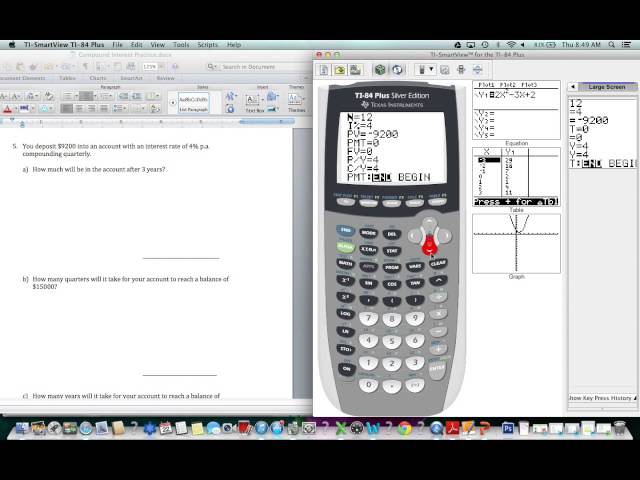

Checkout this video:

Check your credit report

The first step is to check your credit report and make sure there are no errors. You can do this by requesting a free copy of your report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) once per year at AnnualCreditReport.com. If you find any errors, dispute them with the credit bureau immediately.

Next, take a look at your credit utilization ratio, which is the amount of debt you have compared to your credit limit. For example, if you have a $1,000 credit limit and you regularly charge $500 on your card, your ratio is 50%. Chase prefers that you keep your ratio below 30%, so if it’s higher than that, you may want to pay down your balance before requesting a credit line increase.

If you have a good history with Chase (meaning you pay your bill on time and don’t carry a balance), you’re more likely to be approved for a higher limit. If you’ve only had your card for a short time or if you’ve had some false starts in the past (such as making late payments), you may still be able to get an increase but it may take longer or require more documentation.

Call customer service

If you have a Chase credit card, you might be wondering how you can go about increasing your credit limit. Luckily, it’s relatively easy to do.

One of the simplest ways to increase your credit limit is to simply call customer service and ask. While there’s no guarantee that they’ll say yes, it definitely doesn’t hurt to ask. It’s also a good idea to have a good reason for why you’re asking for an increase. For example, if you’ve been using your card responsibly for a long time and have never been late on a payment, that’s a good sign that you’re ready for an increase.

Another way to try to increase your credit limit is to make a larger than usual purchase on your card and then promptly pay it off. This will show Chase that you’re capable of handling a larger credit limit and may prompt them to raise your limit without you even having to ask.

Finally, if you have multiple Chase cards, you may be able to transfer some of the credit limits from those cards onto your primary card. This can be a helpful way to boost your overall credit limit without having to go through the process of asking for an increase on just one card.

If you’re hoping to increase your Chase credit limit, there are definitely some options available to you. It’s just a matter of figuring out which one will work best for your situation.

Use a credit card that reports to Chase

If you want to increase your credit limit with Chase, one of the best things you can do is use a credit card that reports to Chase. This will show Chase that you’re using credit responsibly and help improve your chances of getting approved for a higher limit.

One of the best cards to use for this purpose is the Chase Freedom Unlimited® Card, which offers 1.5% cash back on every purchase with no annual fee. If you’re not already a member of Chase Ultimate Rewards, you’ll also be able to transfer your cash back rewards to participating travel partners.

Use your Chase card regularly

One of the best ways to increase your credit limit is to use your Chase card regularly. Charge small amounts on a regular basis and pay off the balance in full each month to keep your debt-to-credit ratio low. Not only will this improve your credit score, but it will also show Chase that you’re a responsible customer who is less likely to default on a loan.

If you have a good history with Chase, you can also ask for a credit limit increase. Chase will usually do a hard pull of your credit report, so this is not a method to use if you’re trying to avoid affecting your credit score. However, if you have good credit and a solid history with Chase, you may be able to get a significant increase in your credit limit.

Pay your balance in full each month

One of the best ways to improve your chances of getting a higher credit limit from Chase is to show that you’re a responsible borrower by always paying your balance in full each month. Not only will this help keep your account in good standing, but it will also help prove to Chase that you’re a low-risk customer who is unlikely to max out your credit line and default on your payments.

If you have a history of making late payments or carrying a high balance, you may want to work on improving your payment history and credit utilization ratio before requesting a higher credit limit from Chase. You can do this by making all of your payments on time for at least six months and keeping your balance below 30% of your credit limit.