How to Get a Loan on Property in 5 Steps

Contents

Getting a loan on your property can be a lengthy and difficult process. Here are the five steps you need to take to get a loan on your property.

Checkout this video:

Research the Type of Loan You Need

The first step in getting a loan on your property is to research the type of loan you need. There are many different types of loans available, and each has its own benefits and drawbacks. You’ll need to decide which type of loan is right for you based on your financial situation and the amount of equity you have in your property.

Once you’ve decided on the type of loan you need, you can begin shopping around for lenders. It’s important to compare rates and terms from multiple lenders before choosing one. Be sure to read the fine print carefully so that you understand all the fees and charges associated with the loan.

After you’ve found a lender you’re comfortable with, you’ll need to complete an application and provide any supporting documentation. The lender will then appraise your property to determine how much they’re willing to lend you. If everything goes smoothly, you should have your loan in hand within a few weeks.

Find Lenders and Compare Loan Offers

The next step is to get in touch with lenders and compare their loan offers. This is where you’ll need to do some homework and determine which type of loan makes the most sense for you. There are a few primary types of loans that you can get for investment properties:

– Traditional bank loans: These loans are offered by banks and credit unions and are usually the most difficult to qualify for. They typically have the lowest interest rates but also come with the most stringent requirements, such as a high credit score, a low debt-to-income ratio, and a strong history of on-time payments.

– Portfolio loans: Portfolio loans are offered by community banks and small regional banks. They tend to be more flexible than traditional bank loans, but they also come with higher interest rates.

– Hard money loans: Hard money loans are offered by private lenders and are usually the easiest to qualify for. They come with high interest rates but offer more flexibility in terms of credit score and down payment requirements.

Get Pre-Approved for a Loan

1. Get Pre-Approved for a Loan

The first step in getting a loan on property is to get pre-approved for a loan. This means that you will need to go to a lender and fill out an application. The lender will then look at your credit history and income and determine how much they are willing to lend you. It is important to note that being pre-approved for a loan does not mean that you will definitely get the loan – it simply means that the lender is willing to give you a loan based on the information you have provided.

2. Find the Right Property

Once you have been pre-approved for a loan, you can start looking for the right property. This may be a house, condo, land, or any other type of property that you are interested in purchasing. It is important to make sure that the property is something that you can afford and that it meets your needs.

3. Make an Offer on the Property

Once you have found the right property, you will need to make an offer on the property. This means that you will need to negotiate with the seller of the property in order to come up with an agreed upon price. If your offer is accepted, then you will move on to the next step.

4. Get a Home Inspection

Before you finalize your loan and purchase the property, it is important to get a home inspection. This will help ensure that there are no major problems with the property that could end up costing you more money in the long run.

5. Close on the Loan and Purchase the Property

Once everything has been approved, you will then be able to close on your loan and purchase the property. This process can vary depending on the lender, but it typically involves signing some paperwork and providing some additional information such as proof of insurance.

Find the Right Property

The first step in securing a loan on your property is finding the right one. You’ll want to consider the location, size, and type of property that you’re interested in. You’ll also want to think about how much you can afford to spend and whether or not you’re able to make repairs or improvements to the property. Once you’ve found the right property, you’ll need to get in touch with a lender who can help you get a loan.

Close on Your Loan

The process of getting a loan on your property is not as complicated as it may seem. With the right paperwork and a little bit of patience, you can secure a loan in as little as five steps.

Step One: Find a Lender

The first step in getting a loan on your property is finding a lender. You can talk to your local bank or credit union, or you can search for lenders online. Once you have found a few potential lenders, it is important to compare rates and terms to find the best deal.

Step Two: Get Pre-Approved

Once you have found a lender, you will need to get pre-approved for the loan. This means that the lender will review your financial information and decide how much they are willing to lend you. To get pre-approved, you will need to provide the lender with some basic information about your income, assets, and debts.

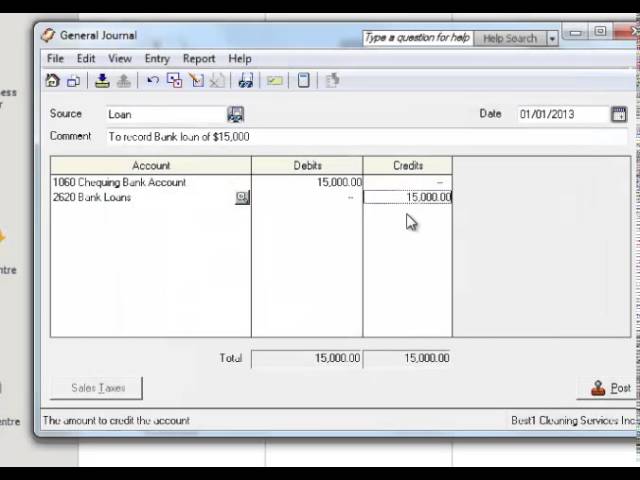

Step Three: Submit Your Application

After you have been pre-approved for the loan, you will need to submit a formal application. This application will include more detailed information about your finances and property. The lender will use this information to determine whether or not to approve your loan.

Step Four: Wait for Approval

Once you have submitted your application, all you can do is wait for approval from the lender. This process can take anywhere from a few days to a few weeks. If everything goes smoothly, you should receive approval within two weeks.

Step Five: Close on Your Loan

The final step in getting a loan on your property is closing on the loan. This process usually takes place at the office of the title company or escrow agent who is handling the transaction. At closing, all of the paperwork for the loan will be finalized and signed. You will then be given the keys to your new property!