How to Get a Manufactured Home Loan

Contents

There are a few different types of manufactured home loans to choose from, but the best one for you will depend on your personal circumstances. In this blog post, we’ll break down everything you need to know about getting a manufactured home loan.

Checkout this video:

Introduction

A manufactured home loan is a type of mortgage designed specifically for financing manufactured homes, which are also known as mobile homes. This type of loan is different from a traditional mortgage in several ways, but the most significant difference is that a manufactured home loan can be made for both new and used manufactured homes. Whether you want to finance a new manufactured home or an older one, you should be aware of the different requirements and terms that are specific to this type of loan.

In general, manufactured homes are cheaper than traditional homes, but they can be more difficult to finance. The first step in getting a manufactured home loan is to find a lender that specializes in this type of lending. Not all lenders offer manufactured home loans, so it’s important to shop around and compare rates and terms from several lenders before you decide on one.

Once you’ve found a lender that offers manufactured home loans, the next step is to fill out an application. The application process for a manufactured home loan is generally the same as the process for any other type of loan, but there may be some additional requirements such as proof of income and employment history. Be sure to ask your lender about any specific requirements before you begin the application process.

After your application has been approved, the next step is to negotiate the terms of your loan with your lender. This includes determining the interest rate, repayment schedule, and any other fees or charges that may be associated with your loan. Once you have reached an agreement with your lender, it’s time to finalize the details of your loan and sign the paperwork.

Manufactured home loans can be a great way to finance your new home purchase, but it’s important to understand the process and requirements before you apply. By doing your homework and shopping around for the best deal, you can ensure that you get the best possible terms on your loan.

What’s Required for a Manufactured Home Loan?

Applying for a manufactured home loan is similar to applying for a conventional home loan, but there are a few important differences. For one, you’ll need to provide proof that the manufactured home is certified by the U.S. Department of Housing and Urban Development (HUD). You’ll also need to have the home inspected by a certified manufactured home inspector.

The Home Itself

In order to get a manufactured home loan, you will need to have the home itself considered. The home must be built after June 15, 1976 to be eligible and it must also beclassified as personal property (also called chattel) by the local assessor.

The home must meet all the requirements of the HUD code for manufactured homes that went into effect on that date. The code includes specifications for things like fire safety, energy efficiency, and transportation of the home.

The home must also be permanently affixed to a foundation that meets HUD standards. This can be accomplished in a number of ways, but generally involves attaching the home to piers or pouring a concrete slab foundation around the perimeter of the home.

The Land

Before you can get a manufactured home loan, you must have a piece of land (or lot) to place your home on. You cannot simply place a manufactured home on any old lot – there are code requirements that must be met in order for the home to be placed there.

There are three different ways you can own the land that your manufactured home will be placed on:

-You can own the land outright and free and clear.

-You can have a mortgage or loan on the property.

-You can lease the land from someone else and have a long-term lease agreement (5 years or more).

Most lenders require that you own the land outright or have a long-term lease agreement in order to qualify for a manufactured home loan. If you don’t own the land outright, you will need to have a minimum of 5 years left on your lease agreement.

The Borrower

To qualify for a manufactured home loan, the borrower must:

-Be at least 18 years old

-Have a steady income

-Have a good credit history

-Be a U.S. Citizen or have permanent residency status in the U.S.

In addition, the borrower must:

-Own the land on which the home will be placed OR have a long-term lease (five years or more) for the land with an option to purchase. The land can be leased from a family member, friend, or other third party. Manufactured homes must comply with local zoning requirements and setback ordinances. These setback ordinances differ from county to county, but they typically require that the home be placed on a permanent foundation and that utility hookups (sewer, water, and electricity) be in place. Some lenders also require that the home be insured against fire and other hazards for it to qualify for financing.

-Purchase a new or used manufactured home that meets certain size and age restrictions set by the lender and/or federal government. The maximum size of a manufactured home that can be financed is dependent on the number of axles it has – single wide homes (one axle) are usually capped at 48 feet long while double wide homes (two axles) are usually capped at 60 feet long. Some lenders also limit the age of the home – most won’t finance homes that are more than 20 years old.

