How to Get an Investment Property Loan

Contents

You can get an investment property loan from a bank or other financial institution, but it can be difficult to qualify. This guide will help you understand how to get an investment property loan.

Checkout this video:

Introduction

If you’re looking to get an investment property loan, there are a few things you’ll need to know. Here’s a quick rundown of what you’ll need to do in order to get an investment property loan.

1. Find a lender that offers investment property loans. You’ll likely need to shop around a bit to find a lender that offers this type of loan. Be sure to check with your local bank or credit union first, as they may offer special rates for members.

2. Make sure you qualify for the loan. Investment property loans typically have stricter qualifying criteria than other types of loans, so it’s important to make sure you meet all the requirements.

3. Gather the necessary documentation. When you apply for an investment property loan, the lender will likely require a variety of documentation, including proof of income, tax returns, and more. Be sure to have all the necessary documentation on hand before you apply for the loan.

4. Shop around for the best rate. Once you’ve found a few lenders that offer investment property loans, it’s time to start shopping around for the best rate. Be sure to compare rates, fees, and terms before making your final decision.

The Different Types of Investment Property Loans

There are a number of different types of investment property loans available, and each has its own advantages and disadvantages. The type of loan that you choose will depend on a number of factors, including the type of investment property that you are buying, your financial situation, and the terms that you are looking for.

Here is a brief overview of the different types of investment property loans:

Conventional loans: Conventional loans arethe most common type of investment property loan. They are typically used to purchase properties that are not owner-occupied, such as rental properties or vacation homes. These loans usually have higher interest rates than other types of loans, but they can be easier to qualify for if you have good credit.

Hard money loans: Hard money loans are another option for investment properties. These loans are backed by private lenders, and they can be a good option if you cannot qualify for a conventional loan. Hard money loans usually have higher interest rates and shorter terms than conventional loans, but they can be a good option if you need to get financing quickly.

bridge Loans: Bridge loansare short-term loans that can be used to finance the purchase of an investment property. These loans are typically used when you are planning to sell the property quickly, or if you need to get financing for a project quickly. Bridge loans usually have high interest rates, but they can be a good option if you need financing quickly.

private lenders: Private lendersare another option for investment property financing. Private lenders are individuals or companies that lend money directly to borrowers. Private lenders usually charge higher interest rates than banks or other financial institutions, but they can be a good option if you cannot qualify for a conventional loan.

Applying for an Investment Property Loan

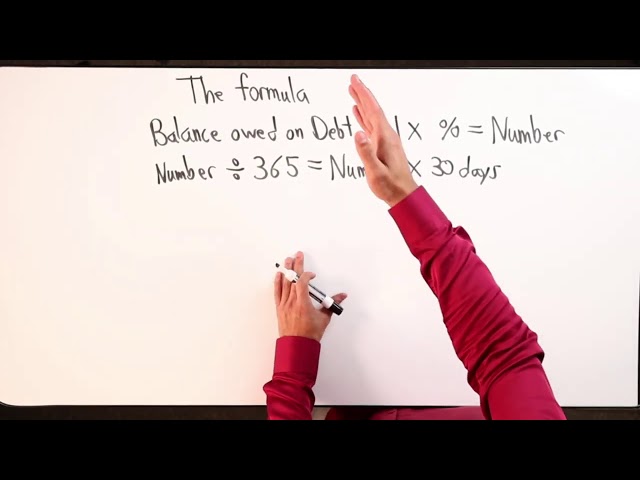

An investment property loan is a mortgage used to buy a property that will generate income or is intended for investment purposes only. The main difference between an investment property loan and a standard mortgage is that an investment property loan has a higher interest rate because it is considered a higher risk loan. There are a few things you need to do in order to apply for an investment property loan.

Applying for a mortgage

Applying for a mortgage is a detailed process that usually takes around 30 to 45 days. The first step is to get pre-approved by a lender, which gives you an estimate of how much money you can borrow. Then, you’ll need to fill out a formal application and provide the lender with financial documentation, such as tax returns and bank statements.

Once your application is approved, the lender will order a home appraisal to make sure the property is worth the amount you’re borrowing. If everything goes smoothly, you’ll then be given a loan estimate, which outlines the terms of your loan and gives you an estimated monthly payment. The final step is to close on the loan, which typically takes place at a escrow or title company.

Applying for a home equity loan

When you apply for a home equity loan, the lender will analyze your equity stake in the property as well as your income and debts, to determine if you qualify.

If you have equity in your home and you need funds for a major expense, such as home repairs or renovations, you may be able to take out a home equity loan. Home equity loans are typically offered at fixed rates, so your monthly payments don’t fluctuate with interest rate changes.

To qualify for a home equity loan, you’ll generally need a debt-to-income ratio in the low 40s or less, a credit score of 620 or higher and home value that’s greater than the balance of your mortgage. You’ll also need to be employed or have another source of income and have sufficient equity in your home to cover the loan amount and any fees associated with originating the loan.

Applying for a private loan

The first step is to find a lender that offers investment property loans. There are many traditional lenders, such as banks and credit unions, that offer these loans. There are also online lenders that specialize in investment property loans.

Once you have found a few potential lenders, you will need to gather some documentation. This will likely include tax returns, bank statements, and other financial documents. You will also need to have a down payment saved up. The down payment requirements for investment property loans are typically higher than for primary residence loans.

Once you have all of your documentation in order, you can begin the loan application process. This process will vary depending on the lender, but you can generally expect to complete a formal loan application and provide supporting documentation. The lender will then review your application and make a decision.

If you are approved for the loan, the next step is to negotiate the terms of the loan. This includes the interest rate, repayment schedule, and any other terms that need to be agreed upon. Once the terms are agreed upon, you will sign the loan agreement and begin making payments according to the schedule laid out in the agreement.

Qualifying for an Investment Property Loan

You’ll need to qualify for an investment property loan if you want to purchase an investment property. This can be a bit different than qualifying for a loan on a primary residence. Here are a few things you’ll need to know in order to qualify for an investment property loan.

Qualifying for a mortgage

To qualify for a mortgage on an investment property, you’ll probably need a higher credit score, smaller debt-to-income ratio and a larger down payment than you would if you were buying a home to live in. Make sure your lender knows that the property will be an investment. You might even find a multifamily mortgage that doesn’t require the borrower to occupy one of the units.

Qualifying for a home equity loan

To qualify for a home equity loan, you’ll need a strong credit score (most lenders prefer 700 and above) and a steady income to repay the loan. Lenders will also verify your employment history and run a background check before approving your loan.

In order to qualify for an investment property loan, you’ll need to have good credit, steady income, and enough money for a down payment. Lenders will also verify your employment history and run a background check before approving the loan.

Qualifying for a private loan

In order to qualify for a private loan, you will need to have a good credit score and a steady income. You will also need to have a down payment of at least 20% of the purchase price.

Conclusion

If you’re looking for an investment property loan, you’ll need to be prepared to put down a larger down payment than you would for a primary residence loan. You’ll also need to have strong credit and income in order to qualify. But if you’re willing to jump through these hoops, an investment property loan can help you make your real estate dreams come true.