How to Get a Home Loan Without 2 Years of Employment

Contents

If you’re self-employed or have gaps in your employment history, you might be wondering how to get a home loan without 2 years of employment.

While it might be a little harder to qualify for a loan without a traditional employment history, it’s definitely not impossible. In this blog post, we’ll share some tips on how you can get a home loan without 2 years of employment.

Checkout this video:

Introduction

If you don’t have a long employment history, you might think it will be difficult to get a home loan. Fortunately, there are a number of things you can do to improve your chances of securing a home loan without 2 years of employment.

1. Get a co-signer. If you have someone with good credit who is willing to co-sign your loan, this will increase your chances of getting approved.

2. Get a larger down payment. A larger down payment will show lenders that you’re serious about buying a home and that you have the financial means to do so.

3. Show alternative sources of income. If you have other sources of income, such as investments or rental property, be sure to let lenders know. This will show them that you have the ability to make loan payments even if you don’t have steady employment.

4. Get pre-approved for a loan. Getting pre-approved for a loan shows lenders that you’re serious about buying a home and that you’re financially capable of doing so. This can give you an edge over other buyers who don’t have pre-approval when it comes time to make an offer on a home.

5. Find a lender who specializes in loans for people without long employment histories. There are some lenders who specialize in making loans to people with nontraditional employment situations. These lenders may be more likely to work with you even if you don’t have 2 years of employment history.

The Importance of Employment History

Employment history is one of the most important factors that lenders look at when considering a home loan application. A strong employment history shows lenders that you are a reliable borrower who is likely to make your loan payments on time.

If you have less than two years of employment history, you may still be able to qualify for a home loan. Lenders will typically consider other factors such as your credit score, debt-to-income ratio, and down payment amount.

If you are self-employed, you may also be able to qualify for a home loan. Lenders will typically require you to provide additional documentation such as tax returns and financial statements in order to assess your ability to repay the loan.

How to Get a Home Loan Without 2 Years of Employment

It can be difficult to get a home loan if you don’t have two years of employment. Mortgage lenders want to see that you have a stable job and income. If you’re self-employed, have a new job, or don’t have a long employment history, you may have trouble qualifying for a home loan. However, there are a few things you can do to improve your chances of getting a home loan without two years of employment. In this article, we’ll discuss a few of those options.

Find a Lender That Doesn’t Require 2 Years of Employment

There are a number of lenders that will consider your mortgage application even if you don’t have 2 years of employment. While most conventional lenders require at least 2 years of employment, there are a number of other options available:

-Government-backed loans: FHA, VA and USDA loans are all available to borrowers without 2 years of employment.

-Non-conventional lenders: There are a number of non-conventional lenders that will consider your mortgage application even if you don’t have 2 years of employment. These include online lenders, private lenders and some community banks and credit unions.

-Portfolio loans: Portfolio loans are loans that are held by the lender instead of being sold on the secondary market. Because they are not sold on the secondary market, they can be more flexible with their requirements, including employment history.

Get a Co-Signer

If you don’t have two years of employment history, one way to still qualify for a home loan is to get a co-signer. This means that someone else with good credit will sign the loan with you, essentially vouching for your ability to repay the debt. Of course, this means that if you fail to make your payments, not only will your credit suffer, but so will the co-signer’s. For this reason, it’s important to be absolutely sure that you can make the payments before taking out a home loan with a co-signer.

Get a Loan from a Credit Union

If you have less than 2 years of employment, you may still be able to get a loan from a credit union. Credit unions are typically more lenient when it comes to approving loans, and they often work with members who have less than perfect credit. In order to get a loan from a credit union, you will likely need to become a member of the credit union first.

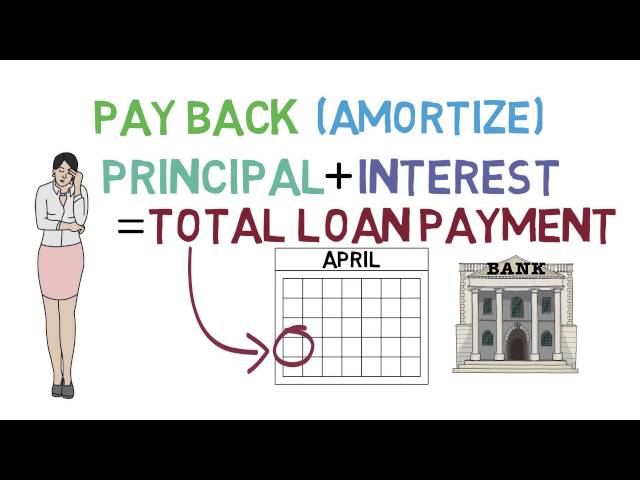

Conclusion

In conclusion, it is possible to get a home loan without 2 years of employment, but it’s not always easy. Lenders will want to see that you have a steady income and a good credit history before they approve you for a loan. If you don’t have 2 years of employment, you may need to provide additional documentation to prove that you can afford the loan.