-The home must be your primary residence – you can’t use a manufactured home loan to purchase a second home or investment property.

How to Get a Manufactured Home Loan

You may be able to get a manufactured home loan if you have a good credit score and a steady income. There are a few things you can do to improve your chances of getting a loan, such as saving up for a down payment, getting pre-approved for a loan, and shopping around for the best interest rates.

Finding a Lender

When you’re ready to finance your manufactured home, it’s important to find a lender that has experience with this unique type of mortgage. Some lenders only finance modular homes, which means they may not have the experience or knowledge to properly underwrite and service your loan.

Manufactured homes are usually financed through personal property loans, also called chattel loans. These loans are similar to auto loans, where the home serves as collateral for the loan. Because manufactured homes tend to depreciate in value, most lenders require a higher down payment — often as much as 20 percent — and charge higher interest rates for these types of loans.

If you don’t have the cash for a high down payment, you may be able to get a personal loan from a family member or friend to help with the down payment. You can also look into government-backed programs like FHA loans or VA loans, which may be available to qualified borrowers with low down payments.

Once you know what type of loan you need, it’s time to start shopping around for lenders. You can start by asking your real estate agent or builder for recommendations. You can also check out our list of the best manufactured home lenders to get started.

Applying for a Loan

When you’re ready to apply for a manufactured home loan, the first step is to find a loan officer who specializes in mobile home financing. Not all mortgage companies offer this type of loan, but there are many who do. You can find a list of some lenders that offer manufactured home loans on the website of the Manufactured Housing Institute.

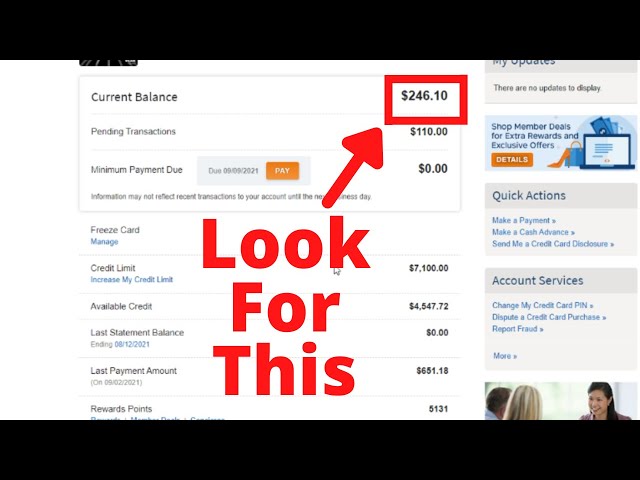

The loan officer will pull your credit history and score to determine if you’re eligible for a manufactured home loan and, if so, how much you can borrow. The amount you can borrow is based on several factors, including your employment history, income and credit score. The loan officer will also look at the value of the manufactured home you want to purchase and compare it to similar homes in the area to make sure you’re not paying too much for the property.

Once you’ve been approved for a loan, you’ll need to provide the lender with additional documentation, including proof of insurance, before the loan can be finalized. Once everything has been approved, you’ll sign the loan documents and then be able to start shopping for your manufactured home!

Negotiating the Loan

The key to getting the best loan for a manufactured home is to be a smart shopper and negotiator. Here are some tips to get you started:

Do your homework. Just because a lender says they offer loans for manufactured homes doesn’t mean they’re the best option. Be sure to compare rates, terms, and conditions before you commit.

Get pre-approved. Most lenders will require that you get pre-approved for a loan before they’ll give you an exact quote. This way they can determine how much of a risk you are and what interest rate they’ll charge you.

Negotiate the interest rate. Once you’ve been pre-approved, use this leverage to negotiate a lower interest rate with the lender. The lower the rate, the less you’ll pay in interest over the life of the loan.

Compare loan terms. In addition to interest rates, compare the terms of different loans. Some loans may have prepayment penalties or other conditions that make them less favorable than others. Make sure you understand all the terms before you agree to anything.

Get everything in writing. Once you’ve found a loan that meets your needs, be sure to get the terms and conditions in writing before you sign anything. This way there’s no confusion about what was agreed to and you can avoid any unpleasant surprises down the road.